how much do the German VCs make?

how much do the German VCs make?

• do European investors have a money problem?

• how much do the German VCs make?

• are you even an investor if you don't do reverse pitching?

Observations

This week I have read in the local media that the European investment ecosystem seems to have a problem because it does not have enough late-stage capital to fund its own biggest tech successes. The premise of the article is as follows:

Europe’s second most valuable startup, Checkout.com, has only two European investors on its cap table. They are Blossom Capital, which has backed the company since its $230m Series A in 2019, and the University of Oxford’s Endowment Fund, which joined for the company’s most recent $1bn round.

It goes on saying that it is a structural problem going as far as EU taxpayers financing innovations in order to make US and Chinese investors richer.

I won't go down the nationalist rhetoric of the article, it's silly, but I am quite sure can stir the ego of old schoolers and bring in readers. I just have a few quick observations:

• First of all, the money problem is false. European investors have unprecedented amounts of cash to deploy at all the segments of the markets, including the later stage. In 2021, not only that this money was invested at historic high rates, but also new funds covering late stage were closed at similar record levels (we track this particular intel).

• Moreover, if we're to be even more catholic than the pope, most of the money in the European market is American anyways - besides the American investors on the ground, the European VCs raised from American LPs. As a very quick example, 60% of the freshly-announced fund by the above-mentioned Blossom Capital was raised from American investors.

So if we're to split hairs, even if the money is deployed by European VCs, the said money may as well be American anyways.

• The main reason for Europeans not being in late stage deals is that those deals are expensive for the regular Europeans doing VC deals. They simply are not suited to play the game at this level because of multiple reasons which can be summed up simply: the risk appetite. This is a chronically fundamental problem of the European investors, and not only at late stage deals. And, of course, also one of the reasons for Europe not having too many late stage investors to begin with, see further below.

And btw, if anybody is curious to dig into the above-mentioned Checkout.com funding history and how Guillaume goes about his business, will understand why Europeans didn't really stand a chance to begin with - you can find out how Blossom managed to snuck in from here, Ophelia is a good deal maker.

• Beside risk appetite problems, another explanation for Europeans not being in late stage deals is that in an ecosystem where money is a commodity, the market is made by the founders following the smart money. The value-add (at late stage or any stage, really) is more important than the money per se, and that means the IPO or liquidity event preparations, a particularly sensitive topic in Europe - the late stage has been wide open because there was no market for it or the role has been mostly played by the PE until not long time ago, and if startups go for liquidity events in the US, most of the European investors are useless in the captable.

• Not last, a bit bitter and a bit funny, since the EU itself actually intended to set up a fund to cover the late stage gap - sadly, a year after all the talk of politicians wanting to be VCs, the EU is still figuring out how set up a fund and actually honour its own VC commitments.

Cheat sheet and intel reports

Web3 in Europe

Web3 is the new hype on investors circle - a new and more mainstream name for startups creating value using blockchain technologies. In Europe it's not a thing, yet, judging by the local media covering, still stuck at writing about grocery funding deals and counting unicorns and decacorns.

But beyond the media sentiment, there is a fair number of investors also looking into the hype, and, in some cases, buying into it. Timidly, still rookies, but you have to start from somewhere, right? We have looked closely into it and have created a list with generalist web3 investors active in Europe and which made at least a couple of web3 deals last year - you can find them here. We expect standard household investors backing "anything with a pulse" in Europe to start diversifying with equity positions in web3 startups in the next 18-24 months.

The value creation side i.e the startups, is a bit more advanced in Europe than the local investors though - that's because it is easier to raise funding from smart investors outside Europe. In 2021, over at Nordic 9 we have tracked a fair number of hundreds of web3 deals in the space, mostly made by vertical-focused investors - we looked into more details of who raised seed funding in the past three months, from which we selected 20 interesting startups that create value in the web3 vertical out of Europe.

• You can find those web3 startups from Europe in this report.

• You can find the web3 investors (non-vertical focused) and their web3 European startup investments they made in 2021 in this report.

The series A investors in Europe and beyond

This year we have tracked new fund announcements totalling more than $2.5 billion ready to be deployed in Europe (you can track them too via our dedicated intel). Cherry, Blossom, Entree, Black Quant or Cottonwood are among the ones positioning at early stages - be them preseed, seed or series A.

Given the current investment environment in Europe, it is hard to pinpoint the exact funding stages of a startup out of their deal announcements these days, as the old schoolers in the business used to go about the venture funding.

As old schoolers ourselves, we think that series A is that point when startups look for funding options in order to scale up their traction together with investment partners. Now, also an old school concept, money is not as important as the connections and experience the investor would provide at this stage and believe that there is a number of good European names checking the list of being valuable investment partners for startups looking to raise series A investments. We have created investors lists by each category:

• series A European investors

• pre seed/seed investors in Europe

• late stage investors in Europe

• super angels active in Europe

Other recent cheat sheet and intel reports

• The most interesting deals from the Xmas holidays in the Nordics, DACH, the UK and the rest of Europe.

• Active angel investors from France.

• A review of the investment ecosystem in Europe in 2022.

• Startups backed by the VC scouts in Europe.

• Euro series As at $20+ million

Popular pieces

• Are we at the end of the tech booming cycle in the UK?

• Was the Deliveroo IPO a flop?

• The profile of European rich people.

• The European unicorn nobody talks about.

• Where is the VC market going.

Note: the reports are available for Nordic 9 paying customers only. You can become one from here.

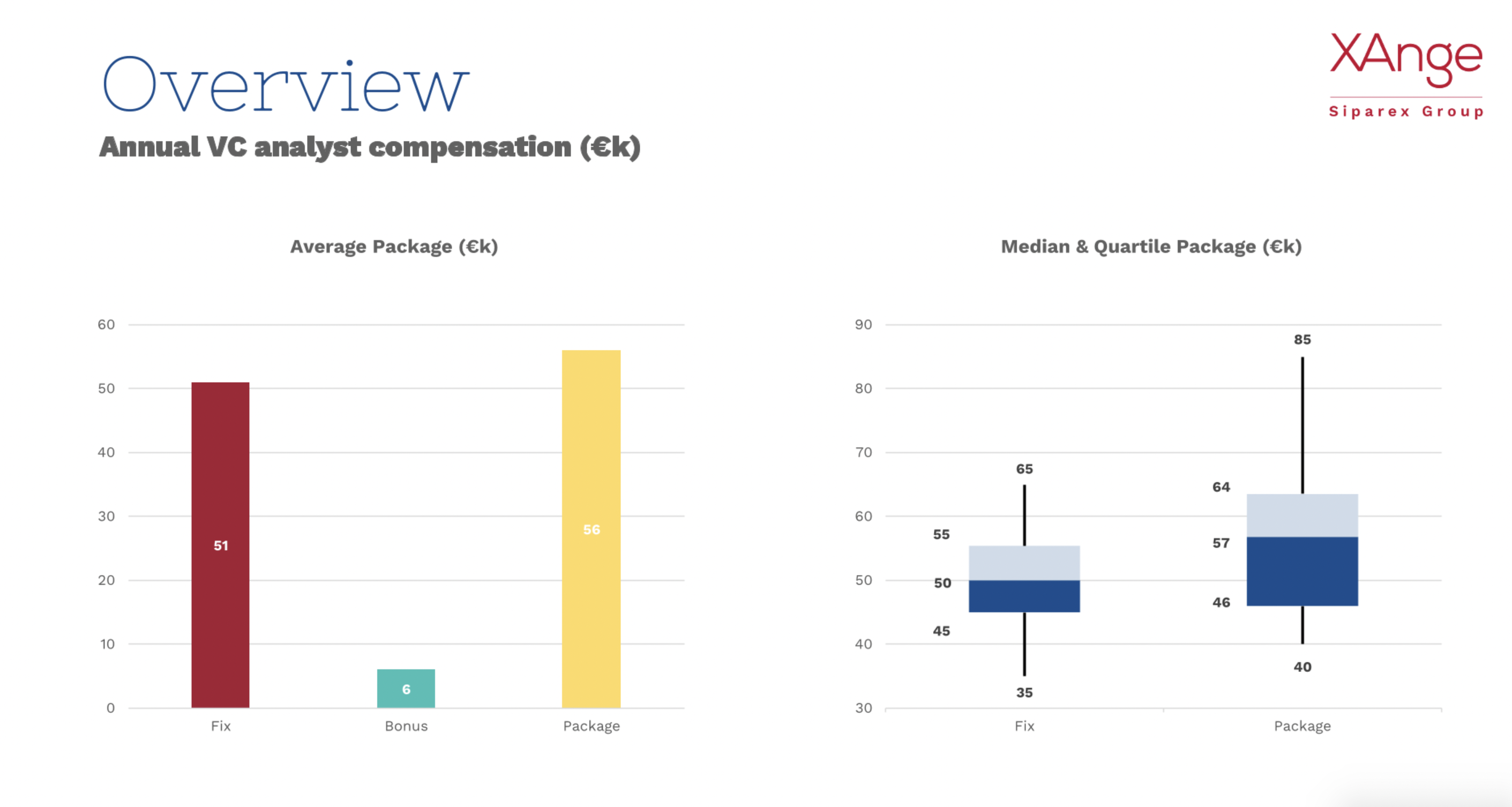

German VCs live off €5,000 a month. Before taxes.

Data is taken from an anonymous 16-question survey filled out by 84 dudes and dudettes making a living as German VC analysts.

Other findings include that those guys are mainly former consultants and have a hard time to negotiate their salaries.

Add web3 into the mix...

Oh, Europe! (check out Greece)

A better way to track intel

Did you know that you could build smart trackers on Nordic 9?

A tracker is a bot that can be customised for tracking intel by one or many countries, by one or multiple investors, by one or many industries, or by one or many size checks.

This way you can have a quick granular overview of exactly the domains you're interested in. More signal, less noise.

We're currently at more than 150 trackers built by our users, why don't you give it a try?

It's quick and simple to add one. And it's FREE.

Quick notes and links

🔥 The market continues to go in its head - Nasdaq had its worst week in two years, the S&P 500 is off to its worst start since 2016, the crypto market fell 11%, now at $1.9 trillion from $3.1 trillion a few months ago - crypto people seem pessimistic but it's Matt Damon's fault, of course. If your paper money is gone and if this is your first rodeo, be cool and listen up to the veterans. The clock is ticking for the private markets as well, if only judging from Softbank complaining that assets are overvalued. Go figure.

Looks like we're in the middle of the reset and the hurt is real, with investors switching from FOMO and greed to fear. Like always in this position, cash is king and building stuff is the right side to be on (or being employed by builders or deep-pocketed corps if your risk appetite is low). How's your week been?

🇺🇸 Still at macro, another noteworthy piece of news is the Americans enabling legislationthat makes it easy for STEM students to study and work in the US. Will it work though, given the exorbitant school prices combined with multiple alternatives that can get you a well-paid job anywhere in the world? The only immigrant upside for going after an US school remains getting the American citizenship, but is that enough to justify the opportunity cost of a few hundred grands on top of four years of your life?

🇬🇧 A warm introduction from a mutual connection leads to 13x higher chance of funding over a cold one. That's the name of the venture business, sadly.

🇪🇺 What are the popular payment methods in Europe.

🇩🇪 The German police was caught using the Luca app (that collects COVID-tracing data on visitors to public places) to search for crime witnesses. The data protection advocates are up in arms.

🇫🇷 The French Airbus upset Qatar Airways over defects at the A350s and the Arabs went to court over $600 million compensation damages, to be judged this spring. QA is a key customer of Airbus - the rift has escalated as the French just cancelled a further contract for 50 A321neo aircraft the airline was to deploy for the upcoming World Cup.

🇸🇪 Sweden has the largest number of electric vehicles in the EU. But finding a place to charge them can be difficult, especially in remote areas. (that's why those guys raised so much so quick)

🇬🇧 Citi and Goldman's London employees were asked to get back to the office. So were all Britain's civil servants.

🇬🇧 DeepMind co-founder and Google executive Mustafa Suleyman left after he was investigated for complaints about bullying employees. He’s now become a VC, will join Greylock Partners in London.

🇬🇧 More job changing - Rumi Morales, who was doing crypto deals for Outlier Ventures in London, is now doing the same for one of the more active investors in the space - DCG in the US.

🇪🇸 Spain will impose restrictions on influencers promoting cryptocurrencies, after concerns over protecting investors in the unregulated sector.

🇬🇧 The numbers Boris put out don't really reflect how hard it is for people from outside the bubble.

🇫🇷 Paris city authorities have unveiled a manifesto for beauty containing plans to spruce up the City of Lights where an online campaign highlighting ugliness and filth has piled pressure on mayor Anne Hidalgo.

🇸🇪 Sweden keeps deporting its high-skilled immigrants without them being at fault.

🤓 Are you even an investor if you don't do reverse pitching?

Often when we’re speaking to investors, they’d cut me off and say, ‘Let me show you what I already know about you.' The reverse pitch from Tiger Global was 90 pages packed with the elaborate research that the investment firm had done on Hinge, including interviews with dozens of its customers and data on its competitors.

🤔 In a world with a broad class of investors that are all well aware of Clayton Christensen and Carlota Perez's models, do they still matter?

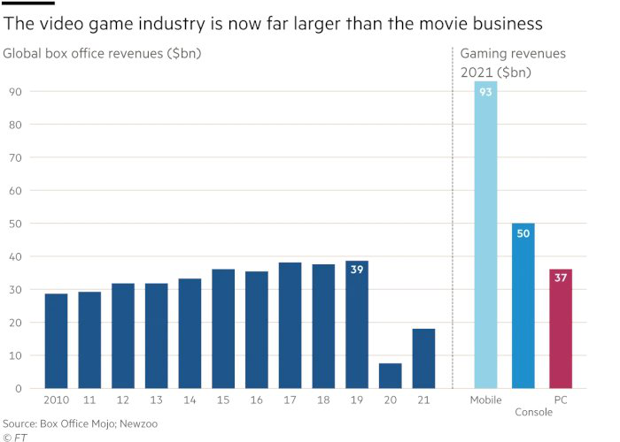

🕹️ Are we entering a period in the video game industry of hyper-consolidation? Yes.

🚴 Peloton stopped production and considers cutting jobs as business demand went down.

👜 Amazon is opening its first-ever Amazon Style physical clothing store in Los Angeles.

🥽 Google has a team working on an AR headset that it hopes to release in 2024. Maybe they'll get it right this time.

💰 Instagram launched subscriptions and TikTok is toying with the idea of it. For, ya know, the creators.

💸 JPMorgan raises pay for junior bankers for the 2nd time - they will start from $110k, up from $100k announced in June 2021. That's a tad higher than what German VCs make, isn't that? :D

😱 Abercrombie wants to become relevant again by partnering with Roblox. That sounds desperate.

🔮 How fifth graders see the world in 20 years.

✈️ Departing Hong Kong residents fly their pets out of city on private jets.

🇨🇳 From now on any Chinese internet company with more than 100 million users, or with more than $1.58 billion in revenue, will need a special governmental approval for raising money.

+

Doing a banal noodle reportage in China is challenging.

🦾 The metaverse looks, uhm, bad. But, in case you were worried, Facebook already has a plan to track you in the metaverse in order to sell advertising.

🚄 24 hours of trains in the Netherlands.

🎙️ Bono says that U2 now makes him “cringe” with most of their songs, his vocals, and their name choice. He's just getting old, that train has left the station 10 years ago.

🍜 Why do grocery stores still have ethnic aisles?

Did you find this useful? 🤔

Sharing is caring

Have your colleagues and friends sign up too. To support our work, please consider subscribing to N9.

Sunday CET

Sunday CET

Notes and commentaries about what matters in the European space - concise, no non-sense insights, interesting stories and implications for founders, investors, employees from tech companies or government representatives.

Published every Sunday morning by Dragos Novac and emailed to investors, founders and decisions makers from 50+ countries who want to understand the ecosystem from Europe.