the tech and the tapas

the tech and the tapas

• how many conclusions can you draw from a banal table

• why are Eastern Europeans doing unicorns?

• NFTs as promotional giveaways

Observations

🍢 Did I mention that I am super excited about next week's Tech Tapas?

I got the idea to do it in an unrelated discussion over a cup of coffee with an investor this summer, talking about how 95% of founders have no investors networks and still a hard time to raise in a super fragmented European market full of money.

As an aside, some of you already know it, Tech Tapas is the name of a networking event I used to do in Madrid a few years ago and which brought me many friends and a great way of understanding the Spanish startup ecosystem.

Fast forward to 2021, this event has a different twist, as its objective is getting brilliant founders funded.

We use all the intel from Nordic 9 to find them (30k+ Euro deals), and are talking to many founders building interesting stuff who still find it difficult to get investors' attention. We try to be as helpful as possible, work closely with them to understand what they do and help with the pitching materials. If they're not a fit for investors or not ready, we tell them that. And so far people seem to trust us because, I believe, we're open and honest with them. There's no tricks or ambiguity when talking to them, we set up clear expectations in a straightforward conversation and we simply listen. And listening to people is a rare thing today, I believe, particularly in an investment environment with lousy signal-to-noise ratios.

Maybe it sounds arrogant but the way I look at it is building some sort of a Euro YC demo day, without the accelerator part. And I treat it as such - it's useful for investors, because they get to meet prepared founders, professionally pitching and which were already pre-screened in terms of the investment viability against a clear set of criteria. And for startups, worst case scenario, it's an all-round exercise that prepares them for the next investors encounter. My ambition is to get them funded via the event though, and that is why I also work closely with investors and I'm being selective about who actually gets to sit in.

Will it work? I guess we will see on Tuesday. I truly believe that connecting great people is a win, and this is a small experiment done by the ear, just following my instincts and which I am learning a lot from. In the past 4 weeks, I screened about 500 hundred startups, analysed a shortlist of 50, talked personally to about 20 or so, and boiled down the list to four:

• a digital POS service developer

• a neo insuretech startup

• a vertical search engine developer

• a VR-based corporate wellness service provider

The guys building this stuff are absolutely amazing and they're killing it already, and I look forward to see them presenting in front of investors from 9 countries.

Their background is here (link available for paying N9 customers ☺️)

🇪🇺 Let's do a little exercise, shall we? If you were quite familiar with the European investment ecosystem, how many qualitative observations would you be able to draw from the following table?

The table, btw, is a screenshot from one of our latest intel updates we send to our Nordic 9 customers every Monday morning (you should subscribe and get it too).

Back to the exercise. Here's what I'd observe:

- Insane pace! Almost 2 deals a week is like fast food investing.

- Seedcamp and Speedinvest were the most active investors in Q3.

- HV Capital, which in a different life was a corporate VC and now acts independently out of a €500 million fund, is also doing one hell of a job in deploying mostly in DACH.

- Insight Partners was the most active PE acting like a VC in Europe in Q3.

- Softbank and Tiger also acting like VCs toe-to-toe in the number of deals closed in Q3.

- Both Softbank and Tiger, which btw have been among the most aggressive dealmakers at later stage this year, are closing a similar number of transactions to the most active seed investors in Europe - Speedinvest and Seedcamp that is.

- One third of the top deals were executed by non-VC companies.

- Accel is the most active plain vanilla later stage VC in Europe, and did presumably more deals than their closest American brothers Sequoia and Lightspeed, probably because they've been a whole lot longer in London.

- Oh hey, look, Creandum is a nice Swedish surprise in the Anglo-American deal making game that happens in Europe. French in there too, ok, Eurazeo is a PE with a VC department, has size, a lot of employees, and an unicorn mission from Macron.

- All in all, it's a remarkably close gap between the number of deals done by early stage investors, which in theory write small checks at high pace, and the later stage, which in theory write big checks at a lower pace. Why? Plenty of money in the street.

Basic stuff, right? Or, if you're a seasoned journalist, you can always differentiate by dismissively noting that you cannot compare SoftBank to Seedcamp because they're kinda different.

Cheat sheet reports

• Fintech startups:

- unicorn wannabes from the Nordics

- consumer SAAS from Europe

- very early stage from Sweden

• Early stage marketplaces in Europe:

- B2B

- consumers

- from the Nordics

• Investors in Europe

- a list of 100 investing at pre seed and seed

- a list of 30 investing at late stage

- top 140 active VCs

- a list of 25 from the new wave of European VCs

• ICYIMI - The most interesting European startups from YC this summer.

Note: the reports are for Nordic 9 paying customers only. You can become one from here.

Did you get your Xmas gifts yet?

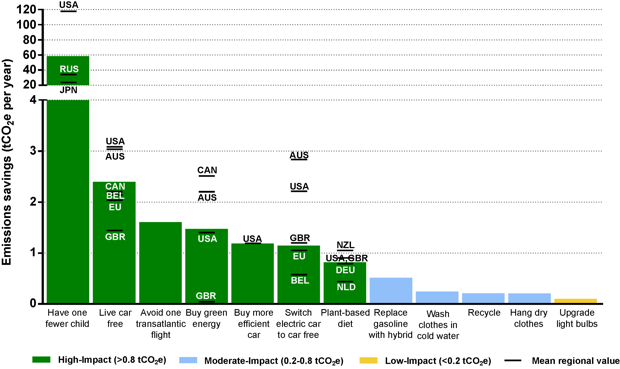

What do you do about the climate change?

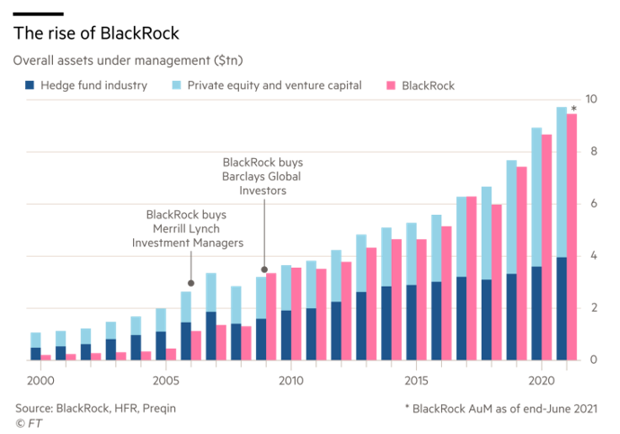

The rise of Blackrock

Nota Bene: last week I mistakenly confused Blackstone for Blackrock, thanks for being vigilant and reaching out. ☺️

Value for money

Every week at Nordic 9 we send to our customers curated intel overview and commentary about the deals we tracked in Europe. You can dig through the archives here.

We also run a local edition, covering the Nordics - the archive here.

You should subscribe and get it too.

Quick notes and links

💪 Some people calculated that 31% of the Central Eastern European-founded unicorns have been bootstrapped, compared with only 7% in the rest of Europe.

What's more important to this - most of those 69% have become unicorns because they have gotten the attention of conventional VCs after they had moved to London. Or to the US. There were not too many professional VCs in CEE 15 years ago anyways.

Another observation is that in CEE people are more resilient and innovative than in Western Europe, because the access to capital and other resources has been very limited (still is to a certain extent). And they do startups because they're hungry and super ambitious, not because it's cool.

🌀 Money is cheap, competition in the private investment market is high, here's the new mercurial:

• Pre-product: $6-40m

• Early-traction: $10-60m

• Pre-Scale: $40-$300m

• Scale: $80m-$1b

Related: The drop-off rates have shifted - 50% of pre-seeds convert to seed, 60% of seeds convert to A, 70% of the A convert to B, 80% of the B convert to C. It used to be a 50% drop off rate for each round of investment - we have moved wholesale into a momentum market.

🇫🇷 Sorare may have to register as a licensed gambling operator as it is investigated by UK gambling regulator. Comes with the unicorn territory, I guess.

✋ Doing startup investments in Germany is a legal pain in the ass, part 37647.

🇬🇧 How does the model for a seed+ VC firm works like.

🤖 The State of AI Report is out.

✨ Accel SaaS Euroscape is also out.

⚛️ Atomico did an NFT as an incentive for people filling out their State of European Tech survey. You still have time to do it this week, you can also get free stuff if you get involved.

🇬🇧 The next fashion trend is clothes that don't exist - British influencer Loftus sees so much potential that last month she gave up her job with a fashion consultancy to devote herself full-time to her website, This Outfit Does Not Exist.

💸 Thomson Reuters is launching a $100 million corporate VC fund focused on legal, tax, accounting and news media startups.

🎃 Apparently some things are not working out at Thrasio, as it aims to SPAC itself. The same Thrasio that went ballistic on Germans cloning their business a year ago (seems like ages).

🔢 Morgan Stanley's analysis on Amazon's financial statements.

🤌 Goldman Sachs investment banking unit had a 88% sales increase in its second-best quarter ever, with total revenue of $3.70 billion. Global M&A volumes have shattered all-time records, with deals worth over $1.5 trillion inked by GS in the third quarter, as it comfortably held its top ranking as the world's leading bank in M&A advisory.

🏭 How do you mass-manufacture, mass-market and mass-retail things whose entire nature is supposedly that they’re individual, or convince people that a piece of mass-manufactured nylon and plastic is unique? The supporting argument is not what you'd expect but that is great food for thought.

🚶 Microsoft’s LinkedIn said that it's shutting down the version of its professional-networking site that operates in China.

🤔 Instead of renting an audience, companies are realizing that owning their audiences and going direct can lower CAC and increase LTV. We have talked about this last summer when Salesforce launched their own media unit.

🇪🇺 The EU wants Facebook and Google to have to provide reams of detailed information on how political groups target people via online ads or face steep fines.

🇪🇸 Spain plans to offer young adults nearly $300 a month to move out of their parents’

houses.

🇮🇹 Italy implemented one of the most stringent anti-coronavirus measures in Europe, requiring all workers, from magistrates to maids, to show a health pass to get into their place of employment. Protests were held.

☕ Remember when Starbucks was cool? It turns 50 this year - today Starbucks is accounting for about 15,000 from more than 37,000 coffeehouses in in the US. In 1991, there were only 1,650, including 165 Starbucks.

Random fun fact - in Sweden, Starbucks quietly closed down most of their shops last year, because covid business and expensive store leases were not a great match. That's the second time when Starbucks closes downs ops in Sweden in 30 years, they also exited the country in the 90s.

🚗 Tesla just jumped into the insurance game, offering a product that uses real-time driving behavior.

🚙 The average price of a new car sold last month (in the United States) was $45,000, a $4,872 increase over September 2020. The average used car sold for $28,364 in September, a nearly $8,000 jump from before the pandemic. link

🧀 Prince Charles says his Aston Martin sports car, gifted to him on his 21st birthday by the Queen, runs on white wine and cheese.

Did you find this useful? 🤔

Have your colleagues and friends sign up too. To support our work, please consider subscribing to N9.

Sunday CET

Sunday CET

Notes and commentaries about what matters in the European space - concise, no non-sense insights, interesting stories and implications for founders, investors, employees from tech companies or government representatives.

Published every Sunday morning by Dragos Novac and emailed to investors, founders and decisions makers from 50+ countries who want to understand the ecosystem from Europe.