the undervalued beast from Europe

the undervalued beast from Europe

• how much should founders pay themselves

• the undervalued beast from Europe

• French investing more in education, already paid off

Cheat sheet and intel reports

The most active American investors in Europe

• late stage deals (41 investors)

• early stage deals (18 investors)

• angel investors (65 investors)

• the profiles of the most visible ones in Europe (20 investors)

The hottest 160 early stage startups from Europe

We have reviewed more than 2000 early stage deals made in 2021 and profiled 160 interesting startups that are in the market raising money now:

🇬🇧 UK (40 startups)

🇩🇪 Germany (35 startups)

🇫🇷 France (30 startups)

🇸🇪 Sweden (20 startups)

🇩🇰 Denmark (15 startups)

🇫🇮 Finland (10 startups)

🇳🇴 Norway (10 startups)

What's happening in the European Fintech?

We have launched a new intel newsletter covering the fintech in Europe - embedded, banking-as-a-service, web3 and a whole lot more. More value for the same money - it is available here and you can subscribe for getting it in your inbox from here.

Web 3 startups and investors in Europe

• Interesting web3 startups funded in Europe last fall - link

• Non-web3 investors which made at least a couple of web3 deals In Europe last year and their deals - link.

Investors in Europe from very early stages to very late stages

• pre seed/seed investors in Europe

• series A European investors

• late stage investors in Europe

• super angels active in Europe

Note: the reports are available for Nordic 9 paying customers only. You can become one from here.

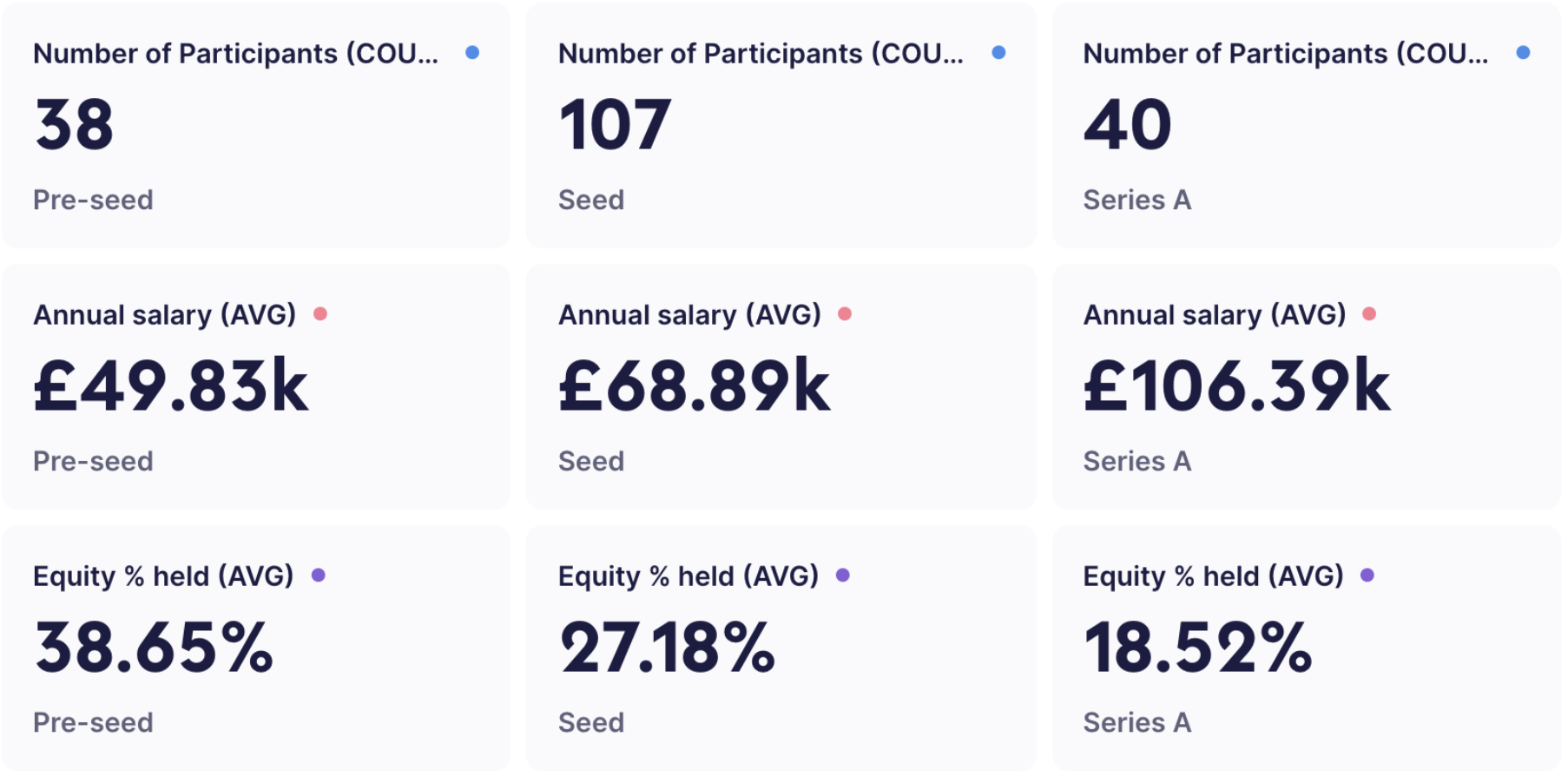

How much should founders pay themselves

The numbers are from a survey made at the beginning of this year, more details here.

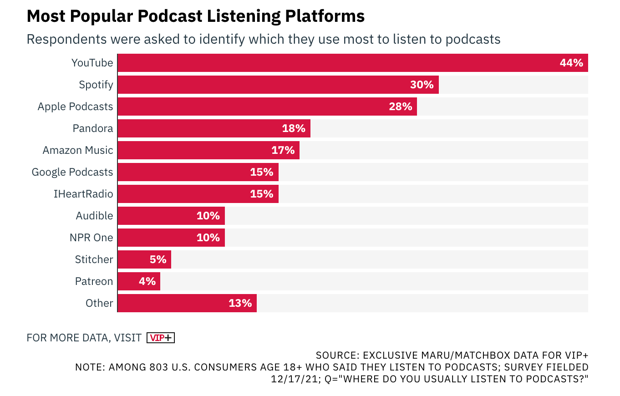

The podcast market

Notes

🇸🇪 Klarna made public its financial performance for 2021, announcing a $1.6 billion operating income, exactly the number we predicted when we evaluated the company a year ago. Their user growth was at whopping 40% yoy - great execution with a huge upside, Klarna remains an undervalued European beast 17 years after it was founded.

🇪🇺 The EU politicians get to be VCs after all - they finally signed off on the €20 billion budget for the investment projects across Europe and will deploy it as early as next month. Reminder: they have had yet to honour their investment commitments due to legal difficulties and infighting at the Commission for a few months now, a big period in the life of a startup.

🇪🇸 Telecom market aggregation. Orange and MasMovil want to combine their Spanish businesses through a €19.6 billion joint venture that would value Orange at €8.1 billion and Másmóvil at €11.5 billion. The new group would become the leader in the Spanish mobile market, with 27 million mobile customers and Spanish players would be reduced from four to three - Telefónica (the largest), Orange, Vodafone. MasMovil, the fourth biggest operator, was taken private in 2020 after an LBO by KKR, Providence Equity Partners and Cinven.

⚽ Serie A-merica. A group of investors led by Boston Celtics co-owner Stephen Pagliuca has agreed to buy into Italian Serie A club Atalanta. 9 of the 20 top Italian clubs are now controlled by foreign names, including China’s Suning Group at Inter Milan and Canadian Joey Saputo at Bologna.

🇬🇧 Abramovich put Chelsea up for sale because he was trying to beat a deadline. The plan didn't work, the club is now effectively an asset of the UK government and if Abramovich does negotiate a sale, the UK government may grant a sanctions exemption to allow the sale - but the proceeds do not go to him. For now, the government has issued a special license to the club that will allow it to go through its day-to-day operations while also being restricted from certain activities.

🇷🇺 The Russian internet company Yandex, second largest search engine in Russia which also offers ride-hailing services in several EU countries, will be the subject of an inquiry as to why the company was excluded from the EU sanctions list against Russian entities.

🇵🇱 Google paid €583 million for a multifunctional skyscraper in Poland consisting of three buildings - 20,000 sqm of offices, retail spaces and a hotel. A couple of months ago it spent $1 billion in a similar deal for buying office space in London.

🇫🇷 The French launched an agricultural school and a campus (world's largest, of course) to educate students and to support startups doing regenerative agriculture. HEC Paris is doing the curriculum, Audrey Bourolleau (ex-advisor for Macron) is doing the management and Xavier Niel (who else) structured the financial architecture. This is not the first education push done by Niel (other projects include a coding school and Station F, which sells more than 30 training programs) - remarkable investment efforts that are already paying off in the French society, where startups have gotten a bit of traction and made the country to finally count in the grand private investment scheme in Europe.

🇪🇺 EU's wooden language is a huge problem. The European Central Bank decided to modernise its monetary policy communication and make it easier to understand to a wider non-expert audience, not familiar with the financial lingo. They did this as a result, a great solid effort, and should get the whole EU institutions adapt in a similar fashion across all their work. Next: they should communicate that they communicate better.

🟢 Long on green energy - Putin’s invasion of Ukraine will drive the continent back towards coal in the short term, but there could be warp-speed deployment of green energy this decade. It's never been a better time to double down on green startups.

💰 The early stage private market is atomising, $1 million at a time.

• exhibit A:

Tiger Global Management's partners have committed $1 billion of their own cash to plug into seed funds, with plans to invest a little more than $300 million in these other vehicles every year.

• exhibit B:

Alexis Ohanian's Seven Seven Six (776) launched a new fund called 776 Titans Fund focused on emerging managers, each with their own "influential distribution channels and unique operational experience". Each will back startups, operate independently and will receive an initial $500,000 investment from 776 and access to Cerebro, which is the proprietary operating system of the firm.

• exhibit C:

AngelList has raised $100 million in Series C funding for its investing arm (AngelList Venture) co-led by Tiger Global Management and Accomplice.

Watercooler talk

🇪🇺 The European Union will require all job postings to show a salary range from August this year.

🇬🇧 Index Ventures stopped investments in Russia indefinitely and will no longer co-invest with Russian entities.

🇬🇧 Mustafa Suleyman of Greylock Partners's London office and of Deepmind co-founding fame, co-founded a startup called Inflection AI, together with Reid Hoffman of Linkedin's fame. That's allegedly the first post-Linkedin startup for Reid Hoffman, who is also a partner at Greylock.

🇫🇷 Cedric O, one of the guys in charge for the tech-related efforts made by the French government, will step down after the presidential elections from next month. He says he wants to build a career on the private side, after having been a politician all his life. He is 40.

🇬🇧 Atomico fired one of its most senior partners, Hiro Tamura, last month, following complaints from staff over his management.

🇬🇧 All crypto ATMs are illegal in the UK as the British government says none of the country's registered crypto firms has been approved for ATMs.

🇵🇱 The Polish retailer Eobuwie did a shoeless shoe store connecting e-commerce with brick-and-mortar shopping.

🇳🇱 Dutch e-commerce group Prosus expects to write off its $769M investment in Russian social media service VK.

🇨🇳 China’s Alibaba is stuck between Russia and Ukraine.

🇨🇾 Cyprus is the other financial hub for Russians laundering money in Europe, besides London.

🇬🇧 Swiss-American venture capitalist Julie Meyer was issued an arrest warrant by London court.

🤡 Bain Capital Ventures has officially launched a $560 million fund focused exclusively on crypto-related efforts and got slammed upon announcing it.

Readings

🧆 Ikea is truly bizarre - its floor plan is a maze-like nightmare hellscape, it sells meatballs and lamps under the same roof and it asks customers to assemble their own furniture. But it's all designed to get you to buy more stuff.

🚚 How do consumers talk about food delivery - digging into the social trends behind DoorDash, Deliveroo, JustEat and Uber Eats. link

🚗 The car dealerships are dead, they just don't know it yet.

💹 Amazon's model - great decomposition

🤔 Twitter plans to add its next 100 million users by making it look like Facebook and bringing boomers in.

➿ The mantra of growth at all costs is over as investors are slowly shifting their focus from momentum to fundamentals and profitability.

🛒 2022 digital commerce trends - link

🦾 The new computing paradigm - link

👀 A scholar of Stalin discusses Putin, Russia, Ukraine, and the West.

How's your week been?

🇬🇧 Imagine you have a 12 year old and you cough up more than $40k a year for their schooling only to find out that the school places more weight on teaching social justice than on subject-specific knowledge, like reading, writing and math. In London that is.

🛰️ Western sanctions against Russia could cause the International Space Station to crash.

🇷🇺 Depriving Russians of access to tech and digital platforms should spur popular protest and undermine Putin’s military campaign. But no one has the slightest idea how it will play out.

✨ The White House briefed the most influential TikTok stars on the war in Ukraine, as a result of this.

🧠 Stolichnaya Vodka rebrands as Stoli, trying to distance itself from Putin.

🤘 Facebook will make employees do their own laundry and manage their dry cleaning. The horror.

⛵ Roman boat that sank in Mediterranean 1,700 years ago was found perfectly preserved just 2 meters below the surface off one of Mallorca’s busiest beaches.

🤟 Uh-oh - we’re having way better sex than our kids.

Did you find this useful? 🤔

Sharing is caring

Have your colleagues and friends sign up too. To support our work, please consider subscribing to N9.

Sunday CET

Sunday CET

Notes and commentaries about what matters in the European space - concise, no non-sense insights, interesting stories and implications for founders, investors, employees from tech companies or government representatives.

Published every Sunday morning by Dragos Novac and emailed to investors, founders and decisions makers from 50+ countries who want to understand the ecosystem from Europe.