are we in a transitory moment?

are we in a transitory moment?

• are we at the start of a massive correction or we're in a transitory phase?

• can the French get rid of the socialist VC model?

• Russian business people only discuss war in their kitchens.

Observations

The fourth week of the year means the fourth week of markets corrections in the US in 2022. Some investors, old timers, have seen this kind of shifts before and are pragmatically wary and prepared. For others, it is the first time when they see a market fully swinging and implicitly their asset portfolio valuation going down instead of up.

I thought it'd be interesting to take the pulse of what people think, so I reached out to some VCs whose opinion I respect and asked them about it. You can see their takes below - some of them asked to remain anonymous for obvious signalling reasons.

Public markets in the US are falling, what is the sentiment with the looming downturn in the private market?

- We're looking at it closely but see no reason to be reactive at the moment. There's more chatter than action now and it's a very different context than 2008 and 2020. It's more of a macro adjustment and the public markets are coming to a post-covid normalisation. There's definitely going to be some exuberance adjustment in the private market, but not sure where's going to settle. (early stage investor)

- Many expected this correction and it's clear that "profitless tech" is the worst hit. Starting to see it affecting late stage raises where companies fall into that latter bucket. (Ophelia Brown, early stage investor)

- I think it can be an interesting opportunity for us, and frankly it's one of the scenarios we worked out last year. (late stage investor)

- Genuinely have no idea. You’d think there are enough crossover funds now that the private and public markets will be in sync faster. What I don’t know is if prices stay the same, or if prices come down. I’m hearing rumors some companies that haven’t closed rounds are being asked to reduce valuations. As one friend said to me, there are so many traders and market participants who have never in their professional career seen inflation, or widening credit spreads, or readjusted valuation downwards, etc. Assuming no additional externalities (eg Ukraine invasion, etc) things may settle shortly after we actually get a rate hike and everyone then reprices and adjusts their models. (Hussein Kanji, early stage investor)

- Not seeing it yet, just heard anecdotes, but it is a correction that will not make it easy for the ones raising today to get the high multiples from the past 12-18 months. Being profitable and generating steady revenue will become more important than the "promise". I am more keen to see how the crypto [market] will pan out. (early stage investor)

- There’s a decent amount of hindsight bias washing around, i.e. lots of comments that the correction had been due and is healthy to help release some of the inflated expectations. Few argue otherwise, but the market hasn’t necessarily acted that way. Volatility brings uncertainty. Biggest uncertainty is everybody’s favourite word from 2021 - ‘transitory’ - is this a transitory moment or going to be more enduring? TBC. If it persists, things will trickle down through the stages over time - usually it takes a few quarters to get a real sense for the extent of any impact. Plenty of anecdotes that the dynamics have started to shift at later, pre-IPO stages with repricing, multiple compression, delayed liquidity, etc. Talk of a ‘flight to quality’ will grow louder. Predictable, explosive and/or durable growth will always remain magnetic to investors, meaning auction-like scenarios, premium numbers and paths to liquidity will always be part of the story too for the best founders and companies. (Tom Wehmeier, late stage investor)

How is this dip going to affect the VC dealflow in Europe?

- More American investors in Europe! (late stage investor)

- There's still a lot of money in the private market, lots of funds were raised last year and will be this year so don't expect a slow down in terms of pace. Wouldn't expect any chance in quality of dealflow. (Ophelia Brown, early stage investor)

- Putting the macro cycle aside, the tailwind of digital change isn’t going to reverse so that core underlying driver of the market will march forward. Once you go digital, you don’t go back. There’s also no question that Europe has its strongest ever pipeline of great founders and companies and its deepest and most sophisticated pool of drypowder ever, especially factoring in the capital washing in from overseas that’s more enamoured with European tech than ever before. This capital is ready to be deployed through all stages of the cycle. So deals are going to keep getting done at scale, but perhaps with a slowing of the overall velocity of the market and compressed multiples. The thing to watch out for, of course, is the ability to keep raising at higher valuations if it's a tighter, less liquid market. A more bearish market is more unforgiving to missed growth expectations - and that creates headaches for both founders and investors, if they’re not prepared and able to adapt. (Tom Wehmeier, late stage investor)

- Maybe some late stage valuations will cool down (I have my doubts) but at this pace I don't think people with big appetite will wait out or bargain too much, it's just too competitive to get to the good ones in the first place. Sure, it can be a moody period with leverage plays on the secondary tiers but likely rather temporary, unless something more dramatic will happen. The return expectation for what's invested now is wider than a presumable 12-18 months hump that's just a part of the cycle. (early stage investor)

- You have a contrast from everyone opening up here and the public markets being bearish on tech stocks. I suspect a lot of the tourist money (family offices, non-venture players, etc) will leave. But so many funds have been raised in recent years that have dry powder. They may extend their investment period (so we go back to 3-4 years) but I suspect they will still put capital to work. When I hear of funds giving back funds or LPs defaulting, then we will be in real trouble. (Hussein Kanji, early stage investor)

- I don't think Europe will be affected as much. Many funds were raised last year and we're in a market pricing out great startups. It's still a founders market! (early stage investor)

What do you see in Europe now and what do you expect for the next 12 months?

- We're hiring! (early stage investor)

- Europe is flushed with money and the market is competitive as f*** at the higher end. But we see a lot of value, we're super busy like everybody else, don't think we'll have a slow down this year. (early stage investor)

- The thing is, European tech has been reinforced across every dimension over the past two decades, so it’s far more resilient now to weather a storm, even if some participants sadly, and inevitably, fail to navigate it. There are - and always have been - plenty of pockets of real value, if you’re prepared to search off the beaten track for overlooked geos, categories and founders - e.g. bootstrapped companies that have stayed heads down building and under the radar or technical teams working on more complex, harder tech problems that have longer roads to commercialisation. (Tom Wehmeier, late stage investor)

- Huge amount of early stage activity, across crypto, enterprise, fintech. Expect quality to continue increasing. (Ophelia Brown, early stage investor)

- About the same on the building side, but with more difficult to get easy money. I do think as LPs rebalance their portfolios the flood of money that’s come from LPs into VCs may diminish, which will tighten the number of funds in the industry. I also think 2022 is not going to be an IPO year, so a 2015/2016 fund may need to hunker down before it can show DPI. You ideally want to invest into a bear market and exit in a bull market. You may end up with funds investing in a bull market, and forced to hold through a bear market. For a lot of VCs who have never experienced a downturn, that’s going to be a change. The funds with experience and industry majority will have a real edge. (Hussein Kanji, early stage investor)

- Europe has become fairly competitive lately, at all the stages. We're amazed at what we're coming across, on average we see more good stuff than what we have in the past. (late stage investor)

So this a bit of the sentiment from Europe.

However. Here's why you should it take it with a grain of salt though. And - exhibit B - some people are becoming cautious.

Add to it that markets being shaky is as good of a reason as any for bad investor behaviour. That means money leverage trumps healthy fundamental value just because it is rainy outside. Will this kind of dynamic startup valuation spiral out?

Last but not least, combine all these with what investors from the US are saying, and please keep in mind that there's a time lag between the American and the European markets, and I don't mean the time zones :D:

- There will be pain, but mostly borne by leveraged players in the short run.

- We probably won't see SaaS valuations @ 40-50X rev multiples anymore.

- That screaming sound you hear is CFOs of private tech cos that were lining up for 2022

IPOs. It’s gonna be brutal to see companies that missed one of the greatest bull market runs get jammed.

- The VC market has a tendency to lag the rest of the market. But it usually catches up, in time, and I expect that will happen again this time around.

- Crossover investors like Tiger Global and Coatue could shift even more of their private market investing to Series A and Series B companies.

- Two kinds of investors right now: those who are licking their wounds, and those who are licking their chops.

- I adjusted 4-6 months ago.

- Now is the time in the cycle that younger VCs will learn that there can be a huge gap btw unrealized values/mark-ups and actual returns/DPI. Mark-downs, lack of secondary buyers, no exit in sight are realities of the business. Winter is here/coming.

- We all got drunk on the 100X SaaS multiples. Whether we were fools to adjust to a new normal or not is the open question - but we are hardly worse off than we were in February 2020.

- Significant chance that sky-high, mid-market deals that are not closed will be reevaluated in coming weeks.

- It's not a bubble, but a balloon deflating. There will be trickle down effects [from public markets] that are inescapable thanks to the magic of market comps at the growth stage of investing. Which then trickles down to venture stage. Which then may trickle to seed stage, depending on how long this “new normal” lasts. Each of these stages will take months to be impacted by what is happening in the public market. Some savvy investors are making moves to get ready for that now. But they will be countered by the bulls who think all of this will rebound faster - so much so that it may not trickle down… link (how's that for 500-words non-committal but opinionated VC speak? :D)

Cheat sheet and intel reports

• Interesting web3 startups funded in Europe last fall - link

• Non-web3 investors which made at least a couple of web3 deals In Europe last year and their deals - link.

• series A European investors

• pre seed/seed investors in Europe

• late stage investors in Europe

• super angels active in Europe

• The most interesting deals from the Xmas holidays in the Nordics, DACH, the UK and the rest of Europe.

• Active angel investors from France.

• A review of the investment ecosystem in Europe in 2022.

• Startups backed by the VC scouts in Europe.

• Euro series As at $20+ million

• The profile of European rich people.

• The European unicorn nobody talks about.

• Where is the VC market going.

Note: the reports are available for Nordic 9 paying customers only. You can become one from here.

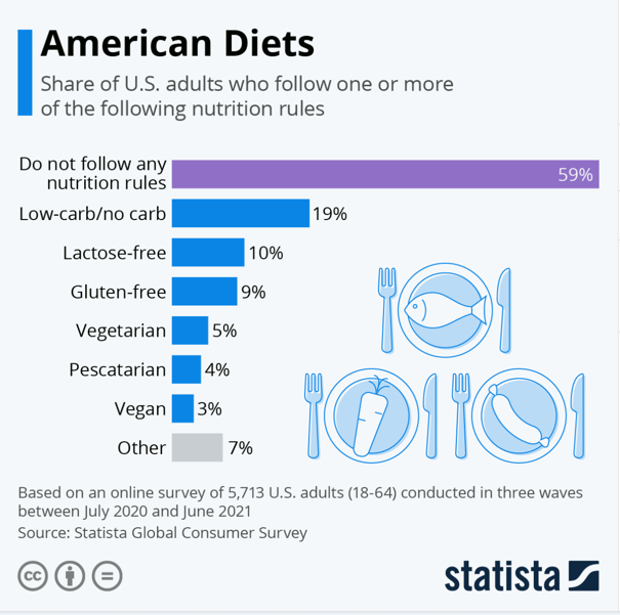

Diet? What diet?

Where you at?

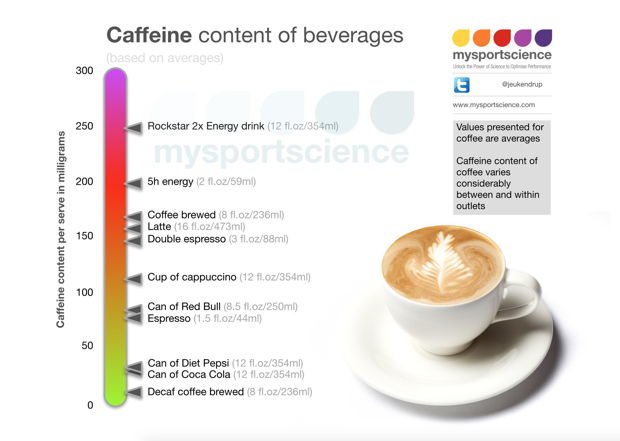

The daily drug

A better way to track intel

Did you know that you could build smart trackers on Nordic 9?

A tracker is a bot that can be customised for tracking intel by one or many countries, by one or multiple investors, by one or many industries, or by one or many size checks.

This way you can have a quick granular overview of exactly the domains you're interested in. More signal, less noise.

We're currently at more than 150 trackers built by our users, why don't you give it a try?

It's quick and simple to add one. And it's FREE.

Quick notes and links

🇫🇷 Sigfox's implosion has been a much discussed topic in some French circles these days given that going out of business is perceived as a failure - and not only in France but also in general in Europe. You can go out of business for many reasons and the whole debate actually begs an interesting question - should the French government stop playing socialist VC by subsidising the local startup ecosystem?

To date, France spent around $15 billion of public money to support startups, which is more than the whole money raised by the French for the entire 2021, which was a record year. And last year alone, BPIFrance only was part of deals with almost a third of the total money raised from the private market. If you exclude the $50 million+ deals, the contribution goes to half.

And BPI is not the only state vehicle through which Macron pumps money into the ecosystem and the man clearly is ambitious.

If the government subsidies were to stop, would the private money be strong enough to support a young and fragile environment that now has started to see some slight signs of success? I know many local founders complaining about the high taxes and the famous French bureaucracy and just saying - hey, at least we have access to easy money. What happens if the state money part of the equation disappears?

🇫🇷 Still at how the French are doing business, they seem to have gotten right this whole early stage investment thingie - $23 million seed, no VC, with a ticket of minimum 1 million per individual. Done by an ex-advisor of Macron.

🇨🇭 The biggest Swiss bank’s deal to buy U.S. robo adviser Wealthfront for $1.4 billion signals how old-guard institutions that have traditionally catered to the world’s moneyed elite are recognizing the importance of attracting younger clients, whose vision of banking differs drastically from their elders.

🇫🇷 Daphni's platform brings them an inbound of 50 deals per week.

🇬🇷 Greek-founded Startups: Investments and Exits, 2021.

🇸🇪 Klarna CEO, Sebastian Siemiatkowski, doing a bit of good PR for the American market.

🇬🇧 It will be cheaper for French or Swedish banks to lend to UK companies than for UK banks.

🇬🇧 Apple News was the most widely used UK news app in December 2021 with 13.2M users and 1.2B minutes spent; BBC News had 12.5M users and 2.2B minutes spent. Third place is thevideo aggregator News Tag, far far away, at a fraction of the top audience.

🇪🇺 The EU lost a court suit with Intel, in an overturning a $1.06 billion fine levied in 2009. Whole fine falls. It's the third court judgment on this. In short, EC didn't do a proper economic analysis of a rebate scheme, and so that part of the decision was annulled.

💰 The pandemic was a light-bulb moment for founders of financing startups, which aim to turn subscription-based revenues into a new asset class.

🇺🇸 Some interesting VC products:

- a $40 million pool of capital for founders & employees of portfolio companies to invest as angels

- Tribecap's Firstlook is also good.

- YC alums launched a venture structure which can scout out and back young crypto startups. The vehicle is only available to other YC alumni.

- Angel List has become a mammoth.

🇯🇵 Nomura has launched a fund designed to parachute young executives into Japanese companies whose old owners lack a successor, a looming issue in the country where a third of small and medium-sized businesses are run by people over the age of 60.

The same Nomura that last year banned employees from smoking during work hours even if they are teleworking at home.

👀 Are Play-to-Earn (P2E) games pyramid schemes? The short answer is mostly yes, but sometimes not.

💸 (Another) Newsletter author with 10k subscribers raised a fund on top it. Closed 4 million out the 10 target.

🍷 The price of Merlot fell and California wineries converted thousands of acres of Merlot grapes into the varietal preferred by Paul Giamatti’s character in the movie Sideways: Pinot Noir. Sideways was released in 2005 and by 2010 Merlot’s growth trend had fully reversed, while Pinot Noir plantings accelerated.

🇺🇸 A market that is super big in the States - eBay launched authentication services for trading cards. The service will now be able to authenticate cards worth at least $750 from collectible card games, as well as sports and other non-sports cards

🤓 Any pmarca interview is highly recommended.

🦾 Understanding something you’re not a participant in is a sign of empathy - which is generally lacking across tech. Do web3 companies need Web3 VCs? link

😱 This week, there were two very Silicon Valley threads on twitter that unleashed a lot of energy and idiotic opinions, revealing more how business is done in the 21st century rather than he-said-she-said stories you would expect media to cover:

- YC & Stripe mafia followed up by YCombinator is not worth it*

- Calendly.

*As a weird coincidence, this week I talked to a super smart founder making the same argument.

🧵 There are 3 ways to get alpha in VC:

1) Invest in companies before it's consensus

2) Help non-consensus companies outperform

3) Have founders take your $ at a lower price.

If you're not doing one (or all) of these, you're underestimating the competition.

🤔 Looks like Mark couldn't save the financial industry so now he is selling Diem aka Libra. Who'd have thought? :D

🇬🇧 It’s not Germany but Britain that is barring effective sanctions on Putin.

🇷🇺 Related:

“After a couple of conversations with the guys directly involved in the Donbass, I transferred all my assets to dollars and sold my Russian stocks,” one official at a Moscow government department said. “This was back in December when nobody expected anything.”

We are wealthy and have a lot to lose. A lot of us have second homes in Europe, we have residency permits in the West, so we are heavily invested in this.

We have become passengers. The business community will only discuss war in their kitchens. Everybody will stay quiet in public.

🇬🇧 A robot vacuum cleaner made a break for freedom after giving staff the slip at a Travelodge hotel. Staff said it just kept going and could be anywhere. How's your week been?

Did you find this useful? 🤔

Sharing is caring

Have your colleagues and friends sign up too. To support our work, please consider subscribing to N9.

Sunday CET

Sunday CET

Notes and commentaries about what matters in the European space - concise, no non-sense insights, interesting stories and implications for founders, investors, employees from tech companies or government representatives.

Published every Sunday morning by Dragos Novac and emailed to investors, founders and decisions makers from 50+ countries who want to understand the ecosystem from Europe.