The European unicorn nobody talks about

The European unicorn nobody talks about

Here's what we have this Sunday:

• who are the late stage deal makers in Europe

• the European unicorn nobody talks about

• is the metaverse the future or an ego thing?

✍️ Observations

The late stage investors from Europe are mainly Americans

One of the investment community's habits is to keep a detailed track of their unicorns - a practice started in Silicon Valley about 15 years ago, when it was rare that a private company would reach a $1 billion valuation.

Now it's not a big deal anymore.

However.

Crossing the ocean, in the little emerging European ecosystem that tries hard to adapt to the investment world of the 21 century, counting unicorns remains a decent proxy for showing that progress is being made. And it's not a bad thing to have public KPIs. It went as far as a president of a country upping the ante and decreeing that the national objective should be creating 10 tech companies valued at €100 billion by 2030. Each.

And so, an intermediary look shows that Europe's KPIs are improving, in the sense it has higher unicorn numbers than China and closes the gap to the US. Forget for a second that in China there are major macro things happening with direct consequences. Europe's national ego should feel good as it finally looks better than others.

But those numbers should be taken with a grain of salt as I believe Europe's context is a bit unusual if we're to look closer at intel. There's a whole lot more money than projects. There's even more investors willing to write a check at $1 bill valuation than the number of startups which have a decent unicorn path.

The hyper-competitive environment ultimately translates in high valuations and hence unicorn levels easier to accomplish, due to increased pressure both on the deal pace, which is at all time high, and on the closing cycles, which have been reduced considerably.

Most of those deals have an inflation coefficient which is not negligible. Due diligence is made in 3 days not in 3 weeks. Companies raise money every 6-12 months at 3-5X higher valuation even though they don't need it. Or because of it.

That means they are judged on growth records of 6 to 12 months, which can be misleading sometimes. And this adds an extra risk which is not accounted for in the deal structure, but rather discounted because competition forces you to bid up and take the deals. You're either in now, or you're out.

Is this the standard way of doing venture investment from now on? Hard to believe, fundamentals will remain fundamentals, and the European pool of unicorn candidates will dry up soon. Not to mention that in the following 12-24 months the companies need to deliver their numbers and we still need liquidity events - not an European strength.

But as long as the hyper competition remains, the market mechanics at equilibrium will definitely look closer to today's environment and will likely spread out across all stages. And ultimately, competition is best driver for innovation.

In this context, this week I had a close look at who backed the 70 Euro unicorns announced this year. And based on the reasoning from above, I extended the analysis scope a bit and looked at all the investors that were involved in European deals closed at $50 million or above.

We tracked 642 investors involved in 225 $50M+ deals in January-August (20) 2021. To put it in context, the numbers are 2X as high as the ones for the whole 2020 - 343 investors and 121 investments.

From those 642 investors:

• 22 did a minimum of 8 deals this year. That is one a month.

• 4 of them did 2 a month, or more.

• 9 of them are in double digits numbers - 10 deals or more.

Here's the breakdown:

• 19 deals - 2 investors

• 18 deals - 1 investor

• 16 deals - 1 investor

• 10-15 deals - 5 investors

• 8-9 deals - 13 investors

9 of the 22 investors who did at least a deal a month are American companies. Here's the country breakdown:

🇺🇸 USA: 9 investors

🇬🇧 UK: 3 investors

🇫🇷 France: 2 investors

🇩🇪 Germany: 2 investors

Norway, Switzerland, Russia: 1 investor each

China, Singapore, Japan: 1 investor each

And who are those late stage dealmakers from Europe? Here's the top 10:

🇺🇸 Insight Venture Partners - 19 deals

🇺🇸 Tiger Global Management - 19 deals

🇺🇸 Accel - 18 deals

🇬🇧 Index Ventures - 16 deals

🇫🇷 Eurazeo - 15 deals

🇯🇵 SoftBank Group - 12 deals

🇺🇸 Goldman Sachs - 12 deals

🇺🇸 BlackRock - 11 deals

🇩🇪 HV Capital - 10 deals

🇬🇧 Latitude - 9 deals

Some food for thought instead of a conclusion: say, if we didn't have the 9 American late stage investors in the above picture, would Europe's ego about their unicorn accomplishments be the same? 😀

More data sets and details are here.

The European unicorn nobody talks about

This week's headlines included OnlyFan's announcement that it would prohibit users from posting material with sexually explicit conduct on its website, which many sex workers use to sell fans explicit content.

For those of you living under a rock, OnlyFans operates a marketplace platform mostly used for adult content, whereas sex workers (and other kind of creators) used it to charge fans for exclusive access to photos, videos and other materials.

This is one of the largest consumer startups from Europe:

• 130 million users

• GMV/net revenue/FCFF as of 2021 - $5.9 billion/$1.2 billion/$620 million

• $12.5 billion payments processed estimated for 2021 (up from $6 bil in 2020)

• 300+ creators earning $1M+ annually

• 16k creators earn at least $50,000 annually

• the long tail is also interesting.

Would you fund those numbers? Of course you would, there's not many Euro deals that look like this, if any.

The funny thing is that, contrary to the myths from the VC business, they didn't even need VC money to get those numbers in 5 years of existence. And the OnlyFans' problem is not that "it makes tons of money and can't find a big outside investor" as you will find in the media narrative. The problem is that the tons of money it is making now will no longer be as much since none of the payment providers want to work with them any longer. As a specific example directly affecting OnlyFans, starting in October MasterCard will implement new rules governing sites with adult content that use their payment processing systems - why, how and a whole conspiracy theory here.

So in an adverse situation with not as much revenue from the existing model yet w/ great engagement numbers, you still gotta make it a business and go raise money from the market in order to recalibrate and regain momentum. You gotta do what you gotta do - change the story and tell investors what they want to hear in order to get their checks. This is what's all about.

Food for thought:

• Is there any other viable solution for a $12.5 billion a year opportunity (i.e. blockchain) circumventing the rigid payment and banking partners rules? Is this is a future opportunity or a lost one due to questionable moral grounds?

• How will the pivot affect the Onlyfans economy and how many of the 130 million users will stick around for a different experience - read somewhere on Twitter a great analogy: it's like strip clubs pivot into selling chicken wings.

• This is one of Europe's unicorns built on solid marketplace fundamentals which you will not find it covered in the media because of the pudibonderie. Investors won't talk to them for the same reasons, mostly, or because their LP commitments prohibit doing business with them. It's the 21st century and in Europe and other parts of the world sex business is regulated and brings in tax money in spite of societal taboos. Would investors bite a bullet here?

Is the metaverse the future or an ego thing?

Another headline this week is Facebook's announcement about the metaverse, as Zuck demoed to a bunch of journalists a B2B business case (i.e. remote meetings) for a product that he says it is eminently a consumer one.

Here's a business case that's not as talked about, btw.

It's true, there's a case to be made as the younger generations and kids these days are building many virtual universes based on the community they frequent - be them games or social networks. They do spend more time socialising online than offline. This is a good premise to start building an evolved environment or two, be it VR, AR, augmented or plain online adapted for this kind of behaviour - I actually buy the premise but not sure that Facebook is the right crew to solve it.

My skepticism mainly comes from the guy trying to build around this, Marc Z. People don't trust his instincts because of his consistent past behaviour - he seems to be the type of smart tech guy without business acumen and any vision whatsoever. If you have ever hired people, it's easy to recognise the profile. Alas, it's the dude's only card to play in order to be considered in the same league with other tech leaders who built comparable business to Facebook but don't have the same mistrust and mockery as Zuckerberg does. The ego is his only stake in the game.

The big picture though is this hopefully gets legs and more people will work on it. It'd be an accomplishment on itself if people copy Zuck's efforts, instead of the usual way around.

Cheat sheet reports

• A list of very early stage SAAS startups from Sweden

• A list of up and coming Nordic manufacturers of electric vehicles - boats, trucks, bicycles, motorcycles and scooters.

• Early stage startups from France that raised capital rounds from non-French investors.

• A list with the non-British early stage startups backed by Seeedcamp.

• The most interesting deals over the summer:

- in the Nordics and the Baltics

- in DACH (Germany, Austria, Switzerland)

- in the UK

- in France

Note: the reports are for Nordic 9 paying customers only. You can become one from here.

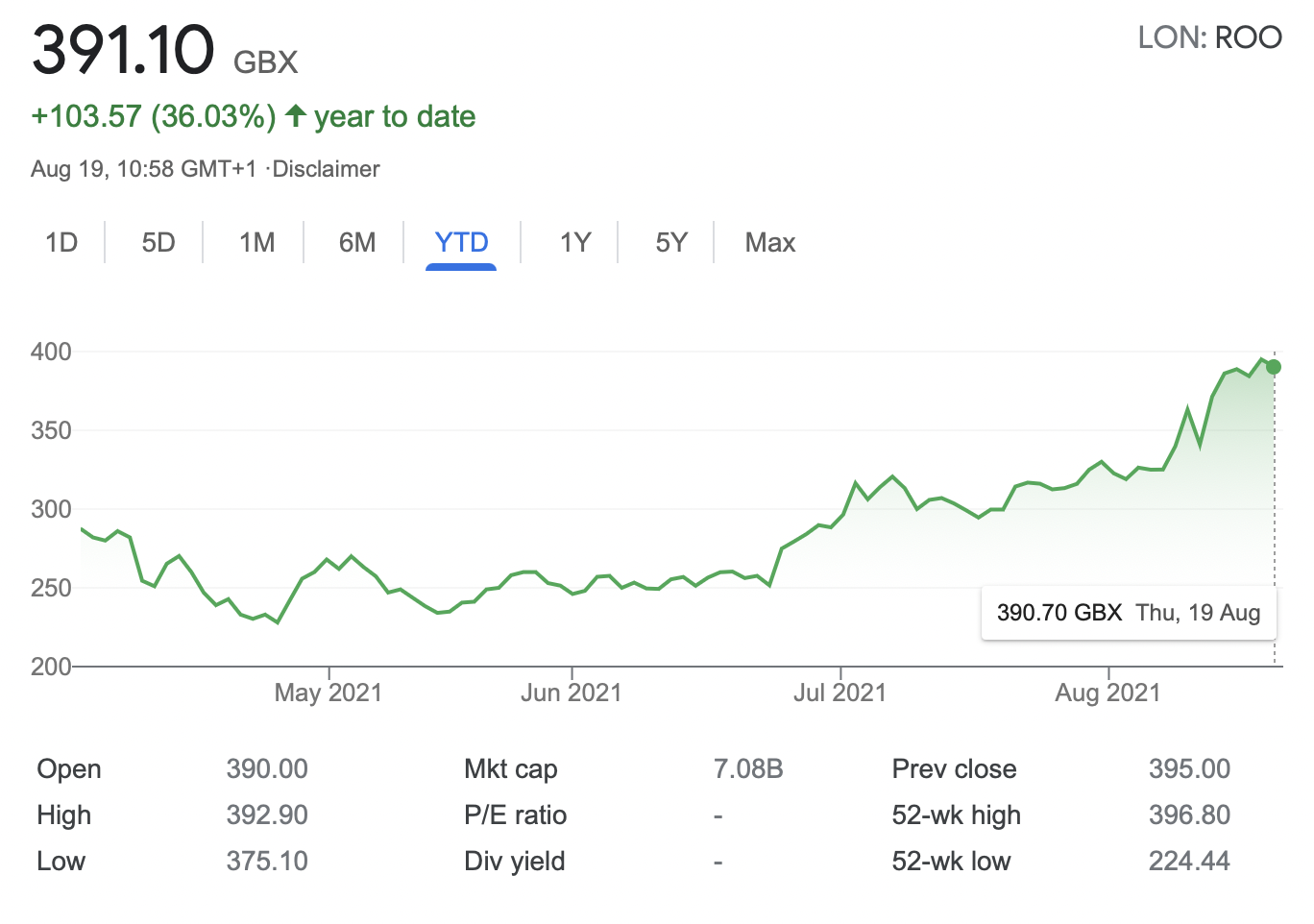

Was the Deliveroo IPO really a flop?

Of course not. A graph is worth a thousand words.

6 months after the IPO, the fundamentals and the open market worked out in spite of some initial adversity. There's hope for better liquidity options in Europe.

✔️ Other notes

🇦 Accel’s 2021 Euroscape is near closing its submissions - it is a great opportunity to be featured in the who's who of Europe's SaaS companies. Last year's list included many of today's unicorns as the Euro SaaS funding is soaring at all stages. Register your company here in order to be considered.*

🇨🇭 Bond Mobility announced that it switched to a B2B model as they will lease their electric scooters fleet to the ecommerce delivery providers that have popped-out lately, especially in the grocery space.

Not a terrible idea to focus your core competence on building feasible and cheap scooters and operate them in an efficient manner, without bothering with the consumer side of the business. Compared to the huge piles of money raised by their competitors, Bond raised only $20 million from a Turkish investor and a Japanese auto parts manufacturer.

🇪🇺 Since we're at this topic, I found an interesting list with some of the fees that are charged by the local authorities for running electric scooters in their cities. The price is per scooter per year and I googled the scooter numbers, you can do lotsa math with them.

• Bremen: €25 | 1,000 scooters

• Dusseldorf: €20 | 1,000 scooters

• Paris: €60 | 15,000 scooters

• Lyon: €45

• Milan: €25 | 6,000 scooters

• Rome: €20 | 6,000 scooters

• Stavanger: €35 | 750 scooters

• Malmö: €180

• Stockholm: €140 | 22,000 scooters

🇨🇭 Speaking of pivots, Angle Audio, launched in 2020 as the Euro version of Clubhouse (funded by Atlantic Labs), announced pivoting to the B2B market as it will start selling audio SDK. The consumer app had around 10k downloads and was closed down.

🇬🇧 Revolut launched Payday, an alternative to credit card debit and short-term credit as it lets you unlock a portion of your wage early. There was a flurry of startups doing this back in 2019.

🇳🇱 Just Eat Takeaway did a back-to-back with Adyen to launch an employee benefit card, pre-funded for meal expenses and sold to the corporate market. Again, a bunch of startups from Europe raised money just for that.

🇳🇴 Harry Stebbings of the 20VC podcast fame co-led the largest Pakistani financing round ($85M) in a last-mile-delivery startup, Airlift. GG.

🇺🇸 Good interview with one of the better American investors out there.

🇬🇧 EF launched a podcast.

🇸🇪 What to do if you get hired as a first marketer in a startup.

🇸🇪 IKEA will sell clean energy on subscription basis to Swedish homes through a service called Strömma. As a subscriber you’ll get certified solar- or wind-generated electricity and can track through a mobile app.

🇪🇺 Back-to-back comparison Germany/UK visavis their carbon emissions.

🇪🇺 Overview of a few European startups building next-gen manufacturing factories.

🇪🇺 Eurostar will increase the train frequency from London to Paris and Bruxelles.

🇮🇹 Italy has a new airline replacing Alitalia, will start flying in October.

🇦🇹 Austria launched a €900 climate ticket that you can use for almost all public transport, all across the country, even across different companies for a year, with up to 4 children.

🇮🇪 Why (Irish) people don't want to get vaccinated against Covid.

💸 Microsoft will raise Office 365 business subscription prices in 2022 - a biz paying $150/yr now pays $450/yr. 3X is steep.

🤡 How Google puts the M in monopoly.

🏬 Amazon plans to open large retail locations akin to department stores. Otoh, here's what it's like to shop in Amazon's un-manned stores. (TLDR: kinda neat)

🚴 Speaking of people with(out) vision, Bird liked the VanMoof bikes so much that they launched one that looks the same.

🧘♂️ Many people are embracing career downsizing, voluntarily reducing their work hours to emphasize other aspects of life. link

🤥 Lies that losers tell.

🇯🇵 Small vehicles of Tokyo.

*This is sponsored advertising content

Did you find it useful? Have your colleagues and friends sign up too.

To support our work, please consider subscribing to N9.

Sunday CET

Sunday CET

Notes and commentaries about what matters in the European space - concise, no non-sense insights, interesting stories and implications for founders, investors, employees from tech companies or government representatives.

Published every Sunday morning by Dragos Novac and emailed to investors, founders and decisions makers from 50+ countries who want to understand the ecosystem from Europe.