how to quantify impact

how to quantify impact

• Seedrs and Crowdcube's valuations, one year after their intended merger

• the impact made by a chief impact officer

• founders gaming the VCs

Cheat sheet reports

• The venture scouts from Europe - who are they and what they invest in?

• early stage B2B marketplace startups from Europe.

• a list of 100 investors investing at pre seed and seed in Europe

• a list of 30 investing at late stage

• a list of 25 from the new wave of European VCs

Intel:

• is Sifted really worth $20 million?

• American tech executives angel investing in Europe.

• non dilutive startup financing takes off

• Swedish success stories

• the most active investors in Europe are Americans

• active investors in Europe by vertical

Note: the reports are for Nordic 9 paying customers only. You can become one from here.

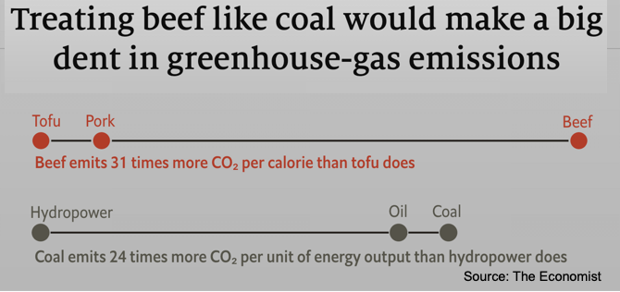

Beef like coal

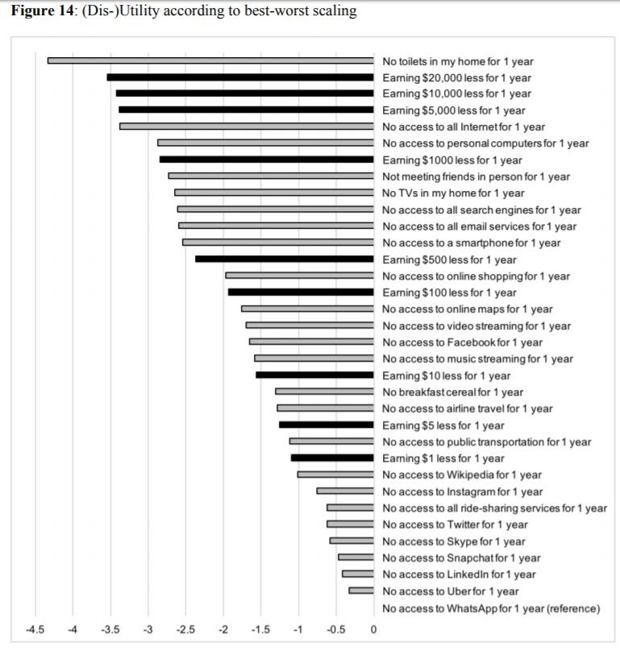

Choices

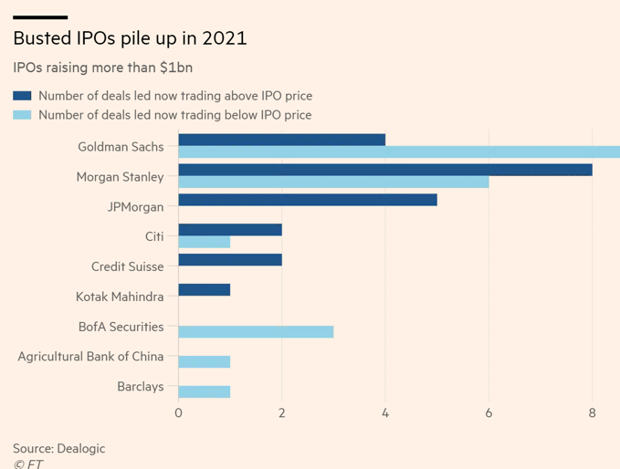

Win some, lose some more

A better way to track intel

Did you know that you could build smart trackers on Nordic 9?

A tracker is a bot that can be customised for tracking intel by one or many countries, by one or multiple investors, by one or many industries, or by one or many size checks.

This way you can have a quick granular overview of exactly the domains you're interested in. More signal, less noise.

We're currently at more than 150 trackers built by our users, why don't you give it a try?

It's quick and simple to add one. And it's FREE.

Notes

🇬🇧 Every year since 1947, Norway ships over a homegrown Christmas tree to be displayed in London's Trafalgar Square and symbolising the country's recognition for Britain's support during World War II. This week apparently something was wrong with the tree so the Brits took to twitter and are asking for refunds. How's your week been?

🇬🇧 These past weeks, Seedrs was acquired for $100 million and Crowdcube raised 13.5M at a $185 valuation pre money.

About a year ago, when they intended to merge, Seedrs was valued at £56M ($70M+) and Crowdcube at £84M ($100M+).

🇫🇷 Why would a startup hire a Chief Impact Officer? TLDR: market expects it, somebody at startups has to do it, even strategically from C-level, and moral sustainability is imperative.

It's unclear why "imperative", "market expects it" and startups "have to do it" though, particularly in cases of a non-marketing initiative and since we live times when being moral is open for interpretations.

I would argue it is not an external factor that makes a startup impactful, au contraire - being moral, or meaningful with your actions, for example, has everything to do with vision, mission and values of the company, whether they include or not an outside of the world kind of impact of the company's ops. Once you've established those, it's an HR (internal) & PR (external) exercise to align the company's behaviour to the outside market perception.

A different direction to look at and perhaps a better question is how you quantify the impact of the Chief Impact Officer? How you translate that into KPIs and how does it have a material effect on the company's bottom line.

Impact is a trendy word nowadays in the investment circles, less so fitting for startups unless they have a specific angle (i.e see the class of 2021 startups tackling the climate change and getting funded in spite of not having a business model whatsoever).

The reason for impact remaining just a buzzword in the startup world is simple, startups are strapped for cash so unless an impact initiative can be quantified into the revenue line it's simply a marketing/HR cost with likely intangible returns. If you have a startup with strong driven-core - i.e. mission, vision, values articulated - then the impact is an intangible that should be visible from the outside of the company. But it is not obligatory to be so - there are many companies with strong values whose business is not impactful at the outside. There's actually a recent case of a company which resisted the internal pressure of employees to be even more impactful at the outside which ultimately failed, as the founders and the core culture of the company prevailed and roughly a third of the employees quit as a consequence. And so, hiring somebody to align it with a desired future external impact may require the alteration of the values and this is delicate more often than not.

Fact of the matter is that unless it's something inner, coming from within, there's not too many specific case studies for startups to learn from, particularly under this cancel culture period. Coming one day to work and saying 'listen up guys, from now on our startup will make impact' may have unexpected resistance and lead to undesired consequences - alas, this is rather the type of corporate speak that McKinsey would love to invoice 100k for doing a report on.

Related: real talk about ESG investments.

💪 The market gaming turned against VCs pt 3527352 - i.e. we now have founders who game VCs because they're in some sort of privileged position and use that to get rich quick out of paper valuations.

It's part of the game in the existent window of opportunity, pragmatically played by some of the <5% all the VCs are chasing and thusly inflating the market and then complaining about it. Econ 101: if there's demand, there'll be supply.

When the music stops, the most leveraged will lose, and those ain't the founders.

🇬🇧 Earlybird getting accolades for its early bet on Turkish from Peak Games, sold to Zynga for $1.8 million.

Not trying to diminish the merits, on the contrary - well deserved - but feel that the Peak story is incomplete without mentioning Draper's handsome netting within a year or so out of a related secondary deal.

🇪🇺 Looks like Rivian is opening shop in Europe (UK, Germany and Netherlands), after it went through the largest American IPO since 2014.

+

Amazon is rapidly expanding its trucking operations in Europe and rolling out a new program to teach wannabe entrepreneurs in Germany, France, Italy, Spain & Poland to launch their own small trucking companies exclusively hauling Amazon goods. Amazon expects to be the largest U.S. package delivery service by early 2022, overtaking longstanding shipping rivals UPS and FedEx.

🇬🇧 It's getting uglier for Facebook by each day - the U.K.’s competition watchdog has ordered Facebook (now Meta) to reverse its acquisition of animated GIF platform Giphy.

🛵 The inside story of Jokr, the American grocery startup done by ex-Rocket Internet people.

🇪🇪 Wise is expanding more into the US.

🇩🇪 The saga of investing directly into a German company.

🇩🇪 About Berlin as a startup ecosystem.

🇪🇪 Self driving robots activity messed up by snow.

🇸🇪 Spotify wants to TikTok-ize its app - makes sense, it's already derailed and speaks in Gen Z's language.

🇪🇺 If you're doing a startup in Europe and don't incorporate in Delaware (or the likes), you may be at disadvantage.

🇪🇺 This week people on Twitter made fun of EU's trying to be at the forefront innovat... er, dreaming that if you have money, you can be a professional investor.

🇫🇮 For a yearly income of around €799k - 418k dividends, 108k salary, 273k share sales - the overall income tax is 193k, which is 24%. In Finland that is.

👁️🗨️ The world’s second most popular electric car (after the Tesla Model 3) is the Wuling HongGuang Mini

+

Baileys Irish Cream was invented in 45 minutes in 1973 by two ad creatives in Soho.

+

50 other things learnt by Tom in 2021.

🇩🇰 Six customers and about 20 to 25 employees spent one night in an Ikea store from Denmark because of a snow storm.

🇬🇧 Journalists not getting early stage tech products, the Techcrunch UK edition.

🇨🇳 China is planning to ban companies from going public on foreign stock markets through variable interest entities, closing a loophole used by the country's tech industry to raise capital from overseas investors.

💰 BNPL surged 400% on Black Friday in the US (so why wouldn't Klarna focus on it?

💨 Jack Dorsey finally stepped down from Twitter. Also changed the name of Square into Block - i.e. the other company where he displays his CEO skills - most likely because a seasoned CEO cannot focus on the cryptocurrency business unless the name of the organisation suggests he does so. Meanwhile, his replacement at Twitter already started cleaning up the house.

🐶 Co-founder mistakes that kill companies & how to avoid them - link.

🐝 What is the world's most evil company and why?

🍭 US debt collectors are allowed to DM you on social media now.

👓 Learning sixteenth-century business jargon.

Did you find this useful? 🤔

Sharing is caring

Have your colleagues and friends sign up too. To support our work, please consider subscribing to N9.

Sunday CET

Sunday CET

Notes and commentaries about what matters in the European space - concise, no non-sense insights, interesting stories and implications for founders, investors, employees from tech companies or government representatives.

Published every Sunday morning by Dragos Novac and emailed to investors, founders and decisions makers from 50+ countries who want to understand the ecosystem from Europe.