NFT in Europe

NFT in Europe

• NFT startups in Europe

• the market is going down

• Dutch can't handle business

Cheat sheet and intel reports

Interesting NFT startups in Europe

NFTs - Non-Fungible Tokens - are a simple piece of tech (i.e. an unique crypto asset linked to an object, typically a piece of digital art) that have gone beyond the tech world, close to becoming a mainstream thing. Business wise it's still early though - like any silly piece of tech, most of the economic models around NFTs are also silly, though there's some NFT startups that have exploded. Beyond the VC-funded work focused rather on inventing new paradigms, I find more intriguing how you can incorporate an NFT in a traditional business - gaming is the lowest hanging fruit (i.e. in-game trading and virtual purchases) but fashion and art can provide equally deep exploratory avenues. That is the reason for which I thought it'd be interesting to dig into what some European startups are building with NFTs at very early stages and created a list with what I found interesting. (NB: the list, as most cheat sheet/intel materials are for Nordic 9 customers - you can become one from here)

Related:

• interesting web3 startups link

• investors backing web3 startups link

Fintech in Europe

• revenue-based financing startups and investors link

• BNPL startups and their investors link

• startups building consumer fintech link

Recent intel pieces

• Early stage VCs cashing out link

• Follow-on and exit deals link

• The Swedish investors nobody talks about link

• Lightspeed's first venture deal in the Nordics link

• Notes about the Euro VC market link

The most active investors in Europe in Q1

• in Europe (late stage | early stage | angel investors)

• in the Nordics

• in DACH (Germany, Austria, Switzerland)

• in France

• in the UK

• the Americans

Note: the reports are available for Nordic 9 paying customers only. You can become one from here.

Oh la la France...

Watercooler talk

🇪🇺 Crash boom bang Remember back in January when I was wondering about the investment environment in Europe, because of all the strong evidence for the market going downward?

Looks like we're in the middle of the reset and the hurt is real, with investors switching from FOMO and greed to fear. Like always in this position, cash is king and building stuff is the right side to be on (or being employed by builders or deep-pocketed corps if your risk appetite is low).

Even asked a few Euro VCs about it.

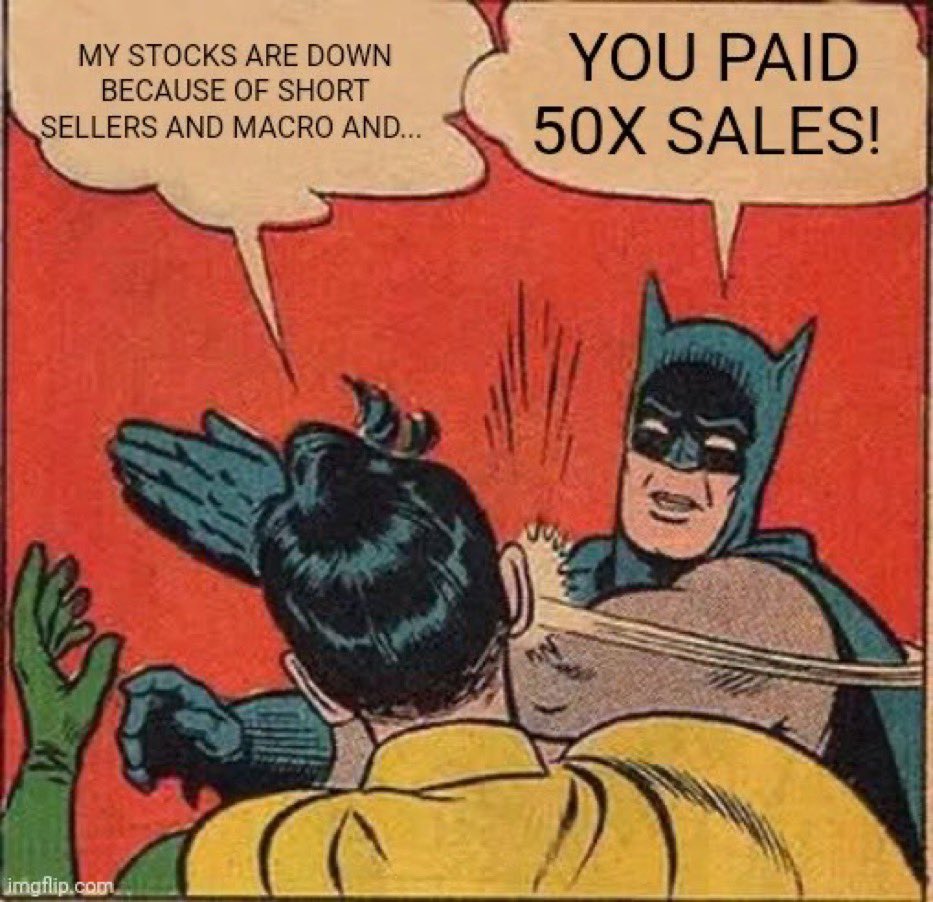

Well, the tide seems to gather strength now. Yes, in Europe too. It's that part of the market cycle when asset fundamentals are more important than exuberant expectations - raising too much too fast because investors model and/or founders greed dictates that is not good more often than not, has too little to do with building a sustainable business, and look, growth is sluggish, Q1 numbers are not great, layoffs are being made, hyper growth is too hyper etc.

🇪🇪 Taavet+Sten Sifted did a good profile of two guys who are among Europe's best angel investors. Their edge is that they have been startup people for decades and don't sell theory as the consultant type you will generally meet in the Europe VC land. Taavet worked for Skype (remember Skype?) and founded Wise while Sten founded Teleport, acquired by Topia. Both long time active angels, a year ago joined forces to invest together and have since made a dozen of deals.

🇬🇧 VC 101 Some chaps doing the finance section for a newspaper discovered that UK's £1.1 billion Future Fund scheme deploying funding in startups resulted into 'over 30 failures'. I am the first to say that the governmental work in the startup area is mediocre at best, but looking at the number of failed startups is the wrong benchmark to consider if you want to make a fair evaluation. This is basic - 'failed startups' is the 'venture' in the 'venture capital'.

🇳🇱 Invite-only for the tourists A Dutch set up a private club for the fund vehicles of the super-rich to explore investment ideas, with expansion based on the global growth in family offices. Over the past two years, the London-based group has hosted almost 100 events and ballooned from just a handful of firms to about 250 globally, with combined assets under management of at least $500 billion. The pros call them tourists. link

💲 Techstars did a smart strategic move and launched an $8 million fund for companies too early for its own accelerator. They also have a positioning for it - invest in underrepresented founders of color in the U.S - but say that further iterations could focus on international founders. This is yet another VC marketing play at the edges as I have been preaching over and over again - ya know, in a world of tons of money chasing too few good projects, if you're an investor at very early stages, what makes you different, other than swag or posting VC banalities on TikTok?

Macro

🤡 Bear markets The Nasdaq is at 13% loss this month, its worst showing since October 2008. The index is down 21% this year, its worst start to a year on record. Brutal.

🇩🇪 Deutsche Bank says that a major recession is just around the corner. Inflation, high interest rates, f** up supply chains, Ukraine... but it's complicated, as rightly put here:

Where exactly is that? In Russia? In Ukraine? What does ‘major’ mean these days? And furthermore, if it comes... and you assume it comes, we will just sit and wait for it? Or do we counter it?

🇫🇷 Capitalism is not socialism, part 21323. Here's one of the reasons for which (at least) half of France doesn't love Macron, vis a vis the last week's elections where 13 million French people voted for Putin's puppet:

Total billionaire wealth doubled under Macron to 17 per cent of GDP, and nearly 80 per cent of French billionaires’ wealth is inherited — among the highest in the world.

On the other hand:

Macron had promised to reduce state spending by about 5 percentage points. Under pressure from protests and the pandemic, state spending rose to a staggering 60 per cent of GDP. France’s government spending is 15 points above the average for developed economies.

🇩🇪 Meanwhile in Germany - thirty personalities from the field of culture and art, including German journalists, musicians and artists, wrote an open letter to German Chancellor Olaf Scholz calling on Germany to stop supporting Ukraine and effectively for its capitulation to Russia. Not a joke.

Related: The moment you allow yourself to hear about the massacre of Bucha or something like that, you start to doubt your government. To avoid this . . . people prefer not to hear anything.

🇨🇳 China is in trouble. Economic trouble:

President Xi has maneuvered himself into two dead ends at once: He can’t change his Covid policy [i.e the current lockdown is even more extreme than in early 2020, and the economy is crashing almost as hard], and he can’t change anything about his friendship with Vladimir Putin. [...] From March 28th, with Covid in Shanghai, everything collapsed. The problem goes far beyond Shanghai: I hear of car manufacturers that produce in Jiangsu province and are not directly affected by the lockdown. But they can’t get parts from their hundreds of subcontractors, either because they can’t produce or because shipments can’t get through the lockdown areas. Everyone is desperately trying to fill their warehouses, the finely tuned just-in-time processes are no longer working. These effects will only be seen in the economic data over the next few months.

And you know something's not right when China is to end regulatory storm over Big Tech and give sector bigger role in boosting the economy.

Readings

🤷 What doomed CNN+ The background strategic story of mergers and acquisitions gone wrong link

🙉 Packaging matters Still at media business - I once told a media guy that doing good content with clickbait titles and tabloid design gives the wrong signal about the quality of the publication. He got upset. Signalling premium.

🤏 Startup valuations - the three eras of startup valuations link

🤔 VCs at work - ownership vs diversification link

🔗 Beyond aggregation: Amazon as a service link

#️⃣ Why North Carolina is becoming the Silicon Valley of the metaverse link

🈺 B2B marketplace funding napkin link

🧲 The big money is in quantum - in 2021, $3.2B was invested in quantum firms around the world compared to $900M in 2020. link

📱 The global refurbished smartphone market grew 15% yoy link

▶️ Play - Startup trail link

How was your week?

🐦 Twitter - The only Twitter mention you will find in today's newsletter link

🇬🇧 LA Dodgers owner Todd Boehly is set to be named the preferred bidder for Chelsea even though British billionaire Jim Ratcliffe announced a bid of $5.3 billion - it'd be the highest price paid for a sports team in history. link

🇩🇪 Former tennis champion Boris Becker is going to jail for 2.5 years for hiding assets to avoid paying debts. link

🇳🇱 Dutch can't handle business - Schiphol Airport asked airlines to cancel flights next week and make no new bookings for the period 2 to 8 May to prevent further chaos at the airport. Schiphol is Europe's third busiest airport.

🇬🇧 Brits can't make profits - Heathrow Airport has announced it will remain loss-making in 2022 as demand remains very volatile. Heathrow is Europe's third busiest airport. link

👀 Job market - I will take your new job if:

• 3-day workweek

• no mgmt responsibility

• annual salary >$190k + stock/tokens link

🇰🇵 Hacking the hackers - I think I just interviewed a North Korean hacker. link

🇷🇺 Rich Russians consider London-Dubai property swap to avoid financial scrutiny link

🇪🇺 EU attacks lawsuits used by rich and powerful to silence critics link

🇮🇹 Italy's Constitutional Court ruled that newborns that are automatically assigned the father's surname at birth is unconstitutional and damaging to a child's identity. link

🚩 California woman dropped her cellphone while using it into a nonflush toilet from mountains and had to be rescued as she fell in. link

Did you find this useful? 🤔

Sharing is caring

Have your colleagues and friends sign up too.

To support our work, please consider subscribing to N9.

Sunday CET

Sunday CET

Notes and commentaries about what matters in the European space - concise, no non-sense insights, interesting stories and implications for founders, investors, employees from tech companies or government representatives.

Published every Sunday morning by Dragos Novac and emailed to investors, founders and decisions makers from 50+ countries who want to understand the ecosystem from Europe.