2021 Xmas deals

2021 Xmas deals

• the most interesting deals from the Xmas holidays

• 30 French angel investors profiled

• investors use media to build hype cycles

Cheat sheet reports

• As we're slowly getting up to speed, we have made a selection with the most interesting deals from the Xmas holidays - in the Nordics, DACH, the UK and the rest of Europe.

• In 2021 we tracked the investment activity of almost 500 angel investors from France, 2X yoy. We have profiled 30 of them.

• Last year we made deep dives on the valuations of a few European startups: Klarna, Whereby, Weezy, Wolt, Sifted.

• We have profiled the up and coming new wave of European investors, the main VC investors from the US who are actively dealing in Europe and the American tech executives angel investing in Europe.

• We have created lists with must know names of investors active in Euroe - 100 investing at pre seed and seed, 30 investing at late stage as well as super angels.

• Not least important, we have reviewed the startups backed by the VC scouts in Europe.

Intel:

• the investment ecosystem in Europe in 2022.

• Tiger's model

• Euro series As at $20+ million

Popular pieces:

• Are we at the end of the tech booming cycle in the UK?

• Was the Deliveroo IPO a flop?

• The profile of European rich people.

• The European unicorn nobody talks about.

• Where is the VC market going.

Note: the reports are for Nordic 9 paying customers only. You can become one from here.

London

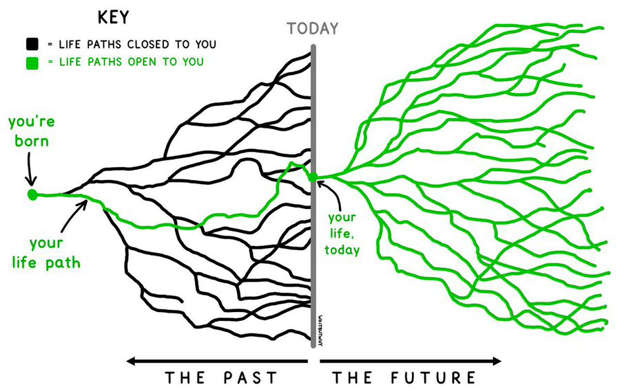

Optionality

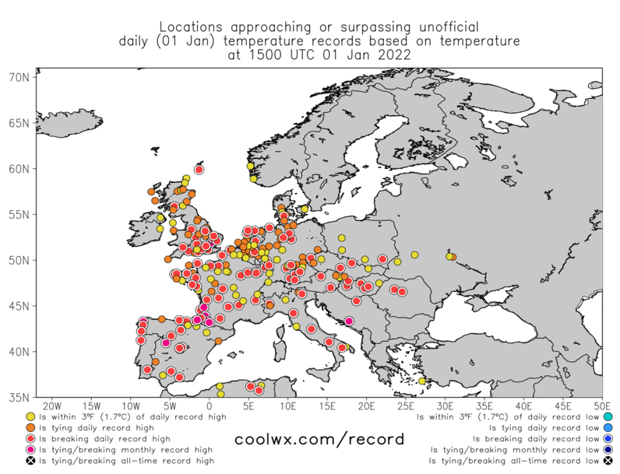

Europe is hot

A better way to track intel

Did you know that you could build smart trackers on Nordic 9?

A tracker is a bot that can be customised for tracking intel by one or many countries, by one or multiple investors, by one or many industries, or by one or many size checks.

This way you can have a quick granular overview of exactly the domains you're interested in. More signal, less noise.

We're currently at more than 150 trackers built by our users, why don't you give it a try?

It's quick and simple to add one. And it's FREE.

Quick notes and links

🇫🇷 France fined Google ($150 million) and Facebook ($60 million) for making it too confusing for users to reject cookies. The companies now have three months to change their ways in France i.e. one button to reject all cookies. The French have a point.

🇬🇧 Santander UK is working to collect about 75,000 payments worth about $175 million made in error on Christmas Day to its own customers and to others who use different banks.

🇩🇪 Gorillas and the Dutch from Jumbo Supermarkets entered into a strategic partnershipin the Netherlands and in the Flanders region in Belgium. Gorillas did the same kind of biz development with Tesco in the United Kingdom, and with Casino in France.

🇬🇧 Interesting story about how big cos bully their way into intimidating competing startups.

🇬🇧 David Bowie's estate has sold the publishing rights to his "entire body of work" to Warner Chappell Music for $250 million.

🇫🇷 A 100+ slide deck on the state of the French tech ecosystem in 2021.

🇬🇧 Richard Branson intends to list a Virgin-branded SPAC on a European stock exchange - likely in Amsterdam - in what may be interpreted as a snub to the London equity market. That would be the third SPAC done by the Brit, none in the UK.

🇫🇷 Société Générale bets big on on the car-leasing business, in a deal whereas its car leasing division ALD has agreed to buy Dutch rival LeasePlan for $5.5 billion to give it more scale as the auto rental market goes electric.

🇬🇧 Southampton bought by Serbian businessman in £100 million deal.

🇬🇧 The reason I have been brilliant with money is that, in the 1990s, I never took cocaine.

🇫🇷 The French way: The academy charged with defending the French language is threatening to take the government to court over the use of English on the country's new identity card.

🇽🇰 Kosovo banned cryptocurrency mining to save electricity as the country has also been experiencing an energy crisis.

🇫🇷 Good piece, albeit 3 years old, about the Laffont brothers - born in Belgium, raised in France and founders at Coatue.

💪 a16z has raised a fresh $9 billion to invest and that would give them a $28 billion AUM. A 2% management fee means muchísimo dinero for operating an investment company.

a16z have been hiring like crazy (have close to 400 partners) and notably invested in a proprietary media asset which they use as marketing in order to build hype cycles, lately pushing aggressively the crypto space under a new name, web3 - because that should be one of their growth areas in the next 3-5 years. Bolder than on demand grocery, wouldn't you say?

As an odd context, the 9 bill is just as much as Google pays to distribute their search engine in the Apple products (going to $12B in 2023).

🇯🇵 SoftBank plans to issue its biggest-ever yen bond worth $4.8 billion in a test of whether individual investors will continue to back one of the world’s most indebted firms.

💨 Remember Clubhouse and all the me-too brouhaha from the last year? One of the #metoo - the corporate droids from Linkedin - finally managed to come up with a clone (15 months, no less), an interactive, audio-only live events feature in beta for some creators and a video version in the spring.

As for Clubhouse, the hype went away very fast - it's yet another consumer software startup with zero differentiation and pushed aggressively in the market by their investors, the same gents from above that just raised 9 billion and make smart use of media.

👀 Why are investors flocking to crypto now known as web3 even though they have no idea what that means? There's increasingly many smart engineers working on it.

Btw, if you were to read only one piece about web3 hype explained in simple words, this should be it.

🔭 Since we're at new words defining old concepts, here's an investor doing a metaverse 101.

🍲 There's three types of seed investors: ones backing founders, others backing fundamentals and the rest stealing the meal of other investors - link ($)

🤔 If you're a founder and consider working with professional investors, this is one hell of a pep talk.

🔥 How early stage investment rounds get done for companies which have heat on them.

👓 The Amazon empire strikes back.

🇬🇧 Tech questions for 2022.

👁️🗨️ Why the New York Times is paying $550 million for the Athletic, the five-year-old sports news service.

+

ESPN's past, present and future.

🐩 Celebrity deathmatch for VCs. This venture business is as mainstream as it can get.

🇮🇹 One of Italy’s most infamous fugitives was photographed after 20 years on the run by a Google Street View vehicle.

Did you find this useful? 🤔

Sharing is caring

Have your colleagues and friends sign up too. To support our work, please consider subscribing to N9.

Sunday CET

Sunday CET

Notes and commentaries about what matters in the European space - concise, no non-sense insights, interesting stories and implications for founders, investors, employees from tech companies or government representatives.

Published every Sunday morning by Dragos Novac and emailed to investors, founders and decisions makers from 50+ countries who want to understand the ecosystem from Europe.