the moving picture

the moving picture

• Klarna's puzzle pieces

• the VC business that is not a VC business anymore

• the grocery delivery business 2.0

Klarna's big puzzle board

Klarna made its most expensive acquisition this week as it paid $1 billion or 20X revenues for Pricerunner, a Swedish ecommerce aggregator.

It is the tenth M&A deal Klarna did in the past 12 months and the rationale seems pretty straightforward: better distribution for partners + embedded payment option in the Swedish asset and likely incorporate the shopping engine technology in markets other than Sweden.

It is an infrastructure play. It may not be obvious, but still think this is yet another step for building a consumer app as the go-to place for doing e-commerce shopping. Let dive a bit into it.

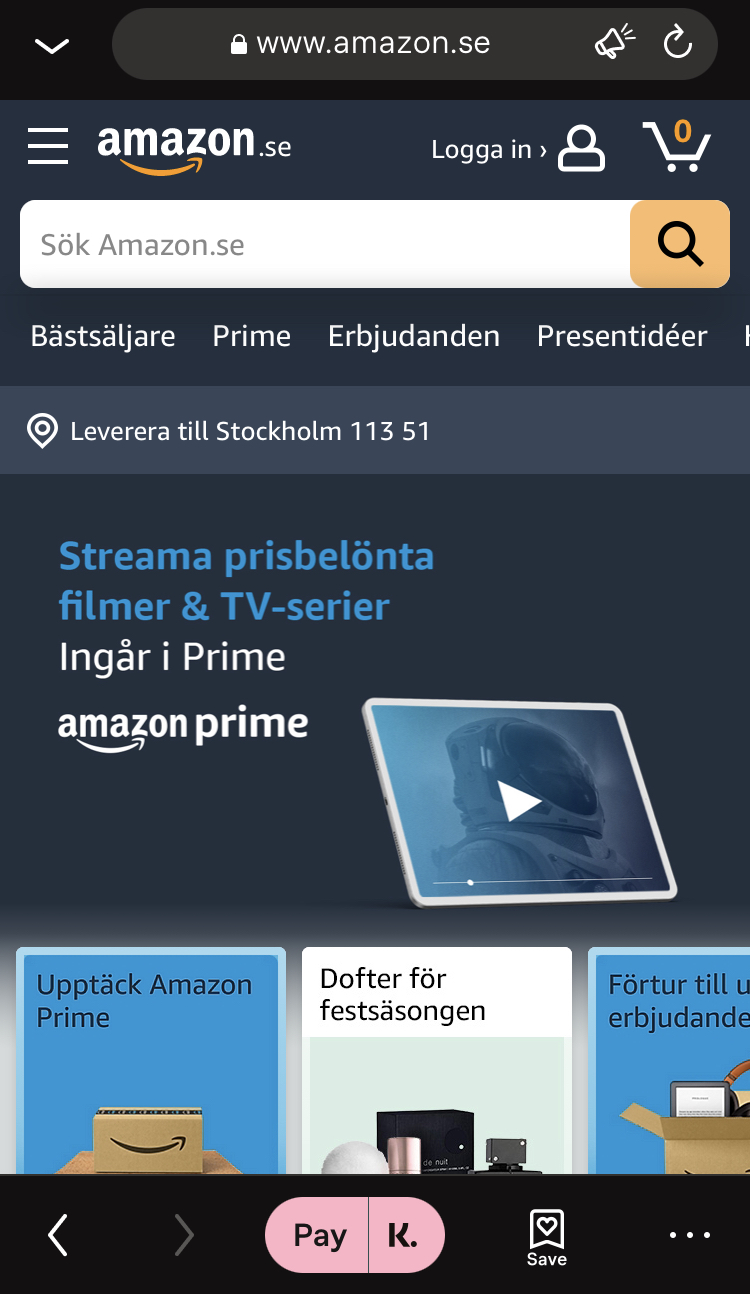

Now, if you ask Klarna, they'll be quick to say that especially with buying Pricerunner, they're rather an aggregator a la Google Shopping than something similar to Amazon's marketplace. It makes sense, Pricerunner does look like Google Shopping and heck, Klarna even has Amazon.se in their Swedish marketplace app. For the moment, all Klarna's acquisitions are made for creating a complete shopping engine that is more rather than less dependent on Google as a lead sales generator. The app play as a marketplace is still weak, and that is likely because of larger, bigger picture business constraints.

The conceptual difference between Google Shopping and Amazon's marketplace is that the former is a distribution channel incorporated in a global search engine*, while the latter is a similar gateway incorporated in an online store, controlling the payment and customer data, covering the whole funnel from discovery to the post-purchase experience.

Klarna is neither a search engine nor a shop but somewhere in between. And, as of today, strategically it cannot become a fully-fledged shopping marketplace overnight without alienating partners, as sensitive of a topic as even Siemiatkowski felt the need to take a stance on it.

My point is that we're seeing a lower part of a possible trajectory and it's telling that Klarna's approach to building its aggregated store is suboptimal, somewhere in the middle, with a hybrid model involving own embedded payment options on the partners site. Which Google does not, or Pricerunner, yet - none have checkout options on their sites.

Klarna does. If you look closely at their app, the payment option is embedded and most visible on their partners site - quite explicit throughout the checking out, where, true, it is an option among vendors' own choices.

That's Klarna's "native but not native" iOs app.

If however, customers use Klarna for payment on vendors site, it is the same experience as if you bought from Amazon's marketplace - Klarna gets the money and the partner takes care of the delivery.

Also notable - Klarna only offers the BNPL payment option for customers. As of today, of course - in Britain they announced they launched the buy now pay now option, for example.

Not least important, think about it this way - how many people do you know saying they bought something from Google Shopping? Not too many, right? That's because it is not a shopping brand, it is an online gateway optimised for a search engine.

Klarna's way, otoh, is clearly focused on making you think about 'it' being the brand where you buy stuff from.

Does all of this matter? Not yet, it' very early and all this is just semantics and small moving pieces in a larger strategic board.

Klarna's adding of partners sites in its native app is far from optimal - it's actually a cringy experience, reminds me of the FB HTML5 prior to building a native iOs app. And make no mistake, the poor implementation was not made because the product guys are incompetent, but rather because they have many business constraints to deal with. It is the lowest common denominator of a temporary state of play.

Those tactical bits can change quickly as a larger strategy unfolds. A better, clear execution of a stronger marketplace play involves also a strategic transition from BNPL, which made Klarna successful in the first place, to a more complete payment solution.

Would you switch to that right now when BNPL is finally hot in the US, with all big boys - Apple, Square, Paypal - having a play? Increased market attention is not competition for Klarna, it is making the pie bigger and faster market grabbing. Take, for example, the discussions for embedding BNPL onto Amazon which ultimately led Amazon chose to work with Affirm rather than Klarna. Btw, should those have gone through, do you think it'd been wise for Klarna to directly force an Amazon marketplace-like play? Another example - Klarna striking a BNPL deal with Stripe, a distro play for exactly getting more US share.

And that's the consumer side of the BNPL. But how about the B2B BNPL? This market is super hot in Europe today, with a handful of VCs backing startups in the space, and even with Klarna backing Billie's series C.

Klarna's core market - BNPL - has still huge upside to milk and further grow. These kinds of deals are more important today than going all in on the marketplace front, which is a lateral move when the core market doesn't grow as much. It'd be naive to say that today, with what it's showing, including Pricerunner purchase, Klarna competes with Google shopping or Amazon's marketplace or any store. All in due time, right now they're just learning and adding pieces on the big puzzle.

However. Overall, all this optionality is the reason for which Klarna is highly undervalued.

*In the American market Google Shopping has (or used to have) its payment option Google Pay embbeded afaik.

The VC business that is not a VC business anymore

Random notes from the past few days:

• Sequoia announced changing the model and heading towards becoming a full-service investment house.

The Sequoia Fund will take in capital from investors and funnel it to Sequoia’s traditional venture funds, which invest in US and European start-ups. It will also hold Sequoia’s stakes in publicly listed companies, such as Airbnb. It will also charge a management fee of under 1 per cent, and potential performance fees, adding an extra layer of fees on top of its existing venture funds

It is a bold move for a traditional company - how will this impact their culture? What assets are they going to build under this new paradigm? How will this impact the other players in the market? How will the evergreen fund and subsequent investing in other asset classes (public stocks, crypto) impact their operational model? Will they be like a hedge fund or like an investment bank? Is this model more protective when the big reset is going to come?

• History repeating:

In the 1990s Kleiner Perkins told all the journalists they were more than a venture firm, they were a keiretsu.

+ this

• SoftBank’s $100 billion fund for startups pays too little to retain top talent. That's apparently for the top guys:

Seven managing partners have left since March of last year, and the only senior managing partner, Deep Nishar, will depart by yearend.

The little people though:

Base salaries for staffers at both junior and senior levels are high. The Vision Fund offers around $500,000 in base pay for its mid-level investors, and $700,000 or above for more experienced staff.

Over here in Europe I know midlevel guys working for 70k a year. :-)

• Big boys spoiling the party of the VC business, the Tiger edition - those anecdotes about how Tiger does business will make you understand all the gossip and why VCs have a hard time to catch up and play ball in the same game.

• Encore:

I’ve heard some VCs be like, “Oh we don’t compete really with Tiger,” which is bullshit. Everyone competes with Tiger in some way right now if you have a pulse and invest in companies at Series A and later.

But who is getting hit hardest by Tiger are mostly older, and frankly lazier, VCs that rode SaaS in particular over the last decade to great wealth but maybe weren’t the best partners to companies.

Tech tapas #2

We're doing it again. Same objective, same one hour format.

Here's the gist: we're doing a small pitching event, as we're looking to showcase interesting established startups made by outsiders or no-network founders. It's an extension of the curated intel we do every week.

The feedback from the last edition was great. Let's make an even better one now.

Tech Tapas is an invite-only event, for both investors and startups. If you're interested to be part of it, or know somebody who should be in, please send me an email. Thanks.

Cheat sheet reports

• The venture scouts from Europe - who are they and what they invest in?

• What you need to know about the European investment market in Q3 2021:

- $15 billion more spent than in Q3 2020

- 1/3 of the deals were in the $1-5 million range

- more than 60% of the money was deployed in $100M+ deals

- London is (still) the capital attracting the most funding, and the Nordics the most active Euro region.

• A list with the non-British early stage startups backed by Seeedcamp

• Early stage startups from DACH that raised capital rounds from non-DACH investors.

• Investors in Europe

- a list of 100 investing at pre seed and seed

- a list of 30 investing at late stage

- top 140 active VCs

- a list of 25 from the new wave of European VCs

• Intel:

- Swedish success stories

- the most active investors in Europe are Americans

- active investors in Europe by vertical

Note: the reports are for Nordic 9 paying customers only. You can become one from here.

The times we live in

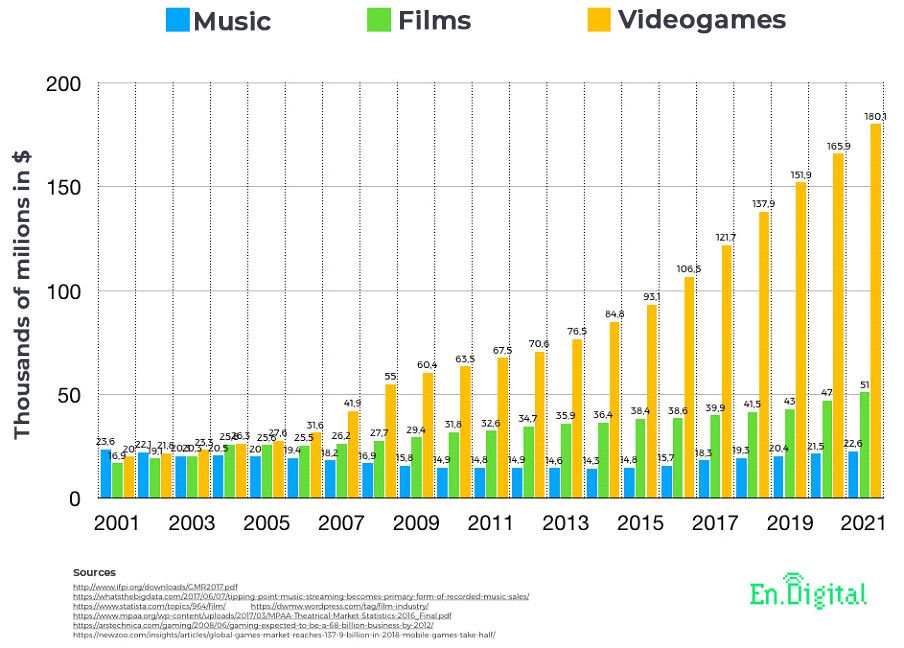

Why Netflix expanded into video games

A better way to track intel

Did you know that you could build smart trackers on Nordic 9?

A tracker is a bot that can be customised for tracking intel by one or many countries, by one or multiple investors, by one or many industries, or by one or many size checks.

This way you can have a quick granular overview of exactly the domains you're interested in. More signal, less noise.

We're currently at more than 150 trackers built by our users, why don't you give it a try?

It's quick and simple to add one. And it's FREE.

Quick notes and pointers

🇩🇪 Last month three startups building online delivery services for OTC meds and pharmacy products in Germany raised funding:

• Mayd - $15M,

• Phaster - $1.2M

• First A - undisclosed value.

Think online groceries but for pharma products - the category is a bit more difficult since there's a good part of it that is regulated and the ne-regulated part is already covered by, uhm, the grocery startups. Once you get the regulated part solved, it's basic online supermarket management operation.

Meanwhile, here's top drugstore items sold by Gorillas in the Netherlands.

🇬🇧 The UK in a nutshell:

• 45% tax on foreign income

• 20% tax on crypto

• 38% tax on dividends

• 0% tax on wealth*

• 100% tax on foreign source pension

• 45% tax on freelancing

• No track to EU passport

• Expensive and rainy

*for now

The nice thing about the EU is being able to take advantage of financial asymmetries, you simply need a good accountant familiar with local and Europe legislation. Now that the UK is not in the EU anymore, it is a bit more difficult, but far from impossible to simply make a sound decision for doing your finance in a friendly environment.

🇸🇪 The best VC deal announcement I have read in a while and from which I actually learnt a lot of stuff. No PR and boasting, just utility and reasoning, my cup of tea.

🇪🇺 Spent quite some time lately looking a bit at the financial service business in Europe - here's a couple of materials that I found interesting:

• Why Debt Capital Is a Good Fit for Europe

• the background of Capchase's new banking product putting to work the idle (huge amounts) capital raised by startups.

If you think the VC market is under disruption, just look a bit at the debt side of the story.

🤔 VCs are ghosting founders like it's 2010.

Ignoring somebody is worse than an f-you, especially when entrepreneurs building stuff don't have time for complicated VC boudoir tricks. Writing 'no, not this time but thank you' + send takes exactly 5 seconds and shows respect for the other side, even though you may find it not suitable for your momentarily needs. If you're a founder and still want to work with those guys, it's on you.

🇬🇧 Five misconceptions and tactics to triumph over community-led growth roadblocks.

I like Sarah's work, and overnight success takes a lot of time, hard work and unsucessful experiments. Building a community is even more difficult and open sourcing the process and being transparent about it is the way to go - gg.

🇫🇷 Should I let a scout invest in my round? Nope.

There's so many venture scouts in Europe (we curated a list of 50) that the concept is over-rated already. For VCs it is easier and cheaper to hire scouts than doing the hard work of mapping and understanding the very early stages of people trying to build stuff out of nothing. As a founder though it doesn't make sense more often than not to work with a scout, and it took a founder to articulate some of the reasons.

🇪🇺 Why Facebook is more worried about Europe than the U.S.

🇩🇰 Copenhagen: cool or boring? Fwiw, my fav city in the Nordics.

🇸🇪 Stockholm’s official app [for managing school/parents relationship] was a disaster. So annoyed parents built their own open source version - ignoring warnings that it might be illegal. Then the city called the cops.

Fwiw, my son's school is at the third app in 6 years, all poorly implemented.

🇳🇱 Tesla is rolling out a pilot program in the Netherlands that opens 10 Supercharger locations to non-Tesla electric vehicles for the first time.

Opening up and being inter-operable is the way to go in the market. It's like with the phone chargers - how many kinds of chargers do you need in the market really. In the EVs case, there's also a few angles to look at it - are you a car povider controlling this vs are you a charging stations operator vs. a marketplace (a la airbnb) operator - see also the bit from here.

💪 The 100x ARR multiple seems to be a benchmark in the industry today. It has some foundation in the public markets, but assumes quite a bit of forward execution.

👓 Zillow is getting out of the business of buying and selling homes for good and laying off a full quarter of its workforce.

That's after the pivot they made in 2018, of going down the value chain and purchasing real estate assets rather than playing the middle market role of aggregating it.

It was a bold move at that time (thoroughly explained here if you're into strategy) and it is even more respectable that they had the guts to call it off, cut off the losses and move on.

Better feel sorry for doing it than for wanting to do it. Idly wondering what will happen to the handful of the (Euro) VC-backed startups that followed Zillow's model.

💨 No, we're not in a bubble, part 625372:

A new venture fund is raising funds to buy venture-stage companies with real revenue and products but struggling to raise additional capital.

Quickies

🇸🇪 Greta: It is not a secret that COP26 is a failure

🚗 The experience of the first *driverless* robotaxi on the streets of San Francisco, now that they're official.

🤔 Why do people cancel news subscriptions?

🤔 Journalists changing jobs to work for investors, because said investors invest in content - 1, 2. This a recurring theme on Sunday CET, you don't need to be a rocket scientist to realise that owned media is the cheapest way of building trust and referrals, exactly the drivers that make the business go round.

🦨 Play dumb, get rich.

🔬 Great research made by FB showing competition, demographics, and consumer behaviour in the consumer social space. TL;DR: they run away from the present realities in the metaverse.

🇸🇪 PayPal launched the Zettle Terminal, a new all-in-one POS solution for small businesses. It took them 3 years.

📺 Pinterest gets into live shopping with launch of Pinterest TV.

🍭 Zoom is piloting ads for free users.

🍔 McDonalds launched an NFT McRib.

🇨🇳 Yahoo's decision to pull out of China also made TechCrunch.com to be no longer available for regular access in the country. So much for the freedom of speech.

🏀 KD’s 7 best investments.

🚬 Cigarette sales went up last year for the first time in 20 years.

Did you find this useful? 🤔

Have your colleagues and friends sign up too. To support our work, please consider subscribing to N9.

Sunday CET

Sunday CET

Notes and commentaries about what matters in the European space - concise, no non-sense insights, interesting stories and implications for founders, investors, employees from tech companies or government representatives.

Published every Sunday morning by Dragos Novac and emailed to investors, founders and decisions makers from 50+ countries who want to understand the ecosystem from Europe.