situational VC

situational VC

• dealing with VC adversity is doing a good job

• marketing is how VCs are doing scale

• investors say Europe has more attractive valuations

Observations

This week I had a look at some of the VC horror stories sampled by Sifted from 59 founders that interacted with VCs in Europe.

To be frank, I was expecting worse - I have been dealing with VCs since the late 1990s and I have a good share of anecdotes. It can get weird or bad dealing with those guys - I have been through many cycles and experienced multiple practices from all sorts of actors, it's a life experience as good or bad as any. And maybe I am a bit cynical here, but think that Sifted's examples are just business as usual, and not too different from what you would find in about any industry.

Let's see:

Ghosting? Welcome to real life - that can be anywhere, have you dated lately? 🤣 It takes a special person to be nice and professional all the time, and more importantly, to be able to stay on top of their communication game, answering politely to any sorts of bad or good asks in a buy/sell cycle. VCs deal with thousands of strangers that want to be their friends every year (i.e. create a relationship), and it is easy to drop the ball and say 'screw them' when sorting thru emails. The standard is really low, and there's no reason to think that VCs are above any minimum from any industry. Being ghosted (or stood up for a meeting without prior reasonable notice) means the other party is not interested and you should simply move on.

Arrogance? Welcome to the consultants world. Being a consultant implies a de facto "know it all" attitude regardless of your experience and knowledge, if you don't exhibit it you will be considered an under performer by your peers. Those guys are taught to deal in a pre-defined framework to anything they see everyday - meaning they already have a prejudice of what a best practice looks like. Most of what they deal daily with is considerably under par - let's be honest, in the investment business you meet all sorts of bad pitches and/or founders. It is particularly hard at early stage when you have to understand intangibles such as vision and drive (very difficult) rather than numbers (any trained monkey can do that) and when you judge by a framework instead of having an open mind it is so easy to become an arrogant asshole as opposed to being helpful, constructive and polite. It is human nature - and, again, it's just a matter of keeping composure and being a well-educated person in any consultant-driven business dealing with a lot of money.

Discrimination? Welcome to Europe. That's probably one of the biggest problems of the times we live in, and it was no different 50 years, 100 years or 300 years ago. I mean, look at how Putin in doing a genocide these days, is this a sign that we live in an evolved civilisation or that we're still dealing with barbarians pretending to be living in a civilised world? Discrimination is the same dealing with barbarians - a societal problem, most of us deal with it every day in all sorts of forms and shapes. If you don't or have no idea what I talk about, you may consider yourself a lucky individual - it is what it is and knowing what to do in these situations is an asset in anybody's personal life.

That is to say the business world in general doesn't have easy roads, and the venture business makes no exception. And sure, all these are mere generalisations, I agree, of course there's multiple particular cases that can be horrible situations making a founder extremely frustrated and put a bad label on the VCs. Some of them are soft skills (i.e. uncivilised individuals not able to deal in a social context) and most of them are situational (i.e. bad business behaviour). Either lack of social skills or/and bad behaviour can be just a gift in disguise and a strong indicator of what a future relationship could have looked like.

Situational VC

But fact of the matter is, if you're a founder and want to work with VCs, you will have to assume and prepare for all scenarios, like in any important business endeavor. It's like going to war - you will have to understand the rules of engagement, and be prepared as a consequence. Or else you won't succeed and will only get frustrated. Selling equity to VCs is not part of building a business, stricto sensu, it is just a distraction from the real thing, and can be a waste of time in many cases. And the secret to tackling it is doing homework extremely well, being patient and persistent - it makes you more resilient and gritty, at the end of the day.

And this brings me to something that most founders I talk to on daily basis don't really understand. 95% of the time in the investment process, a successful deal is not founders raising but investors closing. An important distinction - most of the times, founders have no idea how or why they closed and hence difficult to extrapolate learnings from that.

Raising successfully venture capital is very contextual - not founders closing because what they sell is hot, it is rather they found investors in the right moment at the right time looking for something in particular. Investors' minds about new business are in context modes looking for situational opportunities not for generic shit. They have an agenda and are not driven by serendipity most of the times. A few cases:

1. Investors may look for a particular kind of business (i.e. producer of alternative bread) or a particular space (alternative food producers) or model (marketplace for alternative bread/food sellers).

2. Investors may be simply on a learning mode - ie. not decided to invest but want to understand how the bread is made and talk to as many founders from the bread space as possible. Sure, will tell founders they want to invest even tho it's a lie (we 'might' invest after all) - otherwise founders won't talk openly to them.

3. Investors can be involved in a similar deal and want to gather competitive intel from the space, talk to top 5 competitors and make the decision upon what they like best (like going to the fruits market - you browse around and buy from the shop with the nicest looking fruits).

There's many other situations but you get the point. And it may not be fair for founders most of the times but investors will ignore you or drop interest soon if you're not what they look for. How they do it - that's a different matter but most deals are closed by investors looking for that particular something at that particular moment.

So if you're a founder, you need to understand the people you sell to and how they do business. How they're wired and what contexts they're in. Figuring those out is not easy, by all means and btw that is why raising is a numbers game - meet as many people as possible to find investor context/startup fit, not to mention intangibles i.e. people with similar values that really get 'you' on top of what you build.

It means extensive preparations, homework and honest feedback from competent people on where you are and what you sell. It's strategy 101 before executing - map and segment the ecosystem, prepare the pitch in detail and have clear selling points for situational VC contexts. And - so it happens - helping founders with exactly this is something that I do every day.

Back to the Sifted's anecdotes - having to deal with assholes in an industry is different than executing well a sales process. One may be included in the other, but it is important to draw that line. Life is too short to deal with idiots and you should to know how to handle it anyways but fundamentals are fundamentals and being prepared for hard business situations is giving yourself a fair chance. Because raising money is a hard business case, that's a fact.

Cheat sheet and intel reports

Recent intel pieces

• Early stage VCs cashing out link

• Lightspeed's first venture deal in the Nordics link

• Notes about the Euro VC market link

• The Russian investors in Europe link

Fintech in Europe

• revenue-based financing startups and investors link

• BNPL startups and their investors link

• startups building consumer fintech link

The most active investors in Europe in Q1

• in Europe (late stage | early stage | angel investors)

• in the Nordics

• in DACH (Germany, Austria, Switzerland)

• in France

• in the UK

• the Americans

The hottest 160 early stage startups from Europe

👇 Startups from these lists 👇 have already raised: Ark Capital, Causal, Climate X, Emitwise, Finary, Liveblocks, Zevoy etc

We have reviewed more than 2000 early stage deals made in 2021 and profiled 160 interesting startups that are in the market raising money now:

🇬🇧 UK (40 startups)

🇩🇪 Germany (35 startups)

🇫🇷 France (30 startups)

🇸🇪 Sweden (20 startups)

🇩🇰 Denmark (15 startups)

🇫🇮 Finland (10 startups)

🇳🇴 Norway (10 startups)

Note: the reports are available for Nordic 9 paying customers only. You can become one from here.

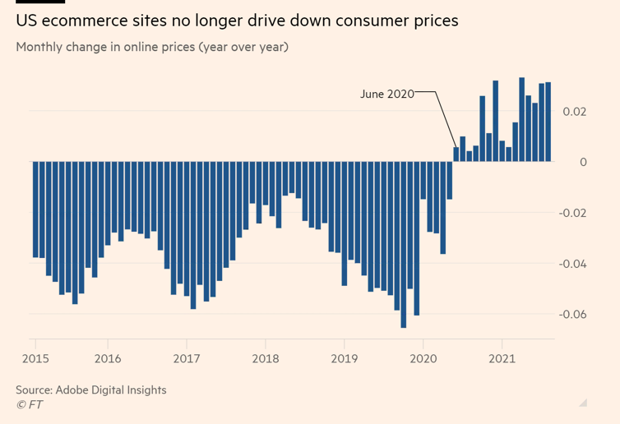

Buying online ain't cheap

Notes

💲 a16z pulled a YC and launched an accelerator concept, some sort of an EIR that offers early-stage founders up to $1M in exchange for an undisclosed amount of equity.

Except that, unlike YC, for a16z it is just marketing, not the core business. The VC is a business of reputation and expertise - the accelerator addresses the former while the latter is supported by a16z's recently announced media and research pillars.

The VC business has become an increasingly competitive and very fragmented space where big gorillas need to compete at the edges. Sure, you get the best deals through networking, as always, but how do you compete at the bottom with the indie VCs and whatnot working their ass off to cherry pick 10-20 super early projects with abnormal ROI every year?

a16z is doing VC business at scale in a space which btw expands exponentially every year and is increasingly more difficult to track. And this is a simple market pull mechanism, albeit expensive, hoping it makes a difference in attracting talent + the brand awareness intangibles + synergies with the core business. Sequoia announced the same thing last month btw.

🇪🇺 The EU unveiled the official version of the European Union’s Digital Services Act, that, among many other things, should force tech companies police illegal content on their platforms. It is a historical moment - regulation of a super emerging space that is - time will tell if the theory envisioned by politicians and consequently enforced as law will work in real life, and one can only hope that they will move fast to amend eventual fuckups, which, no doubt, we'll have plenty of.

🇪🇺 Speaking of EU compliance, here's the latest big tech change to respect the rules: Google finally let users reject all cookies with a single click. Had to pay $170 million in fines for getting convinced to do the right thing.

🇬🇧 UK does regulation too Fake reviews are to be outlawed and it will be illegal for businesses to pay someone to write or host a fake review for a product or service, and sites hosting consumer verdicts will have to take reasonable steps to check they are genuine. Great.

🇳🇱 Dutch lawmakers have introduced a law that tightens restrictions around banker bonuses.

🇩🇪 Germany says that cutting off on Russian gas would lead to recession - instead of growing by 3%, it would cause Germany’s GDP to drop 2% this year, amounting to one of the worst recessions in the country since the financial crisis. Not popular.

🇪🇺 How to fight Putin from Europe. The EU unveiled a nine-point plan called “Playing My Part” that urges citizens to drive less, by using public transport, or working from home three days a week.

🇬🇧 The London Stock Exchange is not a good exchange for higher value and/or tech companies. Period.

🇬🇧 The Brits are said to have cut their on-demand video subscriptions to Disney, Netflix and the likes in record numbers for money saving purposes. 1.51 million cancellations in Q1 2022.

🇫🇷 Techcrunch did a puff piece on Zenly, a French startup doing a mobile social network that's become the tenth most-downloaded app globally. That is a lot of hard work in the five years since the Americans from Snap acquired the company.

🇨🇭 In Switzerland in the meantime, The Large Hadron Collider, Earth's most powerful particle accelerator, was restarted this week after a three-year hiatus for upgrades. The revamped collider will ultimately allow mankind to observe dark matter, physicists hope.

🇩🇪 A drone tour through the new Tesla factory in Berlin. Speaking of Tesla, Elon Musk says that the company’s humanoid robot, named Optimus, will be worth more than the full self-driving car business.

🤡 Elon Musk detailed his financing sources in case he'd be allowed to buy Twitter:

• $13 billion in debt financing from Morgan Stanley and the banks

• $12.5 billion in loans against Musk's Tesla stock from the same Morgan Stanley

• $21 billion plain equity commitments (money from himself)

Best take: You're giving away caviar to buy a hot dog on the street in New York City.

🏠 Airbnb's disruptor. Here's an intriguing business model that's just raised VC money: Airbnb but on a subscription basis ($600/year). You basically can move as much as you want in the houses listed in the network, paying only a $30 service fee + cleaning. I am a big fan of subscription-based models on top of exclusive deals available to a specific demographic - it just needs a juicy market to work out at big scale levels. Hospitality is such a market, Airbnb already opened up the house sharing path and it is the industry gorilla to be poked and disrupted.

💪 Amazon white-labeled its Prime service - the company’s shipping and logistics services to let merchants fulfill orders on their own websites. Tres smart.

🤖 Sh** got serious: a major industrial conglomerate has resorted to buying washing machines and tearing out the semiconductors inside for use in its own chip modules.

⛺ Camping for the night at 24-hour cafes becomes new routine for young people. In Vietnam that is.

Readings

💪 Europe still has cheap deals. 86% of investors believe private markets will outperform their public market equivalents over the long term. 44% of them believe that the APAC region (China, Japan, Australia, and emerging markets) continues to offer the best investment potential in 2022. Europe is now on par with North America for investor sentiment, with respondents citing more attractive valuations in Europe despite an increase in “unicorns” valued at $1 billion+ in 2021. link

🙉 The Surveys of Consumers, the longest-running sentiment survey, started after World War II, shows that the consumer sentiment is pretty bleak, much worse than before the pandemic, and it’s consistent with a recession. Real people, real talk.

👀 Creator as a job. More than 200 million people could be classified as a creator, defined in this case as anyone who uses their influence and creativity to monetize their audience, regardless of platform. Most of them - 139 million - are considered to be semi-pro (1K-10K followers), while while the pros (10K-100K followers) were counted to be 41 million.

🔫 Guns topped car crashes as the leading cause of death for US children and teenagers in 2020, according to the CDC.

Did you find this useful? 🤔

Sharing is caring

Have your colleagues and friends sign up too. To support our work, please consider subscribing to N9.

Sunday CET

Sunday CET

Notes and commentaries about what matters in the European space - concise, no non-sense insights, interesting stories and implications for founders, investors, employees from tech companies or government representatives.

Published every Sunday morning by Dragos Novac and emailed to investors, founders and decisions makers from 50+ countries who want to understand the ecosystem from Europe.