the dollar gap

the dollar gap

• cool Euro NFT project closes after a day

• the huge $ gap between two interconnected industries from Europe

• startup people working for politicians

Observations

🇪🇺 This week a couple of Euro kids launched a digital marketplace for buying and selling fake shares in an NFT form of different startups.

A day later they pulled it off because of legal implications. They say they will still hang on to it, and will transform the transactions-based marketplace into a free to play game.

The money nature of the transactions as they launched it (you had to pay $ for buying fake shares, which you could then trade) puts the whole op on the gambling wagon - i.e. trading something of value on an event with an uncertain outcome with the intent of winning something else of value. Hence the legal complications - add to this that in the US each of the 50 states has their own gambling legislation, on top of Europe's fragmentation, which is an even more regulated mess anyways. If you want to go the gambling road, that is.

The startup portfolio fantasy is not a bad idea, though there's dozens of others doing it, the business model they came up with is just not working out in a simple way. Gambling is a peculiar business and most VCs stay away of it btw. If you take the model to an investment market of sorts, in the US SEC allows investments to be made only by accredited investors, not to mention another range of rules and regulations you will have to meet in order to exist.

In short, it's an intriguing idea with a messy business model. My first reaction when seeing it live was pondering over 'they know about the gambling risk issue but launched anyways' vs 'they had no idea about the gambling legal implications'.

I'd guess they were aware of some of the risks and launched it anyways. I bet they didn't expect to last just one day though, which makes me think that they didn't talk seriously to a lawyer familiar with the American legislation. Fwiw they had 70 people which did transactions in the one-day of existence (they refunded them) and plenty of earned PR they can built on for future other ideas. This one seems doomed before it even started.

🇪🇺 Tech.eu was acquired by the Turkish from Webrazzi because of (in part) Robin's desire to have his own tech stack, custom CMS, bespoke software for managing native advertising campaigns and an events platform.

Fun observation: in a $40+ billion Euro investment ecosystem in 2020 how much money does the media covering it on a pan-European level make? 10 million in total, maybe?

Is there actually any European respectable media house covering European VC/startups business? Not that I know of.

There's the Americans from TechCrunch, which is now owned by private equity and covers European fundraising deals decently. And then there's the Brits from Sifted funded by a bunch of undisclosed angel investors and promoting themselves as an FT outlet (FT is just in the captable with a minor stake fwiw, probably helping with their media sales). And then some independent outlets from Europe, such as tech.eu, still small and trying to make ends meet in a clickbait-driven industry*.

Other than that, there's not too many options, am I missing a major one? All the big media names from Europe don't seem to have European-wide ambitions with regards the new economy funded by VCs as they focus locally rather than via an English-based asset covering holistically the whole continent. That is likely because the English-based audiences in Europe are small, as for example the number of 5-600k unique users Sifted says it has, is about the same to what Breakit, the local investors gossip outlet, is reaching in Sweden.

But I just find it odd that there is a big gap between the money TC + Sifted + Tech.eu et al are presumably making and what the industry they cover spends on annual basis.

And I can only imagine that it's just a matter of time for journalists, now paid with say 40k a year to cover multibillion deals and learn about an ecosystem and their business models, to ultimately make a move in the industries they're writing about. What they write about is not taught in school, they have to figure it out on their own, on the fly. As soon as they're on a decent point on the learning curve, they'll jump off because the upside is much higher on the other side. Just a matter of time.

* I once had a new media guy doing biz on a local level telling me that tabloid (i.e. clickbait, big titles, big photos, gossip reporting) is the only way to draw a month-over-month growing audience, in order to manage the KPIs in the media business. There was no concern about the differences between the brand positioning, the quality of a product and the quality of its packaging, and that their site was as unusable as the standard in the media industry. That is also because the distribution channels are SEO (60%), social media (20%), NLs (10%) - the direct is in the 10% range. But, ultimately, any good media brand sthat tarts as a qualitative product focused on a niche dilutes in time as they scale because they need eyeballs either to sell to advertisers or to convert to whatever premium product they're selling.

Tech tapas

On October 19 (on a Tuesday at 5) we're doing an invite-only pitching event, with the aim of matchmaking investors with startups, in order to get them funded. We want to have at least 5 startups presenting - already selected a deep tech one, a niched financial products provider active all over the world and a stealth-ish fintech done by a serial entrepreneur.

Please let me know if you would like to participate (either as a startup or as an investor) or know anybody who should be in. Thanks.

Cheat sheet reports

• Fintech startups:

- unicorn wannabes from the Nordics

- consumer SAAS from Europe

- very early stage from Sweden

• Early stage marketplaces in Europe:

- B2B

- consumers

- from the Nordics

• Investors in Europe

- a list of 100 investing at pre seed and seed

- a list of 30 investing at late stage

- top 140 active VCs

- a list of 25 from the new wave of European VCs

• ICYIMI - The most interesting European startups from YC this summer.

Note: the reports are for Nordic 9 paying customers only. You can become one from here.

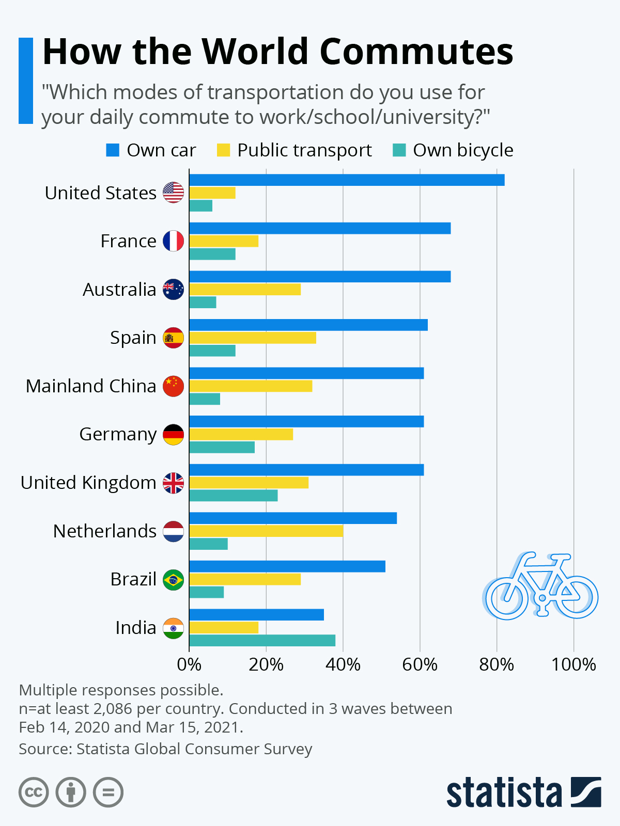

Are you into the mobility business yet?

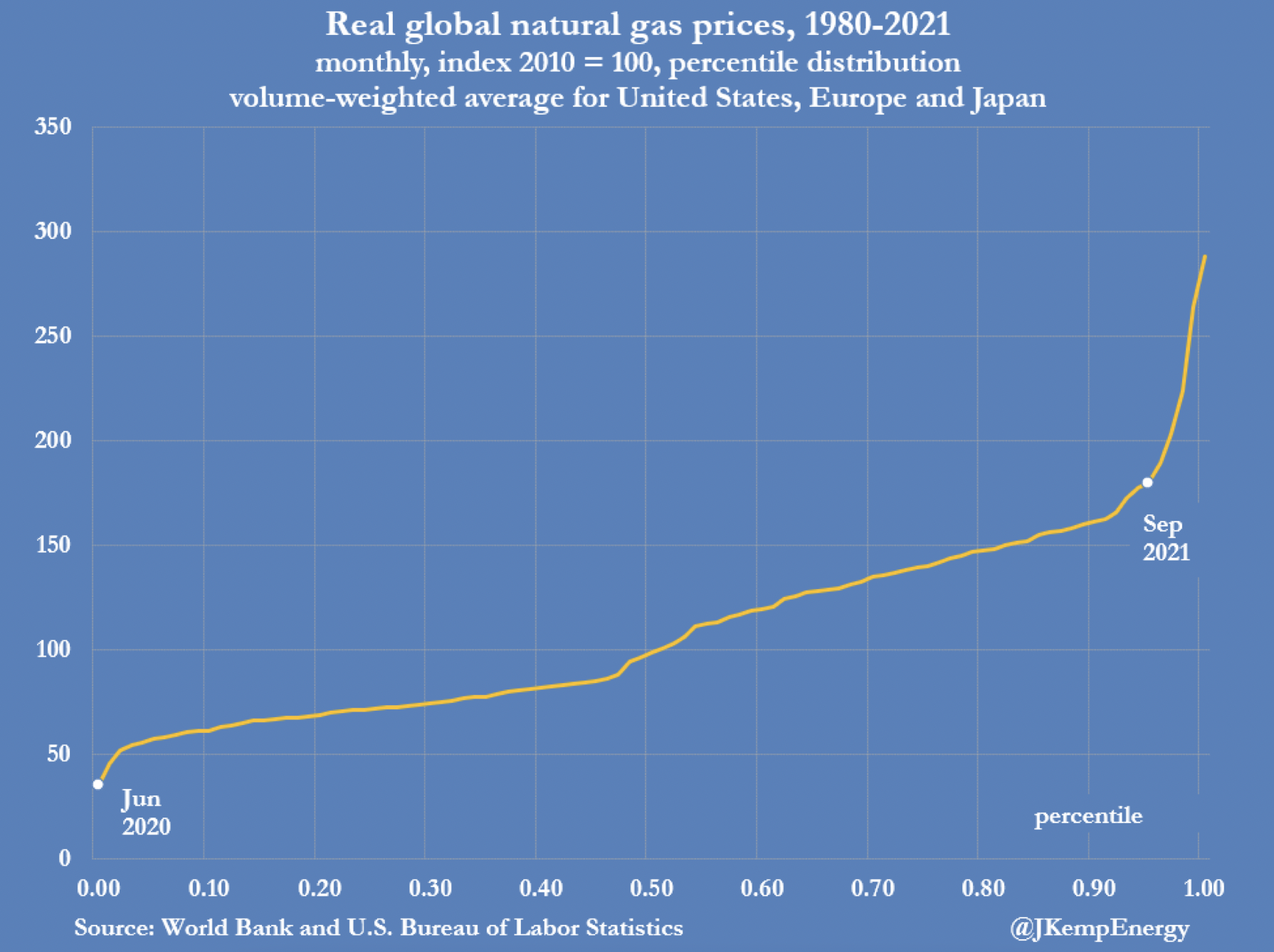

Ready for the winter?

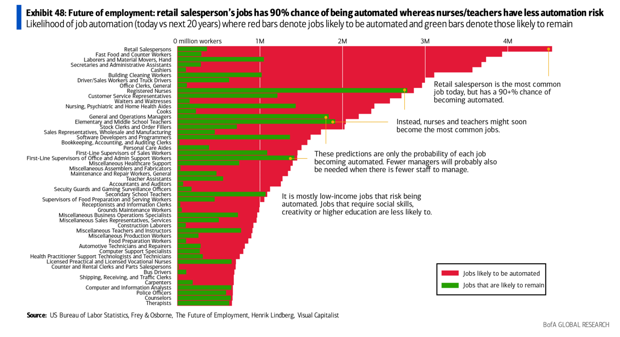

Will robots take our jobs?

Value for money

Every week at Nordic 9 we send to our customers curated intel overview and commentary about the deals we tracked in Europe. You can dig through the archives here.

We also run a local edition, covering the Nordics - the archive here.

You should subscribe and get it too.

Other notes

🇺🇸 Coatue is struggling to find the right people to hire in Europe, as it aims to open an office in London. Coatue is a hedge fund founded in 1999 by Philippe Laffont (Belgian brought up in France) and Thomas Laffont, and invested in 14 European startups this year.

🇫🇷 Mon dieu, it looks like handling the La French Tech is a political thingie, who'd have thought? If you have startup background and go work for politicians, conventional wisdom says you're just doing it because it looks good on the resume and can increase optionality for a future lateral move, and not because you expect your work will be fully appreciated or at least understood, n'est-ce pas? The gap between the startup world and politicians is as high as you'd imagine, and the French dream of unicorns anyways.

🇫🇷 Kima Ventures as of Q3 2021.

🇬🇧 Blackstone is in talks with Merck Mercuriadis, a former Beyoncé manager who runs UK-based Hipgnosis, to purchase and further manage ~$1B music assets.

The same BlackRock that is as big as the global hedge fund, private equity, and venture capital industries combined, w/ $10 trillion in AuM.

🇨🇭 Swiss Post launches Switzerland’s first crypto stamp.

🇬🇧 The cost of doing the music business in Europe: music band Two Door Cinema Club paid £8,000 in visas to play in Spain. Ain't looking good.

🇬🇧 But it's not all bad on the island, the local satellite business seems like it's growing.

🇪🇺 Good thread on the European history of the glass industry.

🇪🇺 Europe becomes largest crypto economy.

🚄 Thalys and Eurostar to merge operations.

✨ If you're an investor scrambling to put together an LP Pitch Deck these days, I gotta say the bar is quite high.

💸 People tracking private investments say startups raised $158 billion in Q3, an all-time record. The money supply is at a record high, where would that money go, in bonds? Expect a lot of similar hot takes for Europe in the local media as well this week.

🇫🇷 The Autorité des Marchés Financiers caught an insider trading for pocketing €250k by trading days before an announcement that CVC Capital Partners was in exclusive talks to acquire French insurer April SA. Investigators tied him to the address of his mother’s apartment in a posh Paris neighborhood because he’d made Deliveroo food orders there and carrier Air France had him registered to that address.

🇬🇧 WW2 training film for US Soldiers on how to behave in Britain - 1943 (spoiler alert: they don't like cold beer in Britain, they like it warm)

🐑 Kids don't want to be VCs any more, they want to be SPAC-ers:

More than a dozen people age 30 and younger have been named as executives or board members at blank-check companies that have filed listing plans since June.

💸 [At seed] Our money is most effective when we think we can make 10 times our money.

💪 The new get rich quick scheme for the software developers:

An engineer a startup hired did great on the interviews but worked unexplainably slow day to day. When pairing: they worked fast. They stopped pairing: slowed down. Turns out, the person had a second job in all cases.

🇯🇵 Wework says its occupancy rates hit 60% at the end of September as it is looking to go public via a $9 billion SPAC merger. Wework was worth $47 billion 2 years ago and $2.9 billion last year.

Paddle launched a payment system as a "true like-for-like, drop-in replacement" for Apple's in-app purchase mechanism, allowing developers to collect payments from customers without having to pay Apple a 15-30% commission on sales.

Does anybody in their right mind think that the fruit cyborg will let them exist?

🤸♂️ NFT projects are just MLMs for tech elites.

🤔 Why aren’t there more Warren Buffetts out there?

🌶️ Guess what media company just jumped on the 'we care about climate change' marketing bandwagon? Hint: it's the 'we used to do no evil' one.

😆 An American startup raised VC money for a bagel that has the same amount of carbs as two banana slices. I'd call it the boring bagel, it takes away all the guilty pleasure.

🔥 Celebrities are launching ghost kitchen brands.

🤖 Twitter invested in an avatar startup.

🦫 VCs dealing with emails - I am amazed at all the responses to this thread. If managing emails is hard, imagine them having to manage, say, a portfolio of companies.

🔝 Things that didn't exist 15 years ago.

Did you find this useful? 🤔

Have your colleagues and friends sign up too. To support our work, please consider subscribing to N9.

Sunday CET

Sunday CET

Notes and commentaries about what matters in the European space - concise, no non-sense insights, interesting stories and implications for founders, investors, employees from tech companies or government representatives.

Published every Sunday morning by Dragos Novac and emailed to investors, founders and decisions makers from 50+ countries who want to understand the ecosystem from Europe.