no good tech company should ever list in London

no good tech company should ever list in London

• do tiny shakes make for a bear market?

• tourists investors to get a blow

• no good tech company should ever list in London

Observations

🤷♂️ Two full weeks into the 2022 and it looks like the circus hasn't stopped. Au contraire.

People are buying like crazy assets from the private market in the lil' European startup ecosystem that got high on the record amounts of cash available in the financial markets from all over the world.

And when you keep taking and taking, it becomes addictive, little by little, barriers and prejudices that seemed insurmountable a year or two ago, seem to be irrelevant now and the name of the game is to deploy in all sorts of combinations.

Meanwhile, in the last few weeks, the public markets seem to have cooled down quite a bit. Software company multiples have halved, fintech stocks went down, the IPO sector is in crash mode and so are the cryptocoins - all these of course can be just be some tiny conjectural offsets. But the private market keeps going up, both in Europe and across the ocean.

It's hard to make accurate predictions but I believe that it's just a matter of time until a calibration process will start. There's too many market unbalances that need to settle or simply reset, and it seems that it's starting already. The Fed will likely increase the rate 3-4 times in 2022. So will the UK, while France already doubled their rate on their popular regulated savings accounts. All three countries are at historic high inflation rates and have been heavily subsidising the economies because of covid, with an even dramatic edge for the Brits since Brexit f-ed them up badly as is.

And this is just basic volatility check, there's a lot of other macro out there that can explode any moment and precipitate things out with multiple implications. It ain't even a black swan anymore, they're all white now, all lined up at the horizon. But simplistically put, more expensive money means an even more cooling down of the public markets, which should be followed by the late stage VC deal valuations, which will then affect the earlier stage. I don't think the correction will be as dramatic as in the public markets, but hopefully we will get closer to a 2020-ish level. If that.

🇪🇪 Bolt raised more capital at $8.1 billion valuation. So did other scooter companies like Voi and Tier at 3-4X lower numbers recently, but why is Bolt more interesting and the higheste valued of them all?

Bolt is the European scooter company that used the corona adverse situation to expand aggressively into the food delivery space - within a year it built out a logistics ecosystem in 10 countries that competes significantly with established grocery delivery providers.

The food delivery business is still super fragmented and I expect to see more Euro and global consolidation. This is an operational-driven business where scale and logistics economics are key - an inventory-dependent business living off a 30% margin, particularly challenging since the supply chains are strained due to inflation, expensive labor or product shortages.

Handling both food delivery and scooter management at the same time has evident synergies and are exactly valued in the 8 bill price tag, together with the upside execution - coincidentally it is roughly the same price that Wolt was sold for. But I can predict that the investors prize will be higher for Bolt. :D

🍲 A notable announcement in the investors world this week was Y Combinator providing a new $500k standard deal for their startups, meaning that on top of the 125k for 7% accelerator money, they provide the difference at terms that other investors find unfair ($350k on an uncapped SAFE with an MFN).

I saw and talked to quite a few investors complaining about it because this makes it more expensive to get into YC deals, which were pricey anyways. Additionally, in countries where valuations are lower startups will find it harder to raise and implicitly having to dilute more because YC's chunk is big, and locals are not having a similar risk appetite like in the US.

My 2 cents:

• most important of all, many investors simply do not understand how much a startup can do with 500k in inception phases, de-risking components and accomplishing milestones in order to reach a decent velocity position. This money gives them breathing room and resources - instead of wasting time chasing small checks or a bridge round pre-demo day, they have cash in hand to spend on the business validating hypothesis, exactly in the 0 to 1 period that's critical for any guy building a startup. This buys them money & time at the same time.

• secondly, from an investor perspective, this move will mostly affect tourists which built their portfolio on the YC economy. That means the discovery costs associated with the YC brand got higher - a bit of segmentation clean up in the world of dumb money.

• it also impacts the world of seed investors looking to lead post-demo day. Instead of a 10000 suitors roaster there will only be 1000 traditional seed/series A investors willing to back large rounds upon graduation. Non-American startups will be a bit more impacted since there's not as many potential investors in the home markets and American investors value them lower - but founders have 500k reasons to put themselves in a better position and Europe has become fairly competitive as well and caught quite quick with American valuations anyways.

• not least, from a landscape perspective, if it wasn't evident until now, YC is consolidating its premium market corner position in the business of selling equity money to startups at preseed and seed stages. And it doesn't really have competition as it scales - they did it beautifully in Europe - it's them and then multiple little guys at the edges.

PS. Here's a lil' Euro overview of the equity/$ ratio in the accelerator world:

• Techstars - 6% for $20k

• YC - 7% for $125k (+ $350k now)

• Antler - 10% for $50k (it's actually 100k but they take back half of it as the cost of their program)

• EF - 10% for $110k

🇬🇧 Real talk: no good tech company should ever list in London. LSE guys beg to differ, of course, it is their job but data, facts and recent events are not really supporting arguments in London's favour.

Is this because LSE is badly managed or overall a poorly packaged product? I find it hard to believe so - in fact it just announced the launch of a special market whereas private companies could trade their shares publicly, which is a great idea.

I think it's something else. Here's a pmarca vintage that anybody who's ever built a company should be familiar with:

In a terrible market, you can have the best product in the world and an absolutely killer team, and it doesn’t matter - you’re going to fail.

That is to say the business environment in the UK, and in Europe in general, is way different than in the US which provides for the generally superior performance benchmark in the world. In the UK/Europe the market's actors are, well, old school, to put it very nicely? The legislation is super fragmented and, again, maybe out dated?

It's a legacy ecosystem based on rules, practices and beliefs colliding with the realities of the 21st century, whereas the old tricks for making money out of the financial markets may not work in their entirety now that we live in a world with metaverses and crypto kitties and self driving cars.

This is an important topic, I know many unhappy cases and people and ultimately the end game for all the huge amounts of late stage VC money spent in Europe that should look for returns sooner or later. Will all those guys flee to the US public markets? Likely, America is certainly the best environment for maximising returns and making everybody happy. And even if it's not, them dudes are great at figuring out a way to eat the cake and have it too.

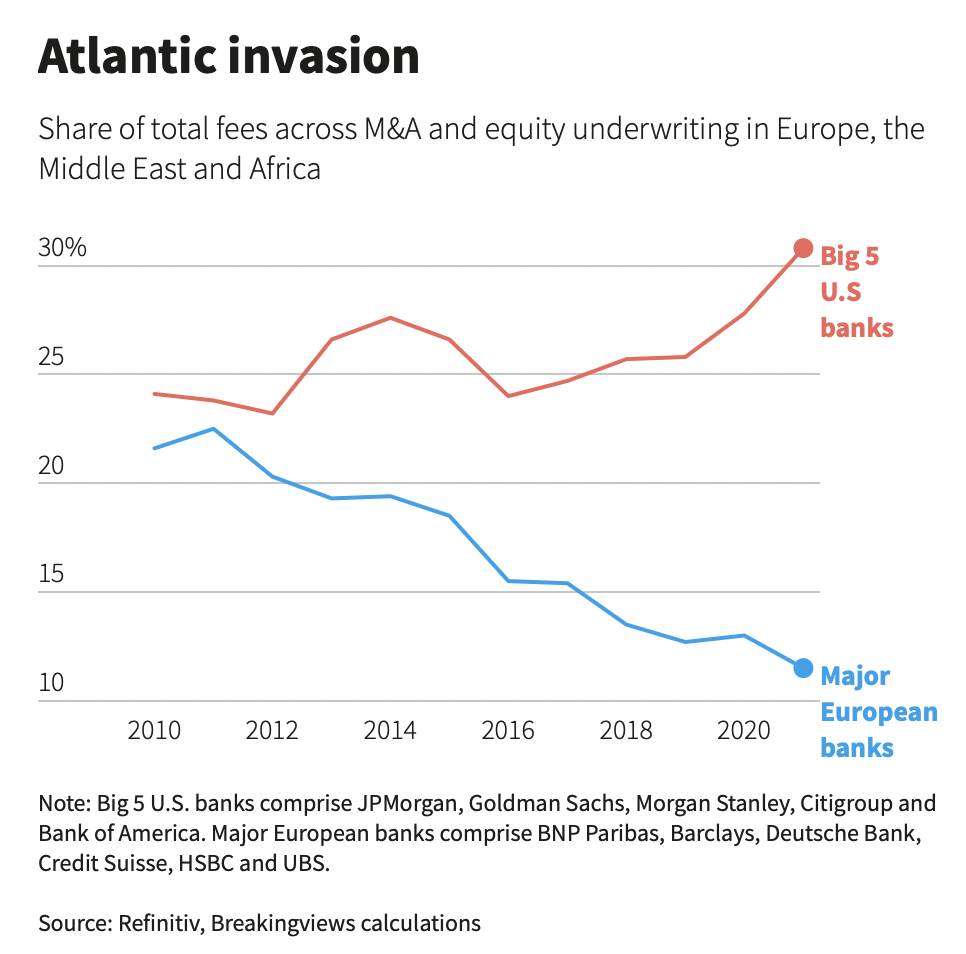

🇬🇧 More on topic - even in a record year, dealmakers at European investment banks still lost market share in their home region. Here's a lil graph to understand where Europe in general stands compared to the American financial markets 👇

Cheat sheet reports

• The most interesting deals from the Xmas holidays in the Nordics, DACH, the UK and the rest of Europe.

• In 2021 we tracked the investment activity of almost 500 angel investors from France, 2X yoy. We have profiled 30 of them.

• Last year we made deep dives on the valuations of a few European startups: Klarna, Whereby, Weezy, Wolt, Sifted.

• We have profiled the up and coming new wave of European investors, the main VC investors from the US who are actively dealing in Europe and the American tech executives angel investing in Europe.

• We have created lists with must know names of investors active in Euroe - 100 investing at pre seed and seed, 30 investing at late stage as well as super angels.

• Not least important, we have reviewed the startups backed by the VC scouts in Europe.

Intel:

• the investment ecosystem in Europe in 2022.

• Tiger's model

• Euro series As at $20+ million

Popular pieces:

• Are we at the end of the tech booming cycle in the UK?

• Was the Deliveroo IPO a flop?

• The profile of European rich people.

• The European unicorn nobody talks about.

• Where is the VC market going.

Note: the reports are for Nordic 9 paying customers only. You can become one from here.

Indoor heating loss

History

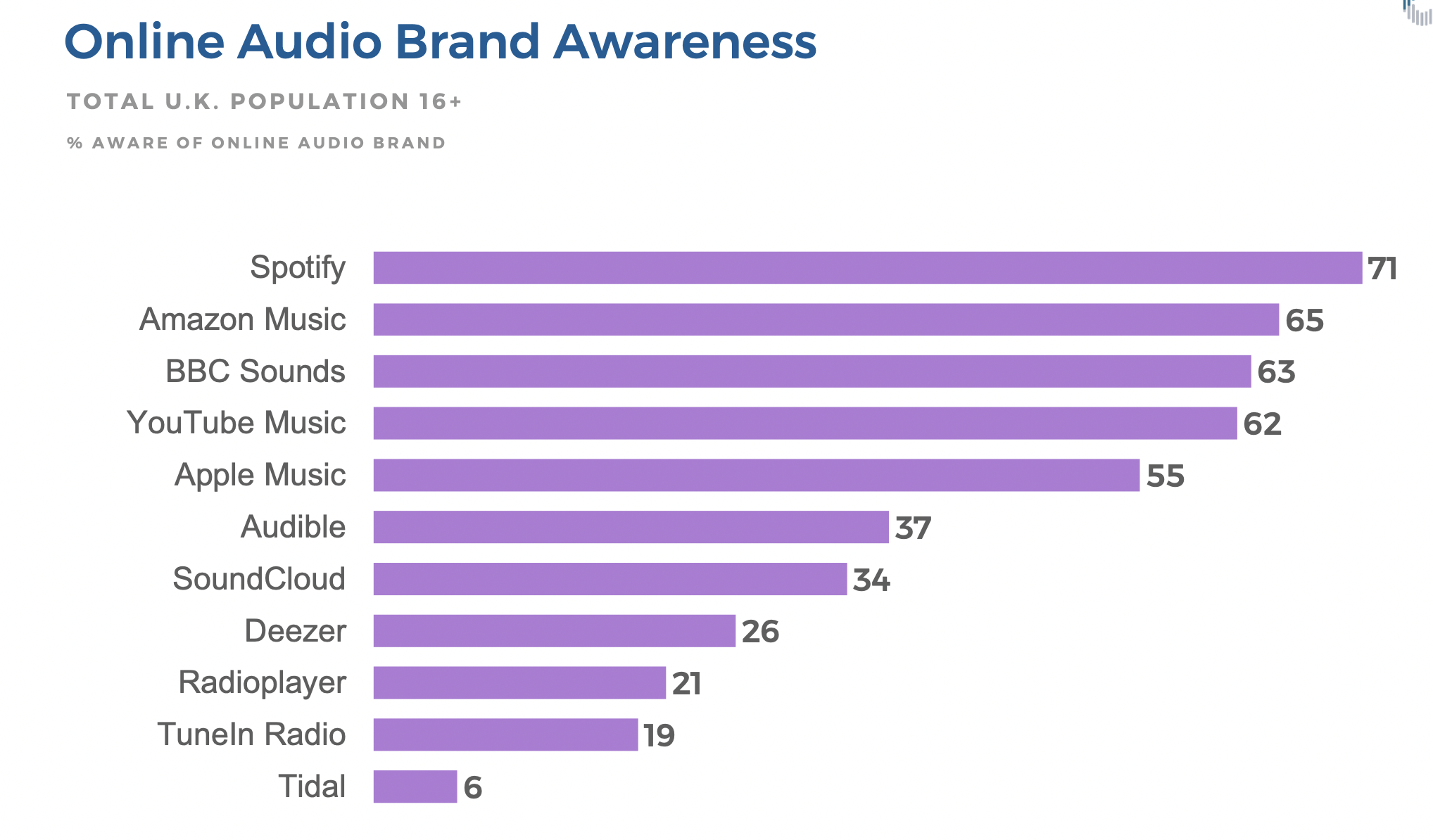

Audio ranking

A better way to track intel

Did you know that you could build smart trackers on Nordic 9?

A tracker is a bot that can be customised for tracking intel by one or many countries, by one or multiple investors, by one or many industries, or by one or many size checks.

This way you can have a quick granular overview of exactly the domains you're interested in. More signal, less noise.

We're currently at more than 150 trackers built by our users, why don't you give it a try?

It's quick and simple to add one. And it's FREE.

Quick notes and links

🇫🇷 Sorare, which was valued at $4.3 billion back in September made $325 million in sales in 2021, which is a decent 13X P/E ratio. However, that's a low multiple compared to what's trading now in the market. (btw, heard rumours that checkout was traded north of 50X - is this true?)

But getting from 0 to 325M in 3 years is a 'holy shit' moment for the French startup ecosystem.

🇪🇺 Remember when the EU people wanted to become VCs as they thought that being a money distributor is not enough anymore but acting as money managers and taking equity positions was a better mean to bringing milk and honey on the local startup ecosystem?

1.5 years later, they still couldn't figure it out and, well, created a bit of embarrassment. Setting up a VC fund is one hell of task, maybe the EU should've taken straight up a DAO path, or something.

🇪🇺 European VCs are hiring like crazy for support roles, what market correction?

🇬🇧 So are law firms in the City, as there's been an exodus from the legal industry:

Departures of associates from London-based law firms outpaced hires from other law firms by 46 per cent between December 2020 and 2021.

[...] Britain’s labour market reached its tightest point in more than four decades towards the end of last year.

🇹🇷 One smart Turkish guy - farmer gives cows VR headsets to reduce anxiety and increase milk production.

🇬🇧 Virgin Mobile and O2 users will not face EU roaming charges.

💪 The average rate for speaker fees is $7,500 regardless of topic area.

🎾 Australian Open did a marketing campaign this winter based on a smart online & offline hybrid mechanism that rewards fans with tennis balls, collectibles and merch and gets them engaged throughout the event. And probably because they use modern technology tools such as NFTs and third parties like OpenSea, they decided to call it the metaverse strategy. The name worked for PR, all journalists crowded to write about it.

Sadly, the Aussies seem to have gotten carried away by the novelty of it and forgot basic web2 details such as discoverability - if you search Australian Open metaverse on the internet you won't be able to find the said metaverse, not even on their own site or social media but hey, at least there's a link at the end of the press release.

This reminds me of one time when I was running an advertising agency back in the day and had a CMO of a top telecom company asking us to clone "the facebook" for them as they wanted to build "a social network" for their Gen X customers. Yeah, there was a moment in my life when I sold lots of "social networks" with only a ppt. Today everything's the same, just some new terminology and more money out there.

🔥 Google was a cool startup in the 2000s with an useful product and smart founders and which totally reversed to date into a reckless monopoly driven by greed. Latest evidence on this:

Google misled publishers and advertisers for years about the pricing and processes of its ad auctions, creating secret programs that deflated sales for some companies while increasing prices for buyers, according to newly unredacted allegations and details in a lawsuit by state attorneys general.

Meanwhile, Google pocketed the difference between what it told publishers and advertisers that an ad cost and used the pool of money to manipulate future auctions to expand its digital monopoly, the newly unredacted complaint alleges. The documents cite internal correspondence in which Google employees said some of these practices amounted to growing its business through “insider information.”

This is plain fraud if it's true - the Enron of the 2020s.

👀 The rise of media-first investors.

👓 How Marc Benioff is transforming Time magazine as it aims hitting $1 billion in revenueand becoming the world's "number one media brand.

🇺🇸 Americans say they need to earn $128,000 to feel financially OK. The median U.S. household income was $67,521 in 2020.

🤔 DoorDash CEO Tony Xu joined the Facebook board. Others in the board: Zuck, Sheryl Sandberg, Peter Thiel, pmarca and Drew Houston of Dropbox.

🇫🇮 What Finland thinks an American workday looks like.

🇪🇺 Polish and Russian officials engaging on twitter like gangsters - it ain't pretty what Putin is doing.

🇷🇺 Speaking of war, the widespread economic sanctions threats made by the Biden administration in case of one includes cutting Russia off from SWIFT, the international messaging system that banks and financial institutions use to send and receive money. Basic crypto use case. :D

🇵🇱 Polish scientists have found a gene that they say more than doubles the risk of becoming severely ill with COVID-19, a discovery they hope could help doctors identify people who are most at risk from the disease.

Did you find this useful? 🤔

Sharing is caring

Have your colleagues and friends sign up too. To support our work, please consider subscribing to N9.

Sunday CET

Sunday CET

Notes and commentaries about what matters in the European space - concise, no non-sense insights, interesting stories and implications for founders, investors, employees from tech companies or government representatives.

Published every Sunday morning by Dragos Novac and emailed to investors, founders and decisions makers from 50+ countries who want to understand the ecosystem from Europe.