Tiger's model

Tiger's model

• how Tiger Global turned the industry upside down

• Europe's quitters

• world's portfolio structure

Observations

If you were to read one piece about Tiger Global, then this should be it. Budget some 30 minutes of quiet time to digest it (and pay the man for his work), as it is long-ish (10k words) and starts from a historical context, as any proper research would do for understanding an industry and its drivers.

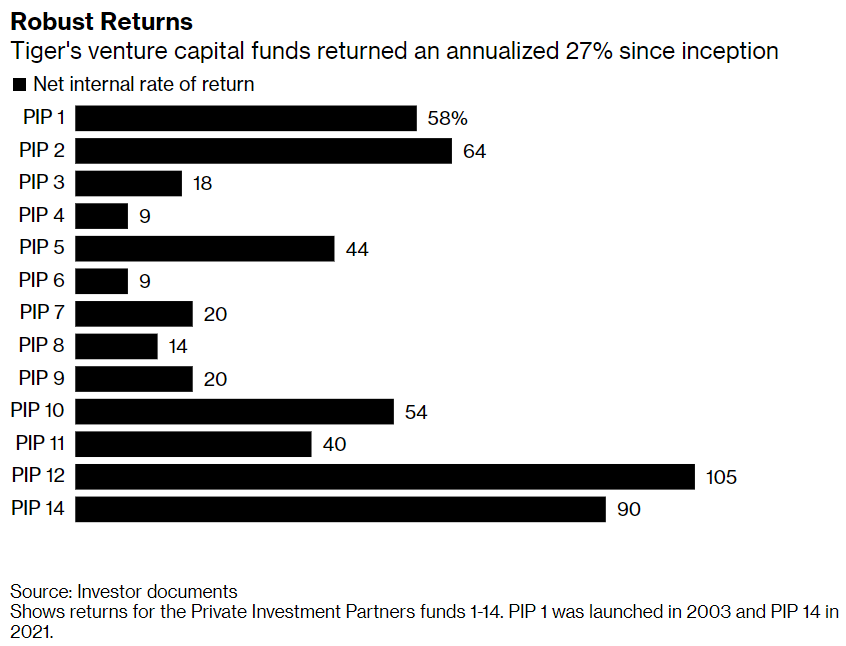

For old timers who are familiar with classics like the late Clayton Christensen, what Tiger does seems awfully close to the innovators' dilemma applied to outdated business models. Another, less theoretically, way to look at it is to ponder the 'should we get a bigger return from fewer fat customers within a fixed cycle (i.e. top 5% of the market) or lower but good enough ones from a larger pool within flexible cycles (i.e. 10% of the market)'.

Frequency and time horizons are equally important to returns size targets, if you're crazy enough to tweak your excel models by challenging the most important hypothesis in the investment business - always optimise for the biggest return on investment. Taking lower returns in the venture business is thusly contrarian - but math shows there's multiple ways of getting to the highest ROI in aggregate, if you built a creative enough model and are able to execute against it.

In order to execute its model Tiger also changed the old school VCs modus operandi by outsourcing their back office to a couple of consulting companies. Again, a contrarian move, as investors make their consulting hours a strong point for selling their financial products and justifying management fees.

Consulting is raison d'etre for investors - they will ask: if we don't babysit the founders, how do we make sure that our investments are safer, as we're there to de-risk it one board meeting (or email) at a time? It is a legit question and not a trivial matter, with multiple implications as it is part of the core of how the VC business works.

But truth is that taking the consulting hours away from investors day-to-day is also taking away a chunk of the BS this business is selling and doing and that is one of the reasons Tiger is not really liked by its peers for - it changes status quo, sets precedence and creates new best practices, if they do it and deliver why wouldn't the rest of the bunch be capable to get up to the task in a similar manner?

Now, change doesn't happen over night, we're in an emerging state but the waves are increasingly going to the size of a tsunami-like event. The market is still inflating, w/ many funds at the beginning of their cycle and this should cover for inefficiencies at least for a while, as long as the money is still cheap. However, if you are in this business you already know the result of Tiger's approach, it's very visible, impactful and you complain about it on Twitter, the tiger is the enemy and is eating everybody's lunch - in the process of doing their things differently Tiger turned an entire industry upside down.

Sequoia already pivoted hard and make no mistake, that is particularly a difficult, painful move for a traditional company that's been doing the same business for 50 years - they did it because it's in the tea leaves, they have done the analysis and understood that you're either in or out for what's coming in the next 50 years. NB: it'll be interesting to see the take of one of Europe's better funds when they'll talk publicly about their $1.2 billion new fund.

We live unique moments in the financial services industry, and this is as good a time as any for making a bold move, being different and mean it - those who do it are the ones with the higher chance to raise funds again in the future. The other option is not do anything with the only hope of achieving superior returns out of the old game. Not impossible, fundamentals are fundamentals, discipline and a good thesis will always take you a long way and Europe's still hugely fragmented.

Besides, Europe is just an exploitation territory favourable to low risk takers - it's a market of late adopters - not exploratory as the American one, meaning that there's still place for little league games and lucky coincidences as long as everything is subordinated to the American funnel*, because this is where the liquidity is. And in this context Tigers and Sequoias play 3d chess while in Europe guys are playing pingpong, still backing American clones because the models were already de-risked and why not.

Anyways, even so, in Europe good deals are increasingly getting expensive** and the long tail of micro-funds is eating up the business from the bottom. If you keep doing what the others are doing, which is what usually VCs are doing, being average may not be enough as the game has become finally competitive. And that is because the Americans have once again changed it. Spillovers effects in Europe may take a few years, per usual.

*direct - IPO over US or raising their money in order to sell out in the US - a better part of the investment deals in Europe are made with American $$, via VCs, or American LPs through Euro VCs.

**the theory coming from the public market dealmakers is that tech-based startups were always undervalued assets, particularly in Europe, and now we see a market adjustment.

Cheat sheet reports

• The venture scouts from Europe - who are they and what they invest in?

• Early stage B2B marketplace startups from Europe.

• Early stage startups building consumer fintech in Europe.

• European startups part of Y Combinator this summer.

Investors in Europe

• a list of 100 investing at pre seed and seed

• a list of 30 investing at late stage

• top 140 active VCs

• a list of 25 from the new wave of European VCs

Intel:

• the mobile metaverse out of the Nordics

• Euro series As at $20+ million

• Swedish success stories

• the most active investors in Europe are Americans

• active investors in Europe by vertical

Note: the reports are for Nordic 9 paying customers only. You can become one from here.

Points of interventions in the food supply chain

Fragmentation

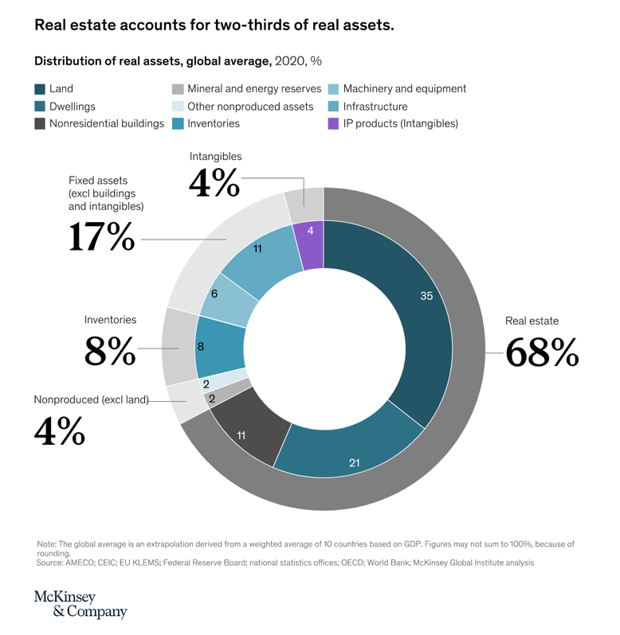

World's portfolio structure

A better way to track intel

Did you know that you could build smart trackers on Nordic 9?

A tracker is a bot that can be customised for tracking intel by one or many countries, by one or multiple investors, by one or many industries, or by one or many size checks.

This way you can have a quick granular overview of exactly the domains you're interested in. More signal, less noise.

We're currently at more than 150 trackers built by our users, why don't you give it a try?

It's quick and simple to add one. And it's FREE.

Other notes

🐶 Gunther the German shepherd put out for sales his Tuscan-style villa with views of Biscayne Bay. Asking price: $31.75 million. How's your week been?

🇩🇪 N26 will withdraw from the U.S. after they did the same in the UK last year. Is the American market too hard to solve or the Europeans too soft for it? Either way, growth should come from somewhere, and if the geo scale is not working out, you can give a try to the product scope.

🇬🇧 Speaking of quitters, Deliveroo's "timely withdrawal" from Spain will come to fruition next week. They also did cut a strategic deal for expanding in France though.

🇫🇷 Google signed a five-year deal with Agence France-Presse to include its content in search results. Google was fined $566 million in July for failing to negotiate in good faith with French publishers.

The 'we distribute your news' thingie is not working because we're not in the 2000s anymore and that traffic is less likely to be monetizable by media assets owners, best case circularly sold back to advertising vendors like Google. Google indexing content and including it in search results means tracking the users behaviour on the said content. You don't pay, you don't get access to the said data, as simple as that. We already predicted this a year ago.

🇬🇧 Two with Amazon in the UK:

• Amazon is fighting with Visa - starting on January 2022, it will stop accepting Visa credit cards issued in the UK because of the high fees Visa charges for credit card transactions.

• Business fundamentals are the same, whether you are digital company or not. Amazon will open 260 supermarkets across UK as it plots to take on on Tesco and Sainsbury’s directly.

🇬🇧 Ben Evans:

From 2010 to 2019, YCombinator alone backed 1,561 US companies (353 have died and 253 were acquired, while 955 remain independent). In the total US market, the NVCA reported 32,000 companies raising their first funding. This, really, is the context for those 400 US GAFAM acquisitions*. Equally, around half of all VC-backed startups produce a less than 1x return - failure to create a giant company is entirely normal, and a necessary part of the model.

*GAFAM bought 400 US companies from 2010 to 2019 for over $1m, of which 86 were over $50m and 314 were between $1m and $50m. In the same period, the NVCA reports 3,600 US VC exits where a value was disclosed (and 9,600 total).

🤔 Here's a good piece explaining DAOs with historical analogies. You can read it also in an "wishful thinking" key i.e. some good analogies don't necessarily make a big mainstream thing and disruptive changes based on innovations come in waves, are we on the right wave now?

Alas if you are a VC and do not fund contexts with this kind of signals, you're not doing a top job and you just play it safe sticking with SAAS and marketplaces, like 95% of Europe.

Quickies

🇫🇮 The Wolt/Doordash acquisition slides + why it's a good deal ICYMI.

🇩🇪 Ableton is the music-production software company from Berlin everybody wants to buy but they won't sell.

🇬🇧 Why did Draper Esprit rebranded to Molten Ventures.

🇬🇧 A profile of one of England’s hardest-working hand models.

🇮🇹 China took control of an Italian military drone maker without authorities knowing it.

🇦🇹 Austria will become the first country in western Europe to reimpose a full COVID-19 lockdown. Neighbouring Germany warned it may follow suit - we are in a national emergency.

🚗 This week we had a power outage in Stockholm. No biggie, these things can happen anywhere, but you know what can be worse than that? Not to be able to use your expensive car because of it.

Speaking of expensive tech-enabled cars, it looks like Apple's will launch in 3 years.

🇪🇺 The ex data scientist Facebook whistleblower worked with an anti-tech lobbying firm to make her case to European lawmakers.

🇸🇪 Sweden's most popular brands:

• local: Swish (P2P money transfer), IKEA, ICA (grocery retailer), Volvo, Wasabröd (100 years old crisp bread producer)

• global: Google, Samsung, Netflix, YouTube, Whatsapp

🧮 The venture insanity calculator.

🐝 The VCs and their illusion of being busy (comments are good too)

👓 Facebook launched a prototype haptic feedback glove that, unsurprisingly, is very similar to the work of a company they have worked with. Different name, same business.

🍭 S&P Dow Jones Indices launched the S&P 500 Twitter Sentiment Index which will measure the performance of the top 200 companies within the S&P 500 that have "the highest sentiment scores," based on how users are discussing the stocks.

💪 Solo capitalists vs VC firms: solo capitalists are increasingly being ranked among the top investors on AngelList by markup rate

💨 Seed rounds at $100mm post money.

🎬 Tarantino wants to NFT seven uncut scenes from Pulp Fiction. Miramax, the production company, doesn't want Tarantino to do that.

💳 Debit cards are hidden financial infrastructure.

🤔 Why should we be clear when we can not be - a guide to understanding founder/VC conversations.

👁️🗨️ The investment memo for a common obsession of Silicon Valley - a new YC.

💸 M.B.A. starting salaries are soaring - median salaries now stand at $155,000, a record high for Wharton, w/ over 99% of the graduate class having received a job offer.

😂 An online dating service targeting Harvard students was recently revealed to be an elaborate prank and the brainchild of an MIT student.

💉 More than 100,000 Americans died from drug overdoses in the past year - more than the toll of car crashes and gun fatalities combined. Overdose deaths have more than doubled since 2015.

Did you find this useful? 🤔

Sharing is caring

Have your colleagues and friends sign up too. To support our work, please consider subscribing to N9.

Sunday CET

Sunday CET

Notes and commentaries about what matters in the European space - concise, no non-sense insights, interesting stories and implications for founders, investors, employees from tech companies or government representatives.

Published every Sunday morning by Dragos Novac and emailed to investors, founders and decisions makers from 50+ countries who want to understand the ecosystem from Europe.