is marketing a useless exercise?

is marketing a useless exercise?

• doing marketing is not a bad thing

• how do you know when the markets are turning

• optimise for your startup not for your investors business model

Observations

Gil posit: YC has gone from being a net positive force in the innovation eco-system to being a net negative force.

It's a statement that results from a longer chain of thoughts in which Gil argues that startups get hurt by doing the accelerator programs provided by big VC names such as Sequoia or a16z, and that the said accelerators are nothing but an useless or an even net negative marketing exercise for the ecosystem.

In spite of the high fives the post received and as a rather impartial observer, I found myself disagreeing mainly because it neglects the startup side of the ecosystem equation - I can only assume that is because most investors have never eaten their own dog food i.e. never had to build a startup and raise money for it cold turkey. And this creates the premise for lack of empathy.

Here's why. When you're pre- or very early revenue in a startup talking to investors, you look for believers not for money per se. You don't think about big or small names in the industry if you're doing your DD right - yes, you will include some notorious ones in the list, but you will sort them through based on an educated guess about what stands out for one or the other related to your defined objective, mainly based on the past record (you assume vertical track = vertical experience), references (i.e. "they are idiots, avoid them" - but you will contact them anyways because maybe this time it's different) and the social media activity (usually full of 'startups for dummies' platitudes). And digging down further, not only you won't find differentiators but you will find that everybody is singing the same old broken record because everybody's selling more or less the same thing. Some of the more common factors claimed as competitive advantages in the industry are that investors care about the founders (they might but it's very relative) or that they invest in a specific vertical or stage (not a differentiator, but rather just a scope of work delineation). Others will say they're smart and knowledgeable (most of them are) and that they will deploy additional intangible resources in case they will fund you (some of them will). This is pretty much standard language and hardly a differentiator - for smart founders it's all BS anyways and will never take those words at par. Because they don't look for what investors are selling up front - they look for smart money who believes in them and checking that box requires at least a conversation, not an outside fake signal. And a simple interaction is the only way to see if the image is for real or just empty words for a nice facade.

When you're at the beginning of the fundraising process, you have a list of 100-200 names you need to talk to in order to do a proper job. It's a sales process and you gotta do it right - most founders find it a waste of time instead of talking to customers but it is a great exercise to understand how the investors market looks at you and ultimately getting a ticket to boost your trajectory. Some will ignore you, some will ghost you after one convo, some will be clueless in their feedback and some will actually take you seriously but will turn you down because they don't have conviction. The last category is to be appreciated because they're treating their job professionally, at least they respected your time and efforts and used a cognitive process for doing their part.

As a parenthesis - even though it is easy to take it personally because you're on the losing side of an intellectual exercise, investors without conviction at early stages shouldn't be a discouraging factor for a founder. The way investors argument and behave with you is more important than their conclusions, which you will likely disagree with - they just don't see what you see and that's fine. In fact, great investors say that doing early stage is the opposite of going to the casino with fully-prepared market analysis ready to beat the house - it is more of a "all on red" kind of betting. That's simply because smart founders at the beginning will iterate and pivot numerous times until they will get it right, and whatever market calculations investors may have made in order to decline them, they could be wrong - everything is fluid in the startup world. Here's a textbook example - 1, 2 - of what I am talking about.

And so, this is the founders side of the ecosystem equation. And in all this context, the larger the qualified investors scope, the better for startups. Founders seeing more programs such as Sequoia's or a16z's, are just seeing yet another chance to find believers while also getting some money for further de-risking ($1 million can get you very far) - that's nothing but a great thing. Once you took that chance, you are in a context where it is up to you to execute and work the market further to advance with the next levels. Founders hardly optimise for investor signalling but rather for building a business to the best of their ability with whatever resources they have available - that's the job description. Investors sentiment can change very quickly when they see the execution and everybody will suddenly become your friend as soon as you have the traction you didn't when selling just conviction. And if they passed and you make it big, that will haunt them for the rest of their lives.

Competition sucks

Not least, on the investor side of things, I totally dig Gil's feelings towards the big industry names doing their thing. I have written about this many times - the buy side in Europe used to be easy. A few consultants here and there willing to take risks by looking more or less at the same deals - most of them locally and a handful with cross-border ambitions as well. There was more collaboration than competition - there was even a spirit of camaraderie and friendship that usually emerges in a small market with not too many people sharing the pie.

Today that is simply not the case anymore. Everybody and their mother is an investor, and everybody competes with everybody, many funds raised above the 50 million threshold, there's an even more dense long tail and a lot of American dudes doing business locally. The market expanded and has become hyper competitive and because of that it started to become segmented.

And this is what the crossovers or the likes of Sequoia, a16z or even YC have been doing for the past 12 months. They have segmented the market and created their own game within the game - either paying a hefty premium for assets, or making a decision in a few days, or not taking board seats, or doing scout or accelerator programs, namely smart tactics or mechanisms to buy more optionality in multiple tiers of the market (top 5% will look them up because of their brand and the following tier will come for the platform). They have changed the rules of engagement in the industry in a smart way and put themselves at the top of the market, and in the process they created a lot of discomfort to the rest who used to doing things the old way. Change is disruption and there's very few equipped to deal with it.

And so, closing the circle to what started my observations - even though they seem to be pure marketing exercises, the platform/accelerator plays of the big names have their own strategic purpose. It is easy to disconsider them as defensive mechanisms destroying the market, but truth is they are offensive weapons for market share acquisition. Marketing is not done in a vacuum, it is a tactic that results from a cognitive decision part of a big picture strategy, which should have some quantifiable results. That is the new reality of a relatively young industry used to do things in a still very old way.

And how do you compete with this? There's many ways, likely the subject for another email and/or private conversations. But fact is - to make an analogy and take this with all due respect - if you are a local indie soda producer competing with Coca Cola, and you claim that Coca Cola sucks - that is not competing, it's just whining.

Cheat sheet and intel reports

Interesting startups in Europe

• NFTs

• web3

• RBF

• BNPL

• B2B marketplaces

• Swedish SAAS

• promising French

The latest Nordic intel

• 2 (two) cyber security startups raised VC money

• €1 billion exit for a Swedish D2C

• private investors find value de-listing assets from local exchanges

• yet another new VC house emerging from Sweden

Link - we send it to the N9 customers every Friday evening, you can subscribe to get it from here.

The most active investors in Europe in Q1

• in Europe (late stage | early stage | angel investors)

• in the Nordics

• in DACH (Germany, Austria, Switzerland)

• in France

• in the UK

• the Americans

Note: the reports are available for Nordic 9 paying customers only. You can become one from here.

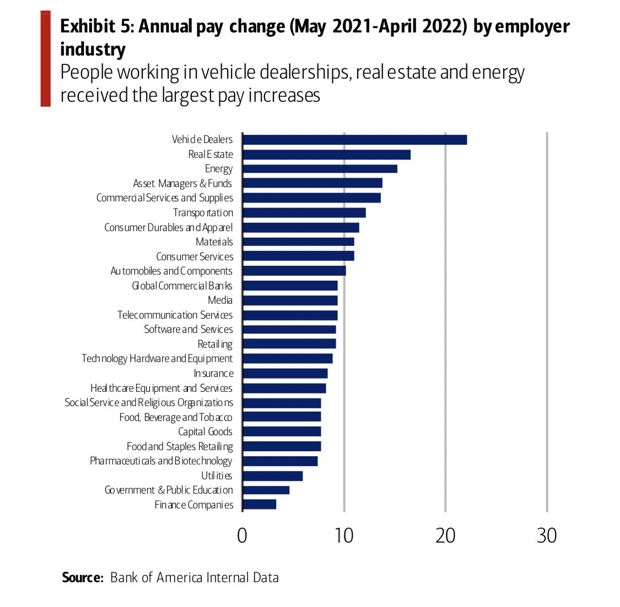

Is your salary adjusted to the inflation?

Speaking of which

Watercooler talk

🈺 The VC ecosystem in Europe - is it in trouble or not? You will rarely get a straight answer from investors when talking to the media 1, 2. Alas everybody seems to be in limbo like they were in March 2020, even though today the macro factors are not as bad as the sentiment - the uncertainty is fed by the general consensus that we will be in big macro troubles by the end of the year as we still have open wounds like Ukraine and Covid for which there's no clear resolutions in sight. The preferred investors swing in this situation is to either sit & wait or to favour profitability instead of growth, because hard cash in the bank is the best alternative to get rich quick mindset for the snowflake bunch. If I were to take a guess, the startup funding business will resume shortly based on the fact that there's still a lot of idle money to be deployed in the market and that there's more founders than ever building stuff out. We'll know we have crossed that bridge as soon as we hit a somewhat predictable equilibrium point and/or when we'll see again funding deals of consumer/longtail B2B SAAS used only by hipster geeks and their VC friends. In the meantime, the fat cutting off frenzy in the well-funded startups league continues - 1, 2, 3

🤡 The private equity industry has grown into a pyramid scheme that will create casualties in around three to five years - deals were being done at exorbitant valuations and private equity firms were on both sides of the transactions. link

🇬🇧 Good example of what happens when founders optimise for investors' business model and not for their startups - investors want to multiply their money as fast as possible while on the other hand founders building a sustainable business takes much more time, patience and, well, a solid foundation that doesn't get done over night just because you have the money. Building something huge and qualitative very fast is an inherent dichotomy - rushing it up for the sake of fast growth just because investors want you to can impact negatively your DNA, which will spread like a tumour across all business levels. link + counter example.

🇬🇧 How will Britain look like in 2050s

• The built environment of most of Britain will look the same as it does now.

• The housing crisis will become more acute- NIMBY Vs YIMBY will be a major political divide.

• Artificial intelligence will make a huge impact on the Labour market, but government intervention/rules will dampen this.

• The UK will be ‘Net’ carbon-neutral, emphasis on the net. The green movement will shift its focus away from climate change.

• It’ll be environmentalists Vs conservationists

• The birth rate will continue to decline slowly — childlessness will be more common, but so will large families.

• There will be flying cars, though only just.

Read the whole thing

🇪🇸 Bank of America is in talks to buy part of the television rights to Spanish club FC Barcelona for €600 million. BOA previously granted the Spanish a €525 million loan and the club previously had been in talks to sell an equity stake to CVC Capital Partners.

🐹 How do you go about getting a job nowadays - I haven't been in the job market for 20 years now, but from I gather traditional channels and portals are long gone. I mean, sure, you will still check those out I'd assume a listing them is a good marketing practice, but even Linkedin has turned into a big, noisy money-making machine that doesn't deliver as it used to. Invite-only networking forums on Slack is where it's at.

🤔 Recurring subscription services for which people forget they are still paying -- from streaming outfits like Netflix to magazines -- cost them about $133 on average each month.

🇪🇸 The government of Spain forces companies to answer the phone in 3 minutes or less in general information, claims and after-sales services. In addition, general claims must be resolved in 15 business days, and not in 30 days. link

🇭🇷 Croatia is set to switch from kuna to the euro currency from the start of 2023. Bulgaria will go next in 2024.

🇬🇧 A pint of beer in the UK costs 70% more now than during the 2008 financial crisis, going as high as £8 ($10) a pint in some pubs. Similar prices from my past weeks experience - Stockholm: $8, Zurich: $9, Warsaw: $5, Bucharest: $3.

🇳🇱 The Dutch retailer Albert Heijn will decarbonise all deliveries in the centre of the Hague by the end 2022, including home delivery and the supply of its stores. Throughout 2023, deliveries in central Rotterdam, Utrecht, and Amsterdam are also to be made only electrically.

🇩🇰 Fantastic read abut the unseen face of the high end restaurant industry in Denmark link (or go here and click on the first result)

🇹🇷 Turkey’s inflation rose by 73.5% year on year, its highest in 23 years, while food prices in the country of 84 million rose 91.6% year on year.

Speaking of which, the country announced changing their name to Turkiye because they had enough of being associated with a large bird that is best known as a symbol of the North American Thanksgiving holiday.

🇫🇷 France is the most attractive country in Europe for foreign investors and London still tops as the most attractive European city for investors in 2021, ahead of Paris. Is this Macron or Brexit? link

💲 Nineteen companies have canceled SPAC mergers in 2022, representing nearly $18 billion of dumped deal value.

✨ Benchmark did a $15 million series A in an 'anti Instagram app' from Los Angeles w/ 5 million users in the 14-18 age range.

🏀 Phil Knight, founder of Nike, wants to buy an NBA team for more than $2 billion.

🤖 Sheryl Sandberg is stepping down as the COO of Facebook parent company Meta Platforms 14 years after accepting the role. Looks like it's all for a banal reason - she was under internal investigation for using corporate resources to plan her wedding.

🕶️ Fanboys are excited that Apple is likely to announce their smart glass product at WWDC tomorrow.

✈️ Google cofounder Sergey Brin is said to be working on the largest airship to be built in the United States since the 1930s.

🧨 The pivot to web3 is going to get people hurt.

🐝 Legally bees are fish now.

Did you find this useful? 🤔

Sharing is caring

Have your colleagues and friends sign up too. To support our work, please consider subscribing to N9.

Sunday CET

Sunday CET

Notes and commentaries about what matters in the European space - concise, no non-sense insights, interesting stories and implications for founders, investors, employees from tech companies or government representatives.

Published every Sunday morning by Dragos Novac and emailed to investors, founders and decisions makers from 50+ countries who want to understand the ecosystem from Europe.