risk taking vs risk minimisers

risk taking vs risk minimisers

• Europe's startup ecosystem is good and dandy

• the delivery business in Europe is consolidating

• American VCs cannot hire European workforce

Observations

As we put 2021 to close, I had a quick look at the deals from our big public CRM aka Nordic 9 that we use for tracking transactions from the private market from Europe.

Some of the raw data for 2021 looks like this:

• 6000 deals - 50% of which closed at $5M or less

• almost 2000 deals closed in the $1-5 million range.

• 200+ deals closed at $100 million+ (doesn't include composite i.e. debt+equity usually labelled w/ undisclosed value if we don't know the split). 29 of those were closed at 500M or higher.

• 1000+ deals with undisclosed value. Most of those are early stage deals.

• 450 startups raised at least 2 times this year. 40 of them raised 3 times. I call this the pre-emptive one-two(-three) punch - aka investors making sure no competitor gets in their deals cheaply.

• 8000 active investors in Europe this year - 40% of which angel investors

• 1400 of those active investors are from USA, 430 of which are angels - many tech executives from across the ocean involved in early stage deals in Europe.

• top region breakdown:

Nordics: 1437 deals (includes the Baltics)

UK: 1208

DACH: 1137

France: 821

This is as intermediary as it gets, we have a backlog of roughly 2000 more deals we still need to vet before we add them on. But make for a good picture I think, trying to put aside the absolute $ numbers and hysterical "Europe spends venture money at historical rates" refrain that is so common on public channels these days.

Reminder: all data is available for our Nordic 9 customers. If you're not one yet, I'd appreciate you considering become one. Thank you!

Some random notes:

• Y Combinator is one of the more active private investor at early stages in Europe - almost 100 startups part of their program and roughly 30 followup investments made this year.

For comparison, two of the mainstream early stage investors from Europe - Seedcamp and Speedinvest - made as many followup deals this year but only got involved in around 30 new companies.

• In the same early stage category but up and coming this year is Rocket Internet's GFC which have had a busy 2021 - it deployed money through more than 150 deals, around a third of which were made in Europe, with the rest spreaded all over the world.

I think this is smart - it seems to be part of a cogent strategy as GFC list on their site 18 offices from all over the world. Seedcamp and Speedinvest also invest outside Europe, but rarely, more as a result of a conjuncture rather than as a planned course of action.

• Interestingly, Seedcamp runs its ops with 15 people, Speedinvest with 60ish and GFC lists 30 guys on their site.

YC has nada presence in Europe - Europe is not even their core market. But YC has the best investor brand in the world that attracts every year 10k+ of the best startups, out of which they have the comfortability to choose 5-600. All this pipeline with $0 and zero people. Amazing - kids call this a PLG approach these days.

And this gives them the upper hand for building dealflow, as in general founders reach out to investors due to personal connections at a company not because of the brand of that company, making the inbound dependent on a person not on the firm. YC is YC, not Paul Graham or anyone else.

• Accelerator wise, the American Techstars and SOSV were also fairly active in Europe this year. Locally, even though technically they run career conversion programs rather than startup accelerators, EF and Antler also put a fair number of startups in the Euro ecosystem. The EF deals are seemingly becoming expensive at the gates, meaning that Matt's team is doing some good work, while Antler's street perception is not the best.

• All in all, it is remarkable that in 2022 Europe still doesn't really have a decent early stage platform that startups have as top of mind in order to get to the next level.

If you run a startup, you're either connected and don't need it, or you work your ass off to get on the radar of the local European backers, or move over the ocean and do the same sales work to a larger and more experienced pool of investors while getting access to a larger market in the process. The 'build an MVP and move to US' is more frequent than not but local investors are super busy with the inbound and don't really have time to care.

• At the edges, I noticed two distinct strategies for early stage investors: build a portfolio based on a clear strategy and/or make the best out of the inbound, which keeps getting higher every year. It's not black and white, of course, those are overlapping most of the times, and there's always an opportunistic play to be considered whatever approach you may have.

The ones doing mostly inbound (network, warm connections etc) tend to be passive, with a rather index-like approach, as they go with the flow and take whatever the market gives them - if they lose, all lose. It's also true that it's easy to do that since the inbound can be so overwhelming, giving little space of thinking proactively and thusly leading to a reactionary behaviour. Chaos is the new cocaine, as they say, and not too many thrive on chaos.

The ones that have a distinct approach in building a portfolio though and actually doing the work for understanding the macro, screening verticals and figuring out fundamentals are likely the ones getting above-market returns. And they tend to be good board members too. They're not as many as you'd think in Europe.

Related: being good at sourcing deals is not enough anymore - you also need to be able to close them, make yourself valuable post closing and create a good relationship with the founders. Again, a bit of an unusual position for the standard European investor.

Not least important, there's more and more cases whereas $1k investments are worth taking for the right investor. And more often they are more helpful than large check investors.

• All in all it was a banner year for both investors and founders in Europe. On one hand, the investors portfolio saw considerably high value augmentation - yes, it's still paper money as one of my investor friend would put it, but that's how it works. On the other, the market is more liquid than ever, with an increasing number of M&As and IPOs providing cash back to investors. On top of that, the competition on early deals also provided liquidity for founders who put it back in the ecosystem as they have become angel investors themselves.

• So what's in store for 2022?

Late stage, data tells us that there's a number of around 4000 leads - the ones that raised <$5M this year - and about as many late stage investors that will chase them (that is the number of investors active in deals upwards of $5 million this year). Assuming a 30% lead conversion rate means around the same number of deals closed at $10 million or higher this year (1300). But because of the high competition, I'd optimistically suggest a 50% conversion rate, meaning an expected 2000 deals to be closed at $10M+ in Europe this year.

I also think that we will see more pre-emptive deals (the one-two punch approach mentioned above) - that should reflect in higher multiples that may or may not be validated by the execution. This will lead to founder/early employees liquidity and to more scrutiny - raising so often is a good enough valuation biz validator/check, close to the role the public earnings in the capital markets play. This however also means startups adjusting their strategy accordingly - are you focusing on short term signals in order to flush your balance sheet with cash and optionality or focus on executing against a business plan laid out for 5 years with modest but consistent progress?

Early stage - more fragmentation and hyper competition for the top 5%, which will lead to increasingly more raids of late stage investors in the early stage territories. We have seen this already in the market this year. I also think the inbound will remain at steady levels, as most of the founders and early employees cashing out this year will build more stuff and will reach out to their investors to get funded. As for newcomers - it's a tricky one. Success stories of people getting rich out of tech startups start making ways out of the bubble to normal people, encouraging them to take risks and try it out. And it's never been more exciting to be a startup founder, even in Europe which is not an ideal environment - the process from zero to one is super hard, since there's very few competent institutional means to guide them through and investors in Europe are in the business of exploitation not exploration anyways. But as information asymmetries have decreased considerably, it is easier than ever to find the right people to talk to and work with, regardless of which city you're based on. And this is super exciting as the world is evolving at a high speed, in spite of the gloomy, covid-trilogy, war-like macro times we live in.

Cheat sheet reports

• The venture scouts from Europe - who are they and what they invest in?

• early stage B2B marketplace startups from Europe.

• a list of 100 investors investing at pre seed and seed in Europe

• a list of 30 investing at late stage

• a list of 25 from the new wave of European VCs

Intel:

• is Sifted really worth $20 million?

• American tech executives angel investing in Europe.

• non dilutive startup financing takes off

• Swedish success stories

• the most active investors in Europe are Americans

• active investors in Europe by vertical

Note: the reports are for Nordic 9 paying customers only. You can become one from here.

Zeitgeist

Leverage

Scarcity

A better way to track intel

Did you know that you could build smart trackers on Nordic 9?

A tracker is a bot that can be customised for tracking intel by one or many countries, by one or multiple investors, by one or many industries, or by one or many size checks.

This way you can have a quick granular overview of exactly the domains you're interested in. More signal, less noise.

We're currently at more than 150 trackers built by our users, why don't you give it a try?

It's quick and simple to add one. And it's FREE.

Notes

🇩🇪 Delivery Hero acquired Glovo at a €2.3 billion valuation - they have had already 43% of it and now increased the equity stake to more than 80%. Glovo has raised around €750M and produces around €3bn GMV out of Spain, Eastern Europe, CIS and Africa.

That's normal - more aggregation in a fragmented and price-based competition industry. Delivery Hero also exited the German market, 7 months after committing to it - well, kind of, as they passed the foodpanda's logistics operations to Gorillas, of which they have acquired 8% at $3 billion this fall.

The strategy board in the delivery business is as competitive as ever, more complicated by DoorDash acquiring Wolt. I think we will see more M&A in this space - add the increased investor attention to the medicine home delivery startups i.e. Lightspeed just paid handsomely to get into Mayd.

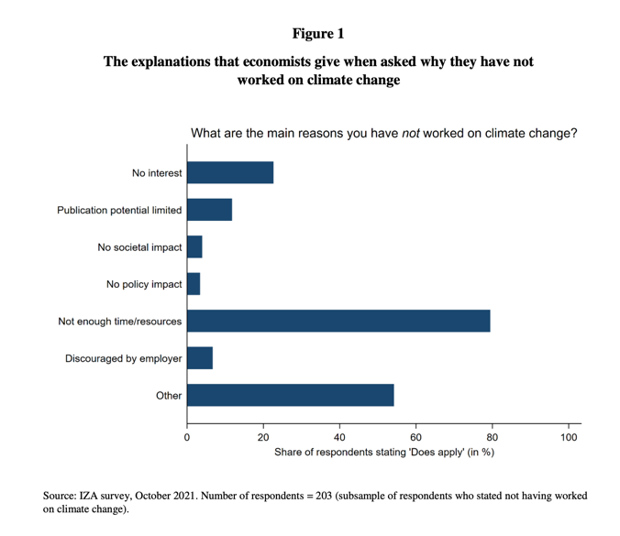

🇪🇺 American VCs find it hard to hire Europeans for running local offices - apparently they prefer people they already worked with, and are looking for risk takers and not risk minimisers.

I believe that it's hard to find interesting people in an industry dominated by consultants and ex-bankers. One move could be to take doers from other domains at the risk of getting inexperienced guys who don't have a track record as investors. But I guess at least smart doers will find it easier to learn the investment business than consultants learning how to take risks.

Another move is to relocate people from the States over to Europe supported by local juniors.

🇪🇺 Gibraltar's regulators are considering a plan to add cryptocurrencies to its stock exchange, risking reputational damage and diplomatic sanctions.

+

Malta's status as Europe's online gambling capital is under threat after it was added to the global money laundering watchdog FATF's "gray list" in June.

🇮🇪 Corporation tax generated €11.8 billion in receipts In Ireland in 2021, with 56% of receipts from the business tax come from just 10 large firms. Top 3: Apple €2.29bn, Msft €1.84bn, Google €622m

🇬🇧 Sotheby’s netted $100 million from NFT sales in 2021.

🇸🇪 Spotify’s top lawyer - and one of the most prominent Apple antitrust critics - was hired by Disney.

🇬🇧 Amazon UK launches ‘buy now, pay later’ product with Barclays.

🇬🇧 Arsenal football club censored for irresponsible adverts for crypto-related fan tokens - the football fans are spending millions on club crypto-tokens anyways.

🇫🇷 874 vehicles burned on New Year's Eve across France overnight compared to New Year's Eve 2019 when 1,316 vehicles went up in flames. The cause seems to be the pandemic.

🇪🇺 Euronews was sold to a close associate of Viktor Orban of Hungary's fame.

🇷🇺 Russia demonstrated their ability to use space missiles to blow up a satellite and now is threatening to blow up an entire GPS constellation. Space is the new warfront.

Meanwhile, experts at Russian state TV are discussing how they will occupy Estonia, Latvia and Lithuania.

🇬🇧 You think we live in a modern and caring society, as we should in the 21st century? How about that:

The Duke of Northumberland, one of Britain’s richest aristocrats, is demanding a yearly rent of £600,000 that could bring a halt to railway plans intended to serve deprived and cut-off communities in northeastern England.

🇨🇭 Switzerland approved physician-assisted suicide.

🇫🇷 France has 30 Michelin 3-Star restaurants as we speak.

🇫🇮 Finnish man blows up Tesla car instead of replacing battery. A replacement would have cost him $22,600.

💪 Hubspot, Stripe and JP Morgan Chase all acquired similar companies recently - media companies and communities. And this type of M&A is going to accelerate.

💨 CB Insights launched a software tool that acts as a credit score but for startup teams and which could do more harm than good.

👓 Great interview with Matt Mullenweg of Wordpress fame, one of the better tech founders of the 21st century.

🧵 How do you know if potential M&A is worth your time?

Apple invented a Miniature External Temperature Sensing Device that estimates subsurface tissue temperatures via the watch. They also have in the works a way of taking sweat samples - one of the few reasons for which I think the Apple Watch is highly undervalued.

🎵 People complaining that artists get paid poorly via Spotify, Youtube and the likes, part 23262. I have talked about this with many founders - that is because they think about those outlets as a sales channel rather than a distribution channel. The old paradigm of producing a hit and live handsomely out of royalties for the rest of our lives is not working anymore, the music business is done differently, with many revenue legs that have little to do with creating good music.

👁️🗨️ Last month I deleted Life360 from my phone as I just learnt that their business is selling precise location data, exactly what I was using it for privately for making sure the offspring is safe and sound. Apparently my kid safety - and of the tens of millions of guys using the app - is the interest of approximately a dozen data brokers who have sold data to virtually anyone who wants to buy it.

Building a business is hard, we all know that, but doing it right is not that hard.

⬇️ Most popular e-commerce domains in 2021:

1 Amazon.com

2 Taobao.com

3 Ebay.com

4 Walmart.com

5 Jd.com

6 Shopify.com

7 Bestbuy.com

8 Target.com

9 Rakuten.co.jp

10 Homedepot.com

Most popular domains 2021

1 TikTok.com

2 Google.com

3 Facebook.com

4 Microsoft.com

5 Apple.com

6 Amazon.com

7 Netflix.com

8 YouTube.com

9 Twitter.com

10 WhatsApp.com

more data

🇬🇧 Mayfair's (London) Connaught Bar is the best bar in the world according to some media outlet. Next places: Tayēr + Elementary (London as well), Paradiso (Barcelona) and The Clumsies (Athens). Fifth place goes to an Argentinian establishment called Florería Atlántico in Buenos Aires.

👁️🗨️ What is one country that you will never visit again?

🇳🇿 New Zealand to ban cigarettes for future generations.

👀 Pope Francis says sins of the flesh aren't that serious.

Did you find this useful? 🤔

Sharing is caring

Have your colleagues and friends sign up too. To support our work, please consider subscribing to N9.

Sunday CET

Sunday CET

Notes and commentaries about what matters in the European space - concise, no non-sense insights, interesting stories and implications for founders, investors, employees from tech companies or government representatives.

Published every Sunday morning by Dragos Novac and emailed to investors, founders and decisions makers from 50+ countries who want to understand the ecosystem from Europe.