active angels in Europe

active angels in Europe

This week:

- active angels in Europe

- the difference between an angel and a super angel

- Europe's long tail

✍️ Observations

Over at Nordic 9, we tracked the dealflow of about 2000 angel investors active in Europe in the first six months of 2021.

We selected the more active ones (i.e did at least 6 deals in Jan-Jun 2021) and had a look at what they invested in. Specifically, we put together and analysed 104 deals made by 14 angel investors.

Why? I think this is a good reality check, telling where things are going on the old continent.

The VCs in Europe were crazy about investing in grocery retail and in the Amazon economy in the first part of the year.

The angels though, not so much. The TL/DR version: they invested in software and financial services.

About half of their deals were made in B2B SAAS. Which makes sense, software eats the world and this is the new economy, as they would teach you in school.

The second vertical with active deals is the financial services. Very lucrative in Europe, with a few unicorns already, huge market, outdated practices and dumb incumbents (i.e banks). Most of those deals are B2B.

A third pattern includes three verticals: food industry, e-commerce, and health care. Not as many deals as I would have expected, each of the vertical had 7 deals each. But all of them are important themes on European investors agenda right now.

This is the whole vertical breakdown:

- B2B SAAS - 47 deals

- financial services - 26 deals

- health care, ecommerce, food industry - 7 deals each

- biotech, education, manufacturing, marketplaces, online marketing, real estate - 4 deals each

- gaming, hardware, recruiting, social network, travel - 2 deals each

- automotive, energy, media, robotics, transportation - 1 deal each

Also notable, the nationality breakdown of the investors is quite even:

🇫🇷 France - 3 investors

🇬🇧 UK - 3 investors

🇪🇪 Estonia - 2 investors

🇩🇪 Germany - 2 investors

🇮🇸 Iceland - 1 investor

🇳🇴 Norway - 1 investor

🇨🇭 Switzerland - 1 investor

🇺🇸 USA - 1 investor

The countries they invested in though... not so much. More than 50% of the deals made by the most active angels in Europe were in startups from UK, France and Germany.

🇬🇧 UK - 38 deals

🇫🇷 France - 20 deals

🇩🇪 Germany - 11 deals

🇳🇴 Norway - 7 deals

🇪🇪 Estonia - 6 deals

🇪🇸 Spain - 6 deals

🇫🇮 Finland - 5 deals

🇩🇰 Denmark - 3 deals

🇵🇱 Poland - 2 deals

🇦🇹 Austria - 1 deal

🇭🇷 Croatia - 1 deal

🇭🇺 Hungary - 1 deal

🇱🇻 Latvia - 1 deal

🇳🇱 Netherlands - 1 deal

🇸🇪 Sweden - 1 deal

🇺🇦 Ukraine - 1 deal

One explanation is that investors reside in countries different than their nationality. Taavet Hinrikus, who is Estonian, lives in London. Andreas Mihalovits, who is German, lives in Spain. And so on.

Another observation is that angels still mostly invest where they reside. French invested in France, Norwegians in Norway and so on... This is where their networks are, and it is natural for them. But the more they invest the more they build network internationally which brings them other opportunities.

And outside horizons combined with their networks access is what differentiates a super angel from a local angel. And you raise money from angels (and investors in general) for their network not for their wisdom, even though they will sell you the latter.

A good example is an American - Charlie Songhurst - who made 5 deals in Germany and 4 deals in the UK in January-June. I have no idea where Charlie lives but the dude is one of Europe's super angels - last year we tracked 21 of his investments from Europe.

The startups country long tail is also interesting to note, and if I were an investor this is where I'd pay more attention. Central Eastern Europe, Ukraine, Austria - those regions are up and coming, with some interesting startups emerging. Turkey should also deserve at least a mention.

Competition is high in Europe these days, you either face it frontally and pay handsomely to seat at the table (and stop complaining about it 😆) or you go compete at the margins, looking for gems in the mud. But, yes, I know, dealing and understanding grassroots is not easy to do, especially sitting in front of a computer. And the inbound is rich these days, no need to get outside the comfort zone.

The investors profile, their deals and a whole lot more data to chew are available here.

More H1 2021 data reports

Active angels, VCs and international investors in:

🇬🇧 UK

🇩🇪 Germany

🇫🇷 France

🇸🇪 Sweden

🇳🇴 Norway

🇪🇺 EU

Note: the reports are for Nordic 9 paying customers only. You can become one from here.

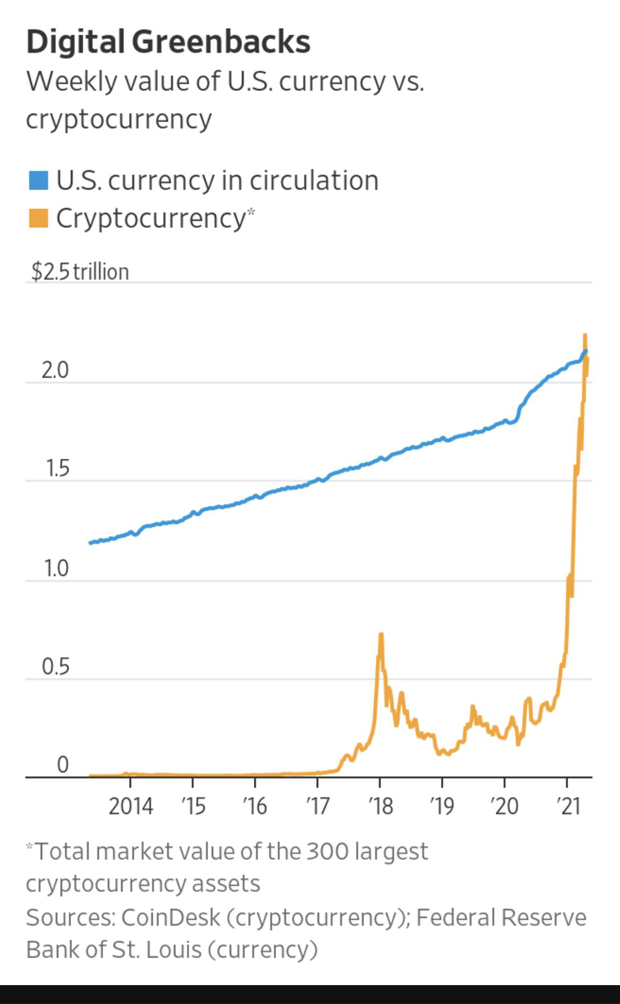

The crypto situation

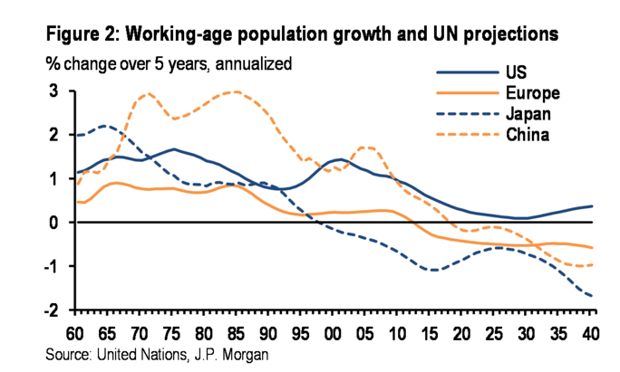

We're gettin' old...

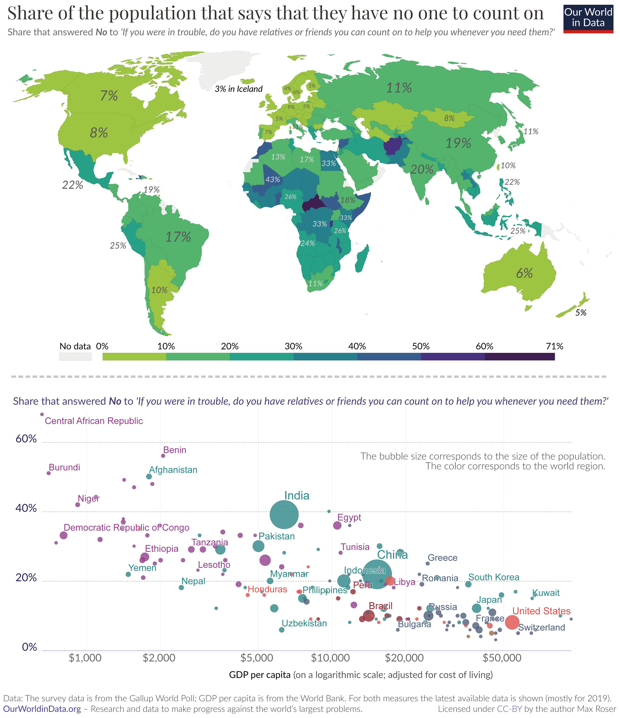

... and helpless

Be different, invest in the right intel sources

The best way to understand what’s going on in Europe is to stay updated

Nordic 9 customers get instant access to:

- up-to-date 20,000+ equity deals from all over Europe.

- 15,000+ *active* investors in European countries

- 11,000+ fundable European startups

The data is doubled down by an intel service with concise, no non-sense insights about the European startup ecosystem, sent via email every week. Nordic 9 screens 1000+ deals from the private European market every month and is available in an easy to understand *and* affordable way.

Don't miss out, subscribe to get intel access too for as little as €20 euro a month.

Other notes

🇫🇷 6 months and 6 millions later, Cajoo is out for sale (joining others including Dija which has been in the market for a while). Done by McKinsey guys in Paris, interesting to re-visit their investors reasoning, a 6 months review would be equally valuable.

🦢 On the same topic, Amazon currently counts 600+ same-day grocery and dry goods fulfillment centers, the latter of which is projected to grow 10x by '23.

When it comes to the ultra-fast convenience wars, it's too early to write off Amazon. It plans to 4x its network of 17 Sub-Same Day facilities w ~100k of the fastest-moving SKUs in under 5 hours this year and 10X it by 2022. link

👍 You know who else, besides the media companies, is asking Google to pay for scraping their content? Wikipedia.

👌 You’re the founder of a nicely growing SaaS startup which has just raised a Series A, Series B, or Series C funding round. You need to hire rapidly to seize the opportunity. But how much should you hire, what roles should you hire, and what should the org chart look like when you’re done? link

🧨 This thread made the rounds in VC circles this week. It's about how the business gets disrupted.

🤡 The Bad Marriage Problem

🦉 The 30 Best Bits of Advice We’ve Heard on Our Podcast (First Round Review's that is).

🇷🇸 Serbia’s central bank said it would take action if Croatia is allowed to put an image of scientist and inventor Nikola Tesla, an ethnic Serb born in present-day Croatia, on euro coins when it joins the currency union.

🇳🇴 Norway’s prime minister Erna Solberg says Oslo remains committed to oil and gas. Greenland, on the other hand, suspends oil exploration because of climate change.

🇪🇺 On the European obsession with America, the dearth of the political on the Continent, and the downsides of homogeneity - link.

Also:

German politics has been a major failure point over the last twenty years. The country has a mediocre infrastructure, mediocre primary education system, it is far behind the curve on tech, it is unwilling to pay to defend itself and meet NATO standards, its foreign policy is partly captured by Russia, it is moving away from nuclear power, it responded poorly to the recent floods, it was slow to line up vaccines and relied on awful EU procurement policies, among numerous other failings.

It has enough wealth and accumulated cultural and social capital to withstand these failings, but it has consistently underperformed for some while now. Matters rarely get settled in an innovative direction and they are masters of complacency and can-kicking. But at least the major parties do not criticize each other too much. - link

🧿 Great story about Spotify’s newest podcast millionaire.

🏇 Million-Dollar, One-Person Businesses.

💢 The Tyranny of Spreadsheets.

💰 Why AppleCare is so sticky.

🔥 Hardcore porn is embedded all over regular-ass websites because a porn company has purchased the domain of a popular, defunct video hosting site. link

🇬🇧 If you want to have a little fun with Brits' sense of self importance, go here and select Title.

Did you find it useful? Please share it with your networks and encourage your colleagues to sign up here - thanks!

Sunday CET

Sunday CET

Notes and commentaries about what matters in the European space - concise, no non-sense insights, interesting stories and implications for founders, investors, employees from tech companies or government representatives.

Published every Sunday morning by Dragos Novac and emailed to investors, founders and decisions makers from 50+ countries who want to understand the ecosystem from Europe.