is GDPR working?

is GDPR working?

• is GDPR working?

• understanding how social networks work

• Musk city in Europe

Observations

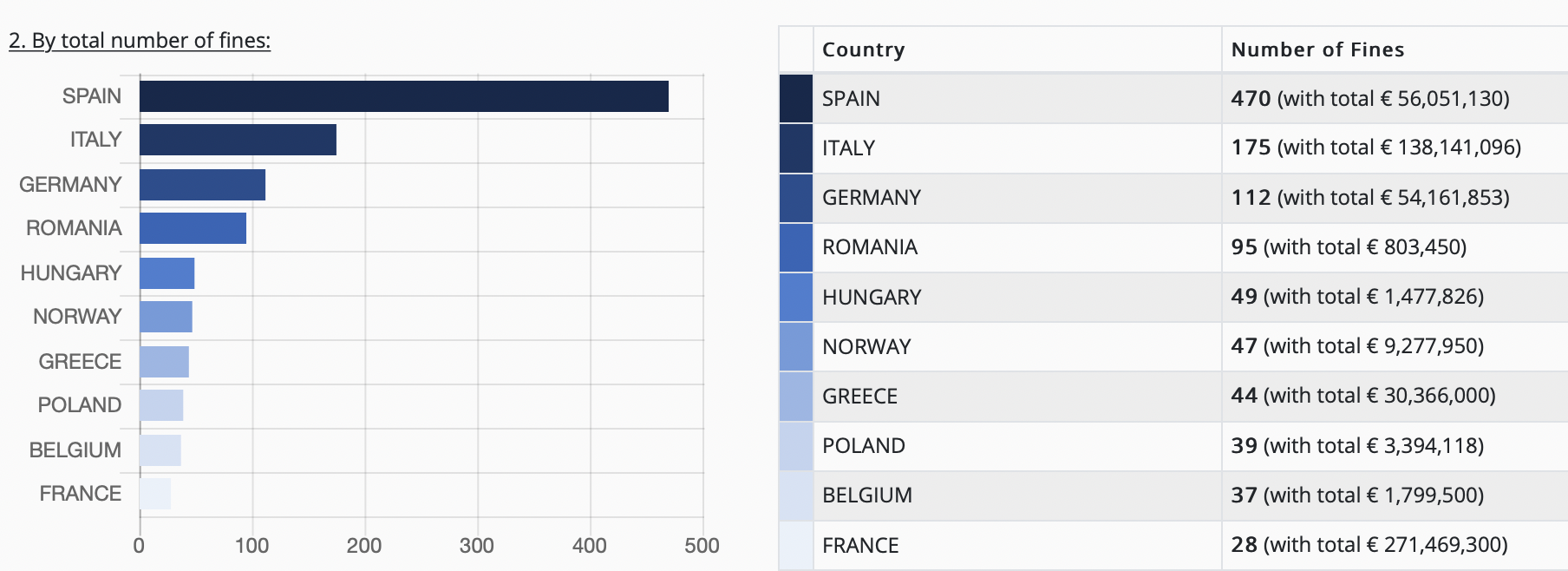

🤔 Is GDPR working? It's been 4 years since GDPR was enforced in Europe and data says that the related-fines now total $1.7 billion.

Not sure it's a big or a small number, but it begs the question whether this effort is really worth it. Ask anybody who builds lucrative stuff on the WWW and they will say that the GDPR is just a pain in the ass that leads to complicated overheads: more costly/work to do, inferior customer experience, lack of specific control on the customer journey etc. Nobody likes change, and complaining about the required changes make sense to a certain extent, particularly the user experience sucks since it is actually annoying to click on popups all the time - dealing with GDPR prompts is even worse than interacting with interruption advertising.

GDPR also impacted the way some big companies were making money via online advertising and marketing automation, like Facebook or Google. It led to fines, fights and instances such as Facebook threatening to block users access to its assets in the EU or Google having to pay for accessing some certain media assets for grabbing their data (which some analysts still childishly think it should be free because they simply don't understand how Google works).

But I believe all those are minor issues. Businesses always adapt and arguing with regulators will only improve the legislation in the end. And, in time, the UX will be optimised also. Overall, in spite of the inconveniences, the GDPR is working to its purposes of protecting consumers and all businesses altogether - it is a first step bringing order to the wild wild west, so to speak, whereas any internet company could do anything they wanted without being too much bothered by the legislators. Specific cases such as consumer scams and cyber vulnerabilities are not a low hanging fruit anymore. And, in general, GDPR is like any other laws from the Western society that lead to good behaviour, mostly a result of the non-compliance fear of being subject to law penalties - i.e. it's not a moral thing to do but the cost of not obeying is higher that doing wrong (like criminal behaviour etc).

GDPR also brings consumers a greater awareness of what data is being collected about them, and a greater ability to control that data. Yeah, it is a cumbersome process and most people have no idea what/why they click on, but being able to have a choice make them more comfortable with using the medium - trust leads to more usage, which leads to more business, which is good for all the actors involved.

Also notable, to date, Google, Facebook and Amazon are on the top ten highest individual fines related to GDPR. The Euro actors in the top also include H&M from Sweden, Tim (telco) and Enel (energy) from Italy and British Airways. More data specifics here.

🤔 Understanding how social networks work This week I read about a first time encounter of a Sifted journalist experiencing BeReal and not getting it - it made me realise that there is a big confusion between what a social network is and what entertainment is. In short, Georgina from Sifted seemingly expected a passive experience, to be entertained, and instead all she got was having to make an effort to contribute and create utility within a like-minded graph.

Of course she was disappointed, any mainstream user would be. They're hardly the target audience. The sites we now call generically social networks started as such and in time have became entertainment tools - the general expectation when trying an incumbent is to compare it to the utility provided by other entertainment providers. And that utility is passive content consumption as a general standard. The larger the network operator becomes, the higher the need of keeping the participants engaged and you do that through content - TikTok, Facebook or Linkedin are not social networks anymore, they are content farms keeping people engaged, making them addicted to return. And that content side of it was built in time, on top of the graph, as a mean to accelerated growth, while the graph itself has been diluted and become a secondary or tertiary purpose of the tool, if that - the main reason for consuming such sites is for the content. NB: that is why they invented terms such as "creators", "influencers" etc - to make them feel important while have them create content they don't own for free (see more data further down the email).

That is why I think it is harder to understand Bereal as is - unless you're a teen or understand the business playbook. Bereal is still at an inception phase where building their own graph and growing fast is more important than doing content for engagement. They found a hook (2 min/pictures) and a well-defined, rather homogenous audience (teens) and are pushing so that they saturate this segment. And even though based in Europe, they ignored the local market and went straight to the US physically, via an ambassador program in unis/high schools - a textbook example on how to grow a mobile consumer app. And it seemingly works, they're at 10 million DAU, and growing like crazy.

That is very unlikely of any other social network startups emerged from Europe in the past decade or so - they all had big challenges to scale globally.

A recent example is Zenly, another French startup that started as a rocket - raised series A at 1 million users and series B half a year later (at 2 million users) in a round led by no other than Benchmark, just to be flipped for a mere $213 million to Snapchat in less than a year afterwards, at 4 million downloads. A good return for European standards but not exactly a banner deal for Benchmark.

Another example is Vivino from Denmark, which grew spectacularly as a wine social network to the point where they realised they need to actually make money and scale, and pivoted from social network to e-commerce, now one of the largest wine sellers in the world.

Scaling is where it's at - another way of looking at this is the business model which, in time, forces a social network to change its fundamental mechanics. If you aim to become the largest network on the planet, then your implicit model is selling the attention of those people against advertising. Not only competing for global users attention is super hard, but also the advertising business you target is locked in the hands of Google/Fb/Apple. And I have said this before, creating utility, and selling it, can be more interesting and intellectually challenging, especially when you focus on a target profile and serve it well.

This is probably the biggest reasons for which not many social networks startups have become a huge business - a clear user utility that can be monetised should be defining in the history of a company, if it makes it big. Examples include in-app purchases, monetizable features, adding an e-commerce component or building a marketplace on top the graph. Google and Facebook already are doing this successfully as secondary revenue drivers, to some certain extents - but the good strategy practice here is to compete at the edges not to frontally fight the gorillas.

Tech Tapas reloaded

We have started working on a new edition of Tech Tapas, soon with more details. Related to that - we've been doing pitch preps with a select few founders looking to raise and in need to get feedback as how they're perceived by the other side.

If you're interested (or know somebody who is), we're taking applications for the next session here - super informal, direct and personalised sittings, also free of charge.

Cheat sheet reports

150 hot early stage* startups in Europe

• climate-focused (20)

• cybersecurity (20)

• financial services (50)

• marketplaces (30)

• web3 (30)

*curated from the ones that raised rounds less than $2 million in H1 2022

A curation of 80 deals led by American investors in Europe in H1 2022

• seed (34 deals)

• series A (40 deals)

• series B (16 deals)

+++

• European startups at Y Combinator in summer 2022 (30)

The most active investors in Europe in H1 2022

🇸🇪 in Sweden

🇫🇷 in France

🇩🇪 in Germany

🇬🇧 in the UK

🇺🇸 Americans

🇪🇺 top 250

Note: the reports are available for Nordic 9 paying customers only. You can become one from here - use code SundayCET at checkout to get 10% off.

Current situation

.png)

Related: About 45% of Gen Z creators say they aspire to own a business and make money from content shared online.

Watercooler talk

European affairs

🇳🇴 Musk City A Norwegian entrepreneur did a parody clip with the objective to invite Elon Musk for a cup of coffee, since he's rumoured to visit Norway.

• The clip went viral locally and it's actually cool, if you dig Norway/Norwegians.

• The guy who did it, Jonas Helmikstøl, is a startup founder building Easee, a manufacturer of EV chargers sold both to consumer and businesses.

• Musk has a great perception in Europe in spite of the bad press from America - particularly in the Nordics, which has been the top runner in buying Teslas and switching to everything electric in the society.

🇫🇷 France is giving €4,000 to people who trade in their car for an e-bike - for low income earners that is.

• French citizens from higher income brackets can also claim smaller subsidies.

• After doing a tremendous job of transforming Paris downtown in a pedestrian area, France makes another step to change its car-centric society - fwiw, Norway provided its citizens with a similar $25% subsidy thing in 2017 and Sweden in 2018.

🔋 The winter pickle

• In Britain, the Asda income tracker is painting a dire picture for the UK consumer, worrying signs include spike in demand for pawnbrokers, as well as a beer shortage from a lack of carbon dioxide.

• Moreover, it's estimated that a typical British household will pay in energy bills 80% more this winter, with the specific numbers showing a budget raise from £1,971 per year to £3,549 beginning in October.

• The UK is not a special case, we're in this all together to some certain degree - for example, French power prices for 2023 are trading 30X the 5-yr average price, at €900/MW,H with winter prices above €1.500/MWH.

🇬🇧 Brits looking to deter protests. Data obtained by Big Brother Watch shows UK police appear to be routinely abusing stop and search powers during protests. The civil liberties group’s investigation into stop and search data comes as Priti Patel, the home secretary, is proposing a significant extension of the grounds for justifying a search. A new public order bill currently before MPs would allow police to search almost anyone close to a protest deemed to be causing “annoyance”. The sole purpose of this expansion of the law is to deter protests.

🇩🇪 Germans doing hydrogen trains. In Lower Saxony, Germany launched a network with hydrogen fuel cell trains in passenger service - 14 hydrogen-powered Coradia iLint regional trains, replacing 15 diesel trains. link

🇫🇮 Digital euro as alternative to crypto Bank of Finland says digital euro could facilitate pan-European services to consumers - the digital euro centralized bank digital currency (CBDC) functioning in tandem with private fintech solutions will make easier the cross-border payment of services across Europe. Earlier this month, the ECB identified CBDCs as the best method for cross-border payments compared to stablecoins and other cryptos.

🇨🇳 China also doing the digital yuan Beijing announced a two-year "metaverse innovation and development plan", a pompous name for pushing the mainstream adoption and utility of the digital yuan. The Chinese government has even partnered with food-delivery giant Meituan and e-commerce platform JD.com to integrate e-CNY payments.

Investors dealings

💲 The world's most successful investor, John Doerr, now operates 32 funds, regrets not investing in Tesla early on, says energy transition is as formative as the Internet revolution + many old stories for newbies in this interview.

🐯 The Tiger name (of Tiger Global) was inspired by Julian Robertson’s habit of calling people “Tiger” if he couldn’t remember their name. Robertson founded Tiger Management, one of the first hedge funds, in 1980 - he died last week. Related: a dozen things some dude learnt from JR about investing.

❓ Investors questions - a list with questions that investors ask during a pitch + a thread with what founders say need the most from their pre-seed / seed investors

🦆 More Euro VC content - Sifted launched a brand new NL aiming to help the VCs, it's free and gossipy.

🤡 Oh no, really? VC and private equity investors are becoming concerned over the exit environment, and the majority believe the asset class is overvalued.

Also notable

💲 Big boys bets Amazon bought Whole Foods five years ago for $13.7 billion - here’s what’s changed at the high-end grocer.

💎 Money out of NFTs Nike’s NFT-related projects have generated $185 million this year in a top also including Dolce & Gabbana w/ $25 million and Tiffany with $12M. More data at the link, which, btw, is LeBron James' Dune account. :-)

🤔 Bloomberg doing cost of capital deductions as it featured a couple of analysts saying that rising rates (due to higher inflation and liquidity drying up) have stressed the BNPL business model.

🍻 Thursdays are the new Fridays - indeed. That is according to a trial of the four-day week has been going for more than two months in the UK. As more flexible hybrid office working has persisted, the pubs have become noticeably busier on Thursdays.

🙈 Snowflake Zuck says that waking up every day is like being punched in the stomach by his messages - he resets by working out.

💲 The top 10 richest athletes in the world in 2022 - link

1. Michael Jordan (basketball)

2. Vince McMahon (wrestling)

3. Ion Tiriac (tennis)

4. Anna Kasprzak (dressage rider)

5. Tiger Woods (golf)

6. Eddie Jordan (race car driver)

7. Junior Bridgeman (basketball)

8. Lionel Messi (football)

9. Magic Johnson (basketball)

10. Michael Schumacher (F1)

🧅 The Onion guide to BeReal. link

🇨🇭 Swiss glaciers have shed half their volume since 1931, following the first reconstruction of the country's ice loss in the 20th century.

🐑 The sheep human - herding sheep is like herding people, the French edition.

🇫🇷 In France there's a street cleaner who is live streaming from his job - has 260k followers on tiktok and also wrote a book.

🎶 If nothing works, blame it on jazz.

Let's have some fun

🧩 I got a lil' quiz for you.

You have the following clues:

• multistage investor

• active across all Europe

• did an equal number of deals in the UK and France this year

• top 30 most active investor in H1 2022 in Europe

What investor could that be?

Email your best guesses by sending us an email - the winners get one month free of the N9 PRO package and will be announced in next week's email, along with correct answer.

Don't dig for deals

Discover how Nordic 9 can make your life easier with access to the most important Euro VC deals of the week.

• Concise, easy to scan format of what's relevant, structured by early/later stage and geography - in your inbox every Monday early in the morning.

• You get smarter quick via a clean, faster access on the deals, trends and lists of who is transforming your industry.

• Proprietary, manually curated databases of 10,000 Euro startup transactions every year. Not scraped from others, nor licensed from third parties.

Use code SundayCET at checkout to get 10% off your subscription.

Did you find this useful? 🤔

Questions or comments? Let us know!

Sunday CET

Sunday CET

Notes and commentaries about what matters in the European space - concise, no non-sense insights, interesting stories and implications for founders, investors, employees from tech companies or government representatives.

Published every Sunday morning by Dragos Novac and emailed to investors, founders and decisions makers from 50+ countries who want to understand the ecosystem from Europe.