sunny side up

sunny side up

• Will Klarna bite the bullet and IPO?

• Ireland is home to GDPR infractions in Europe

• the job of consultants explained in kids words.

Tech tapas

We're doing a small pitching event next month, as we're looking to showcase interesting established startups made by outsiders or no-network founders. It's an extension of the curated intel we do every week.

It is an invite-only event, for both investors and startups. If you're interested to be part of it, or know somebody who should be in, please send me an email. Thanks.

Cheat sheet reports

- 20 interesting early stage startups building consumer fintech in Europe.

- 80 VCs backing fintech in Europe

• Europe had two calendar SAAS startups pre-seeded in the last 8 weeks.

• How much will Weezy be sold for?

• The most interesting European startups from YC this summer.

• Top 140 active VC investors in Europe in the first part of 2021.

Note: the reports are for Nordic 9 paying customers only. You can become one from here.

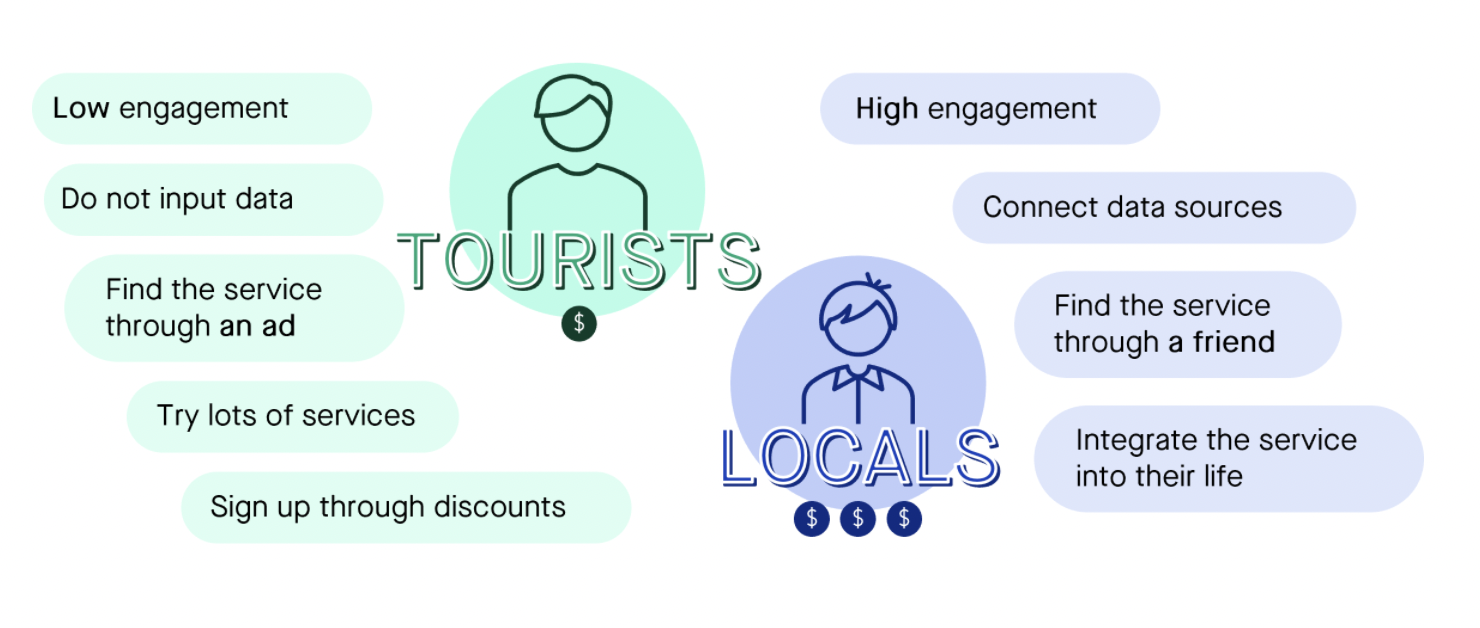

What kind of customers do you onboard?

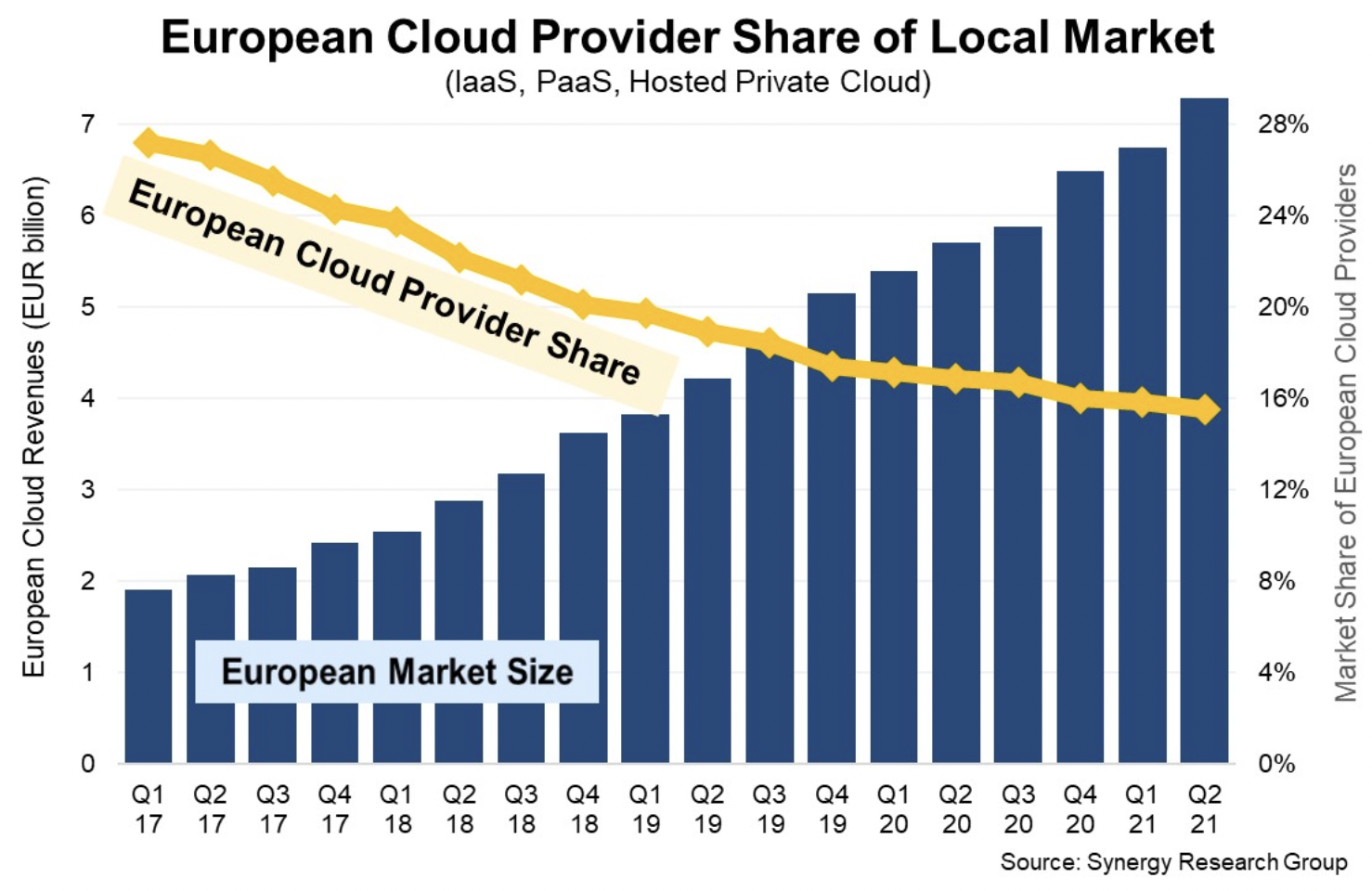

Amazon + Microsoft + Google = 69%

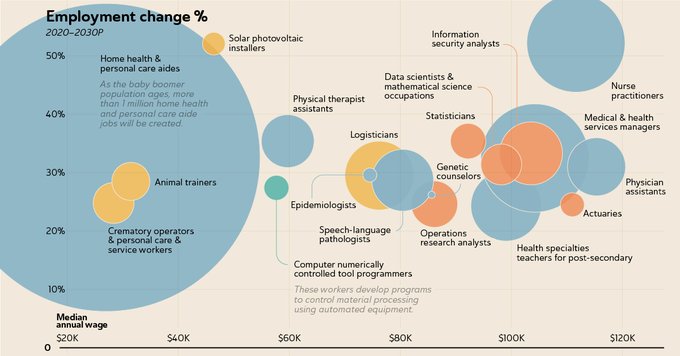

What will you do for $ in the next 20 years?

Did you know?

Every week at Nordic 9 we publish an intel report about what is important in the European startup ecosystem.

We curate through hundreds of deals and create an executive summary written professionally in an easy to understand format - tactical bits and industry-wide trends, curated deals, active investors and relevant early stage transactions.

We email it to the Nordic 9 customers every Monday morning - investors, founders and decision makers willing to stay updated with the strategic moves from Europe.

People seem to find is useful, you should sign up to get it too.

Notes

- a series A closed at $100 million for a restaurant SAAS

- a series B closed at $680 million for a gaming company

- a series E closed at $555 million for an ecommerce SAAS

- a series G closed at $209 million for an ecommerce marketplace

This is just a little part of the monopoly race that happens nowadays in Europe. And you have to understand the French ego, France is not exactly a top of mind, go-to place for equity investors in Europe.

And boy they do have to deliver. At least two out of the four deals (Sorare and Sunday) are heavily including an North American expansion, and French are not really famous for conquering the world - as a coincidence, they just got screwed by BJ and Biden in a different ballgame the other week.

Also notable, the series E and G are made at lower levels than the series B. Softbank is in 2 out of 4 of those deals, Coatue in another and PE (Silver Lake) in the other.

• Lagos, in Nigeria

• Dar es Salaam, in Tanzania

• Kinshasa, in the Democratic Republic of Congo

Did you find this useful? 🤔

Have your colleagues and friends sign up too. To support our work, please consider subscribing to N9.

Sunday CET

Sunday CET

Notes and commentaries about what matters in the European space - concise, no non-sense insights, interesting stories and implications for founders, investors, employees from tech companies or government representatives.

Published every Sunday morning by Dragos Novac and emailed to investors, founders and decisions makers from 50+ countries who want to understand the ecosystem from Europe.