is Wolt worth 8 billion?

is Wolt worth 8 billion?

• is Wolt worth really 8 billion?

• is London the right place for doing business?

• N9 is launching a new product

Observations

🚚 The highlight of this week was Wolt's acquisition by DoorDash for $8.1 billion.

Is it a good deal? Of course it is, any liquidity event in Europe is significant, particularly because Europe is not really a great environment for this kind of deals.

Investors are happy and were quick to publicly trumpet in the market that they cashed out at 200x. That is just a minor media angle though.

Founders also happy not because of returns but because it looks like a good chemistry match to further build stuff with a strong partner. In a hyper competitive industry like e-commerce, having on your side a savvy American strategic looking to build is more important than having a bunch of investors looking for the right time to exit.

Also notably, Wolt was acquired, not sold. Doordash has been shopping around Europe for a while, and was known to have been eyeing many deals from the young VC-backed grocery startups class. They actually led an equity round in Flink at a $2.1 billion valuation, and now they have upped the ante, Europe is strategic and tech-based assets are still relatively cheap compared to long term returns.

Wolt was tentatively planning to IPO in the near future, and the $8.1 billion tag is at around a 100-120% premium than what their investors were expecting. Did I mention that investors were happy with the DD deal?

Well, is Wolt worth $8 billion?

The American market certainly thinks so, as DoorDash's stock price jumped 24% on the news. On the other hand, Wolt's direct competitor, Delivery Hero, said though that they were also interested but not at an exceptionally high price. Of course it is a high one, even the 4 billion IPO tag was high for the Germans - the price does carry a premium but if you cannot afford a deal it doesn't mean it is not worth it though.

To put it in context, Delivery Hero just paid to get 8% of Gorillas at 3 billion, a company active in 9 countries, about a year old and only doing online groceries.

Wolt, on the other hand, is active in 23 countries, with good brand throughout Europe and strong rep in the street as they've been around for 8 years, and already with core business in the restaurant deliveries and aggressively active on the grocery front as well.

To add more context, in Sweden, for example, the local retail chain Ica was just valued at about $12 billion as existing owners want to delist it from the local stock exchange. Ica operates 2000+ retail stores (physical) only in Sweden, owns a bank, real estate division and a pharmacy chain. Its ecommerce side is weak and is overall a business with local ambitions.

So. At 2.6X Gorillas, if you approach it as an accountant, it's likely to say that Wolt is probably not super interesting.

However. If you look at the business context though, DoorDash's bet is on the upside, and paying a premium for a company with good fundamentals and strong management is totally worth it. Overall the upside will make up for the premium in the long run anyways, in a market going up and to the right at double digit figures yoy.

Add it to the Flink deal, which presumably should lead to an acquisition, and we have an interesting European position that is a result of an articulate strategy. I wouldn't be too surprised to learn about an even higher appetite - as I said, European assets are cheap and local VCs are looking to get out of their grocery positions anyways because both markets and execution are hard.

Also worth noting that Americans expanding to Europe are not always welcome by the locals - from the EU itself, which has become hostile lately towards American big companies, to the local dealmakers who suffer from the 'not-invented-here' syndrome, as they're usually not keeping up with the way the yankees are doing business.

And even in the very same industry of Wolt, just this spring high profile CEOs publicly jabbed at each other just like in high school, signalling cultural animosity rather than the standard respect that you usually pay to people creating value in the same space.

So yeah, I guess it pays off to acquire a great, solid company, with a good DNA and management, and the Finns are nothing but that. And DoorDash got itself a great deal, there's no doubt about it.

🇬🇧 One more about liquidity events in Europe. Remember how Deliveroo got f-ed up upon taking its company public on London's stock exchange earlier this year? It looks like there's more to it, with more people complaining about similar problems - that's a signal of structural issues and overall a reflection of the quality of the London's business environment.

Here's the CEO of THG, who took the company public in the largest IPO on the LSE since 2013 - a year after listing, THG's share price began tumbling, down by more than 60% since the start of the year.

Genuinely I can say, from the moment I even announced the IPO, from that day forward has been the worst period ever. Ever. And there hasn't been a positive day since IPO, or even announcing the IPO, in terms of for what we do.

[...]

We've had a pretty aggressive short attack. You wouldn't rob banks any more – you'd just do short attacks, you can get away with it, it's legal. And essentially, it cuts across a few industries from media, investment banks, fund managers, hedge funds, etc. They come together. They're not technically or legally together, but essentially operate in tandem. And then they move aggressively to change the share price of a company. They bet on the share price falling, ahead of doing some activities. They do their activities and then they make a lot of money when the share price falls.

If you run a high profile company exploring an IPO in Europe and read about all those cases, would you seriously consider London Stock Exchange as an option?

Remember Klarna's CEO nervous media statements from a couple of months back about exactly this? Also, maybe related maybe not, but worth noting is that Alex Chesterman SPAC-ed his UK company in the US and not in his home country, where he is fairly connected and well known.

Capitalism at its best.

Introducing TTMV, our own meta verse

Guys:

I am beyond excited to announce that we're launching the first and the best investors/startups meta verse from Europe and, I believe, from all over the world!

Powered by Nordic 9 - we call it Tech Tapas Meta Verse (TTMV), and its objective is matchmaking investors with startups, in order to get them funded.

The TTMV will showcase interesting established startups made by outsiders or no-network founders. It is an invite-only meta verse, for both investors and startups.

Our meta verse initiative is part of a larger strategy of going full web3 with Nordic 9, following the read / write / own principle:

- you get to see interesting startups pitching in the metaverse

- you get to contribute with feedback and additional questions

- you get to own it, because you can invest.

I would have made a creepy video to present it better, but time is tight and resources limited - suffice it to say that our TTMV is a great opportunity, trust me!

Jokes aside, if you're interested to be part of Tech Tapas, or know somebody who should be in, please send me an email. Thanks. 😊

Cheat sheet reports

• Why Klarna is under-valued - we opened up the report and can read it for free only this week.

• A breakdown calculation of a video SAAS startup from Europe that raised $12 million.

• 50 venture scouts from Europe and 80 of their deals - link

• Investors in Europe

- a list of 100 investing at pre seed and seed

- a list of 30 investing at late stage

- top 140 active VCs

- a list of 25 from the new wave of European VCs

Note: the reports are for Nordic 9 paying customers only. You can become one from here.

Big league

From the 'spare-me-the-obvious' dpt.

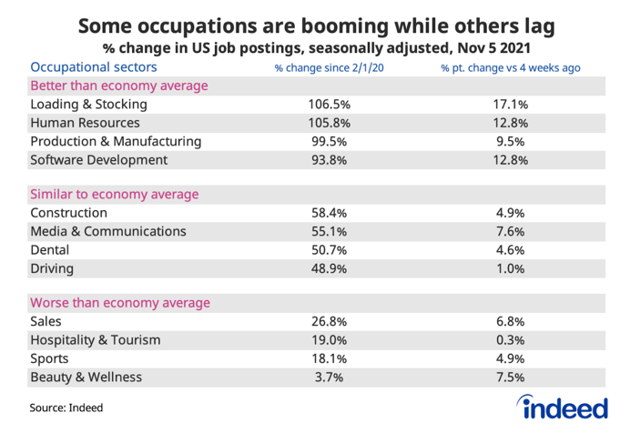

HR up, sales down

Value for money

Every week at Nordic 9 we send to our customers curated intel overview and commentary about the deals we tracked in Europe. You can dig through the archives here.

We also run a local edition, covering the Nordics - the archive here.

You should subscribe and get it too.

Quick links

🇺🇸 Elon Musk sold Tesla shares worth $5.8 billion this week. How's your week been?

🇮🇸 The icelandverse.

🇹🇷 Hackers in Turkey allegedly used Twitch to launder $10 million.

🇩🇪 Twitter has set up a team focused on crypto, blockchains in Berlin.

🇬🇧 Uber increased the prices by 10% in London and by 25% for peak time airport rides as driver shortages hit app and its CEO flies into London to talk to mayor Sadiq Khan about it.

🇬🇧 After acquiring Dija and Fancy, instant grocery startup Gopuff launches in the UK en route to European expansion.

🇬🇧 Draper Esprit rebrands to Molten Ventures.

🇺🇸 Paul Murphy on Lightspeed's push into Europe.

🇺🇸 Two good interviews by Sonali De Ryker of Accel - one with Avito’s Jonas Nordlander and the other with Hopin’s Johnny Boufarhat.

🇪🇺 More suspense building onto the up and coming Big Bada Boom:

Wall Street banks push into Europe’s private capital markets, amid a broader feeding frenzy in capital markets. They are betting that the increase in fundraisings by private companies will prove to be more than a temporary boom.

🇪🇺 Americans need to learn to live more like Europeans - written by a New York-based lady who seems to have had an epiphany.

🇪🇺 Facebook whistleblower tells Europe’s lawmakers to rein in Big Tech.

🇪🇺 European regulators are concerned that video-game like prompts have encouraged excessive trading on app-based brokerages that fueled a explosive surge in value for GameStop Corp. and other stocks this year.

They refer to meme stocks, you guessed it.

🇪🇸 A former Spanish Bishop has been accused of being ‘possessed’ after he left the clergy to be in a relationship with an erotic fiction writer and began working at a company that exports pig semen. Can't make this up.

🇺🇸 General Electric has paid more than $7bn in investment banking fees since 2000, as Wall Street lenders reaped rewards from a frenzied period of dealmaking that culminated in a sinking share price and the eventual break-up of the best-known US conglomerate. Since 2000, the company has shelled out more on investment banking fees than any other US business. The next biggest spenders were Citi and JPMorgan, which paid their bankers $6.8bn, while the biggest outlay at an industrial group was GM, which spent $3.8bn.

link ($)

Read the above in the context of GE deciding to get dismantled into three companies these days - representing its health-care unit, its energy units and its jet-engine unit. GE is not alone in this breaking up boat, so are Johnson & Johnson and Toshiba.

🇺🇸 A record 4.4 million Americans quit their jobs in September - 3% of the entire workforce, according to a report from the American Bureau of Labor Statistics.

Quits increased the most in arts, entertainment and recreation (like people who staff live events); other services (which ranges from auto workers to hairstylists to laundry workers); and local and state government jobs.

🦾 Great interview with Chris Dixon, who's been lately pushing the web3 thingie.

⚔️ In the supply chain battle of 2021, small businesses are losing out to Walmart and Amazon.

🎃 Google charges more than twice its rivals in ad deals, wins 80% of its own auctions. I am shocked.

🤔 Will VCs start selling software too as consulting firms are becoming software companies?

💸 What I tell all new VCs about their first funds.

🤌 Are you even a business if you don't have a metaverse strategy - the Nike edition.

🪝 NFT explained

🦨 Verse Meta Verse - Facebook attempts to change the conversation…

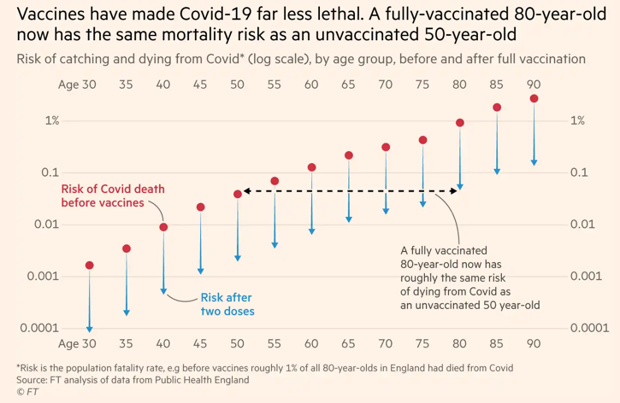

🤖 Do you fear growing old?

Did you find this useful? 🤔

Have your colleagues and friends sign up too. To support our work, please consider subscribing to N9.

Sunday CET

Sunday CET

Notes and commentaries about what matters in the European space - concise, no non-sense insights, interesting stories and implications for founders, investors, employees from tech companies or government representatives.

Published every Sunday morning by Dragos Novac and emailed to investors, founders and decisions makers from 50+ countries who want to understand the ecosystem from Europe.