the circle of trust

the circle of trust

• Swedes got confused by an IPO announcement

• 1000X VC return in Europe deserves more than a twitter mention

• the VCs circle of trust

Observations

🇸🇪 In the upper small corner of Europe that is Sweden, one of the more discussed pieces of private investors news this week was Klarna's boss outing of its personal investment fund and listing it on the local public market (link in Swedish).

Judging from the local media reactions, Swedes got confused because they don't get it - understandable, it is not that every day a private investment fund gets its stock listed in the public market. Add to the context that the said investment fund is actually a tech founder with a day job who does it out of the blue in a conventional society, where being different is being an outlier, and everything is planned and announced well in advance.

Silly media takes don't make it a wrong business decision though, au contraire, I think it is a very good strategic move, with the obvious upside of being able to raise money much easier than the normal 18-36 months sales process from the market. (Draper Esprit in the UK is a successful pioneer at a different scale in Europe with this, btw). And it requires transparency, which you get plenty from looking at their entire portfolio, currently standing at 40% IRR and 5X multiples.

Why did he do it though? Well, first of all, because he could, dude's ballsier and smarter than the average Joe you read about in the local paper. Apart from that, I believe that the listing process was a great exercise for Siemietovsky to get a better understanding of the whole IPO process. Klarna's IPO is evidently on his top priorities, and I'm quite sure he's looking at it from all the angles, including talking to another Swede whose work is a Harvard case study about doing a direct listing on the NYSE.

And, intentional or not, another benefit is extended scope for personal PR, which he needs in the light of prepping Klarna's IPO. And the PR works - at least in my case, that's the second consecutive week he gets the lead mention in this little email you are reading. :-)

🇬🇧 Balderton returned some chump money to their LPs this week. Roughly 1000 times more than they received initially - guys, you should be louder about it tbh, some old school PR could be done instead of the banal deal announcements under the news category, and would be surely more media interesting (and effective) than all those materials written for gen Z out there.

🔥 A month ago:

Another variation of this [VC market diversification] is that folks will start selling complementary financial products, with risk hedge wrapped up in other forms i.e. revenue-based. We already have an emergent class of VC-backed incumbents, as well as VCs themselves already hedging their bets in this direction.

Today: General Catalyst launches $300M fund to buy future earnings of tech start-ups.

🎃 A great observation: if there's hyper competition, how do you balance your VC time between bringing in new business vs being hands on in the existing one.

Thing is that the current investment market behaviour is an act under disruptive circumstances. It's a storm. The excess money needs to be deployed (see the above point) and this requires resources, while this scaling process, vertically and horizontally, is not fitted for a shop with a few consultants who do both the sales and portfolio management.

How does Tiger do it (to my surprise I met a lot of folks who don't know) - they outsource their back office to a huge army of consultants from Bain, whose billable hours are also wrapped up as consulting services to entrepreneurs. In addition, not having board seats means extra time for hunting great deals.

So, if you don't do what Tiger does and yet you want to compete, you need to allocate resources (i.e. Softbank), eventually for building moats/assets at the edge (i.e. a16z) and in general be smart in a strategic way. It's something that not many people know how to do, particularly in a know-it-all, smart-asses industry, and truth is most consultants don't have the mindset of building their own assets, it's a step outside the daily grind process.

A rule of thumb that I like is when in doubt, double down on strengths. And when competing with deep-pocketed gorillas, be smart, sneaky and nimble. And I may sound like a smart ass myself, it's easier said than done after all, but strategic thinking fundamentals are mostly the same regardless of the cycles and industries. And there's very few doers out there.

🤡 Here's a great thread about how a startup can choke up if it gets overfunded by VCs not accustomed to early stages but getting involved anyway because they can. It totally makes sense - if you're a founder, it's an useful read.

However, keep in mind that in an abundant and cheap money environment, savvy dudes building biz will always take what they can get, when they can get, and figure out a way later. It's true, those who don't know how to handle unreasonable investors will have problems, it's never easy. And particularly when things are not dandy, it's sensible to consider as working hypothesis that investors will be assholes more often than not because i) they're in defensive mode protecting their money first and foremost, at the cost of empathy and common sense, or ii) they can - they have leverage and need to feel important - or iii) a company is just a line in a portfolio, and a bad day behaviour can be compensated by being nice to a better performing founder.

Not least important, if you're a founder out there raising in Europe, reading about all those deals can easily give you an impostor syndrome and make you feel incompetent just by looking at the shitloads of money thrown on boring bets done by ppl in the circle of high profile VCs trust. That is just an image that's not representative most of the times - keep in mind that those circles are small and arbitrary, with less than 5% of the founders out of there.

And you have to understand that they exist because investors mainly think that losing from a previous winner they have history with has lower odds than winning from somebody they don't know. It's a simple risk calculation combined with the comfort of familiarity.

As for the rest of the 95% of the founders - most still have a hard time to raise their first million while having to figure hustling their way out and building a sound business with the right fundamentals, without accounts filled with money and a bunch of VCs cheering them out on social media. This is the real game.

But, I hear you say, what about all those big names with huge funds raised particularly for seed levels? A great part of this money will go to the same 5% of the founders, but in larger chunks because the valuations are higher - roughly the same number of founders are working with the same number of high profile VCs via 10X money. That, my friends, is the circle of trust.

Are they right to behave this way though? Is there substance to this privileged-based gaming? Who cares, it is what it is, those are the times we're living and more often than not, founders gotta deal with this kind of circumstances in more contexts than the singular event of raising financing from professional investors Just keep in mind, most don't play to win, but not to lose.

Tech tapas

On October 19 (on a Tuesday at 5) we're doing an invite-only pitching event, with the aim of matchmaking investors with startups, in order to get them funded. We want to have at least 5 startups presenting - already selected a deep tech one, a niched financial products provider active all over the world and a stealth-ish fintech done by a serial entrepreneur.

Please let me know if you would like to participate (either as a startup or as an investor) or know anybody who should be in. Thanks.

Cheat sheet reports

• Marketplaces from Europe.

• Insurtech startups from the Nordics.

• Who are the investors backing Nordic fintech startups

• The most interesting European startups from YC this summer.

• ICYMI - The most interesting deals over the summer:

- in the Nordics and the Baltics

- in DACH (Germany, Austria, Switzerland)

- in the UK

- in France

Note: the reports are for Nordic 9 paying customers only. You can become one from here.

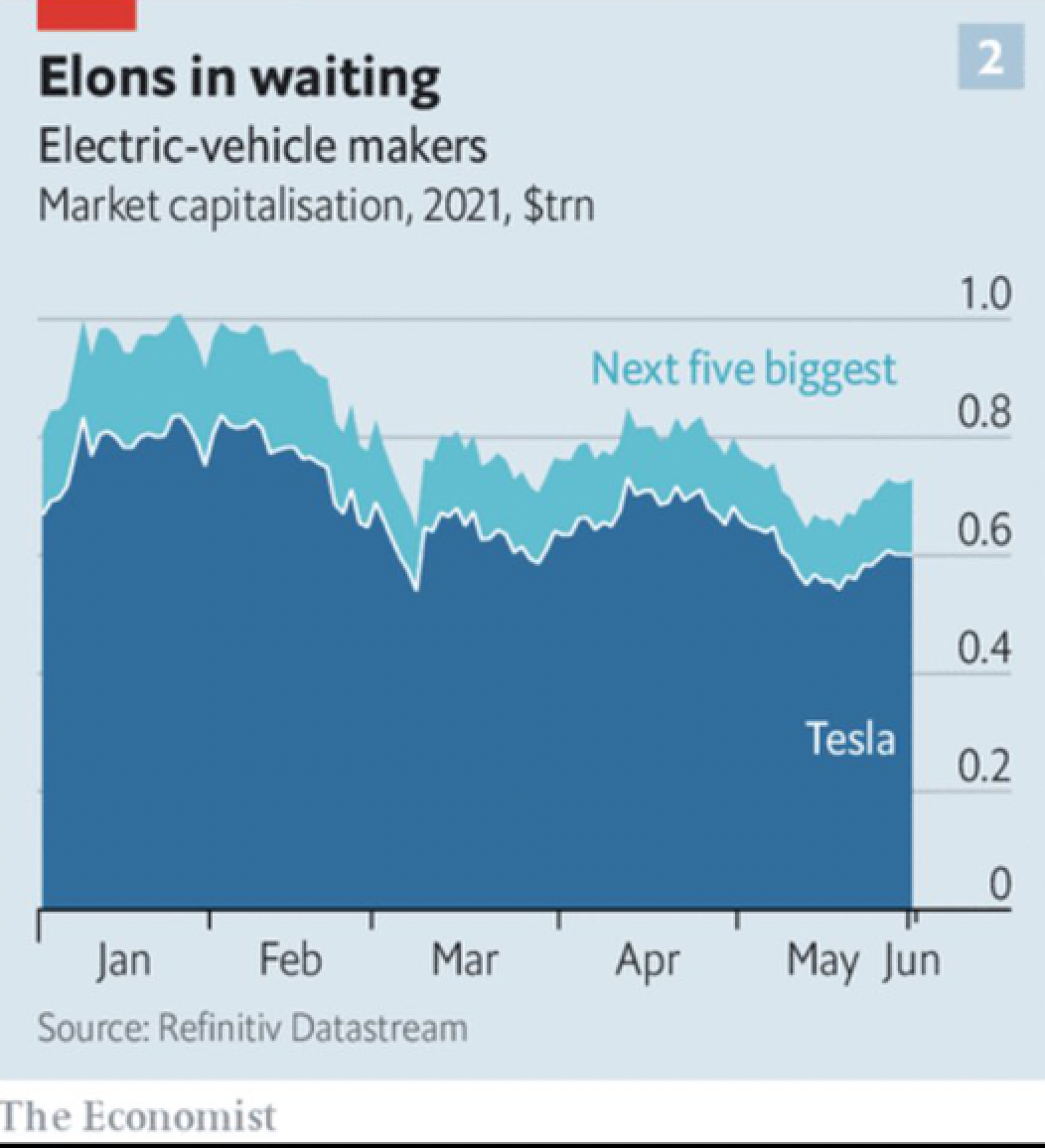

Elons in waiting

Mainstream reality check

:format(webp):no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22883359/Netflix_Code_Conference_V2.001_X3.jpg)

:format(webp):no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22883365/i_L578TP9_X3.jpeg)

Value for money

Every week at Nordic 9 we send to our customers curated intel overview and commentary about the deals we tracked in Europe. You can dig through the archives here.

We also run a local edition, covering the Nordics - the archive here.

You should subscribe and get it too.

Other notes

🇪🇸 A Spanish guy working for Goldman Sachs in Poland and whose job was to help the bank prevent insider trading was himself charged with insider trading by the American SEC. Dude used brokerage accounts opened in his parents' names to trade ahead of significant transactions at least 45 times from September 2020 until his May 2021 resignation, reaping nearly $472,000 of profit. Sounds like petty cash.

Since we're at investment bankers, here's a list with 10 laws of insider trading by Matt Levine (check #4 btw):

1. Don’t do it.

2. Don’t do it by buying short-dated out-of-the-money call options on merger targets.

3. Don’t text or email about it.

4. Don’t do it in your mother’s account.

5. Don’t do it by planting bombs at a company and shorting its stock.

6. Don’t do it while employed at the Securities and Exchange Commission.

7. Don’t Google “how to insider trade without getting caught” before doing it.

8. If you didn’t insider trade, don’t forget and accidentally confess to insider trading.

9. If you are going to insider trade, do it in a company that is far away from a Securities and Exchange Commission office. Like, physically.

10. If you are already under a federal ethics investigation about your ownership or promotion of a stock, don’t insider trade that stock.

🇨🇭 Six people and a Swiss financial services firm have been charged in the United States with helping clients evade taxes on $60 million of assets.

They did the Singapore Solution - funnel money out of Switzerland, through structures in Hong Kong and Singapore, and back into Swiss bank accounts.

🤥 The story of the week comes from the world of VCs and founders:

There was this startup guy with what investors call pedigree (great schools, eyes-catching former employers) which was in advanced fundraising discussions with Goldman Sachs. The discussions went great and resumed with credential checking involving Goldman having a video discussion with one of their customers. The call though raised some suspicions due to the video lagging - upon further investigations, turns out that it was done by an impersonator (the dude's co-founder, no less), who used a software screen in order to pretend he is the customer. Upon confrontation, he played the mental illness card - you gotta give him the innovative implementation though.

The story here. Spoiler alert: Goldman didn't invest in the end.

😓 Ain't easy:

In the past two years, my profession has morphed from founders asking VCs for money over in person coffee meetings, to outbound telesales meetings on Zoom where we desperately try to cajole founders into taking our money.

🇳🇱 How will the Dutch live in 2200? Plan B.

🇮🇹 Stefano and Yann are building a community for like-minded people in the Alps, in Northern Italy. You should check it out and consider it, if that's up your street.

🇨🇿 There's an old Romanian saying literally translated 'the thief meets the stupid' and which I was reminded of by reading this story of a 600-year-old Bohemian noble family launching an NFT in order to get money to pay for the restoration of its artwork collection and his huge ancestral castle. You'd basically pay for getting blockchain-based proofs that you contributed to restoring the castle or certain items within the private collection.

In English that saying would be 'if there's demand, there'll be supply'

🇩🇰 Danish artist delivers empty frames for $84k as low pay protest.

🇬🇧 If you're living in London and still not happy with the current market options of having toilet paper delivered in 10 minutes or less (I hear things are getting shittier on the island), you have to worry no more, big boys are coming to the rescue.

🇬🇧 Btw:

Nobody is stupid enough to go to the UK for temporary work after Brexit, you would have to spend half of your earnings to pay for roaming on your phone!

🇬🇧 Also on the island: boomers will be pleased to learn that IMDb TV is now available in the country.

For kids reading this newsletter, IMDb is a movie app that used to be the go-to internet website 20-30 years ago for checking what kind of movies to see in theatres or on DVD/VHS* and what other people think of them.

The background story is that IMDb was a startup launched at the beginning of the 90s and acquired for $55 million in 1998 by Amazon, which still handles its business.

*Yes, Netflix was making money out of renting DVDs at that time, sent by post. That's how it started out. Savages.

🇪🇸 Spanish gaming organization DUX Gaming have reportedly purchased a slot in the NBA 2K League for a whopping $25 million. Building tech startups in Europe feels small chow in this context, doesn't it?

🌶️ The main differences in VC between 2001 to 2011 was that in the former entrepreneurs largely had to bootstrap themselves (except in the dot com bubble) and by 2011 a healthy micro-VC market had emerged. Today you have funders focused exclusively on “Day 0” startups or ones that aren’t even created yet.

In the United States of America, that is. In Europe, on the other hand... Discuss.

🌶️🌶️ Startups and their valuations growing so fast means that the employee equity packages should be accordingly adjusted.

In the United States of America, that is. In Europe, on other hand... Discuss.

😮 That took a while though:

Investors are pulling cash out of SPACs (special purpose acquisition companies) at increasingly higher rates, with a number of vehicles having their trust accounts almost wiped out as more than 90 per cent of their shareholders redeemed investments.

🔥 There has never been a better time to start building a media company.

🤔 Why Web 3 matters, by Chris Dixon + Overcoming Web3 Bias.

☑️ Right now, Virtual Reality is at its “1980’s beige noise machine” stage: a geek cynosure and a consumer novelty. What’s coming will look very different from what’s here; nevertheless, the DNA is already taking shape. link

💯 People are spending $3 for an app to get rid of Google AMP.

🤖 Amazon launched a $1000 creepy robot that does home monitoring and checking in on household members, along with providing entertainment. Maybe I'm old, but feel better off with my Vroom.

🔝 Top Apple Podcasts Subscriptions + Top Free Channels on Apple Podcasts. How many of them have you heard of?

🇯🇵 Japanese esports team is filled with senior citizens - the ages of the team members range from 66 to 73 years old.

🐟 Drugs in urine from Glastonbury festival pose threat to rare eels.

🍝 Eminem's promo for his new Detroit restaurant is very American and it feels cheap.

Did you find this useful? 🤔

Have your colleagues and friends sign up too. To support our work, please consider subscribing to N9.

Sunday CET

Sunday CET

Notes and commentaries about what matters in the European space - concise, no non-sense insights, interesting stories and implications for founders, investors, employees from tech companies or government representatives.

Published every Sunday morning by Dragos Novac and emailed to investors, founders and decisions makers from 50+ countries who want to understand the ecosystem from Europe.